If you had diverted $100 in Filecoin last week, your investment would now be worth around $200. Yes, Filecoin has been one of the few alts that registered seven successive green candles on its daily. From its 26 July lows of $5.1, Filecoin rose by 122% to $11.3 on Monday. At press time, a minor pullback was noted, and FIL was trading at the brink of $10.4.

Nevertheless, the high three-digit gain made FIL the top weekly gainer among the 100 most giant coins.

Potential catalysts

Toward last week, Watcher Guru reported that asset manager and Web 3.0 data storage provider Holon had partnered with Gemini to give Australia its first unlisted retail Bitcoin, Ethereum, and Filecoin funds. The partnership is set to utilize Gemini to provide custody solutions for all three funds. And the investment vehicles will foster the direct purchase of Bitcoin, Ethereum, and Filecoin.

Per Holon, the Filecoin Fund is the first retail-managed investment program for digital assets other than Bitcoin and Ethereum registered with the Australian Securities and Investments Commission.

Read More: Holon x Gemini: Australia’s First Unlisted BTC, ETH, and FIL Fund

Thus, it can be speculatively attributed that Filecoin getting a separate fund alongside big league coins like Bitcoin and Ethereum might have boosted FIL’s bullish momentum and fostered its three-digit rally.

Here, it is also interesting to note that this was not the first time Holon and Gemini entered a partnership. In August last year, the two firms collaborated to launch a wholesale Filecoin (FIL) fund designed to purchase FIL and lend it to Holon Global Innovations, a subsidiary of Holon Global Investments.

In another recent development that took place last week, the Filecoin Foundation for the Decentralized Web (FFDW) revealed that it’s going to support an initiative with Harvard University’s Library Innovation Lab (LIL) called the “Democratizing Open Knowledge” program. With the support of FFDW, LIL intends to cast around decentralized technologies that can preserve digital information.

The tie-up with premium universities like Harvard and the launch of solo FIL funds is a testament to Filecoin’s growing popularity.

Other positive takeaways for Filecoin

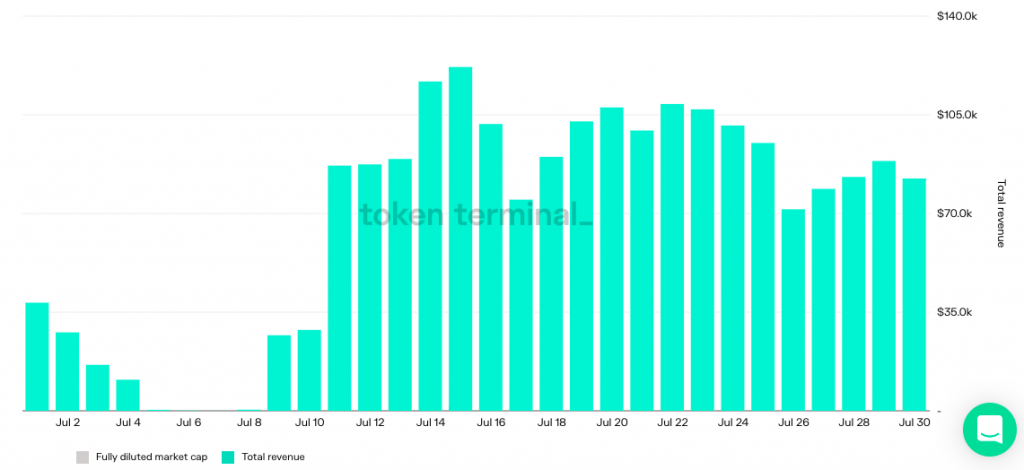

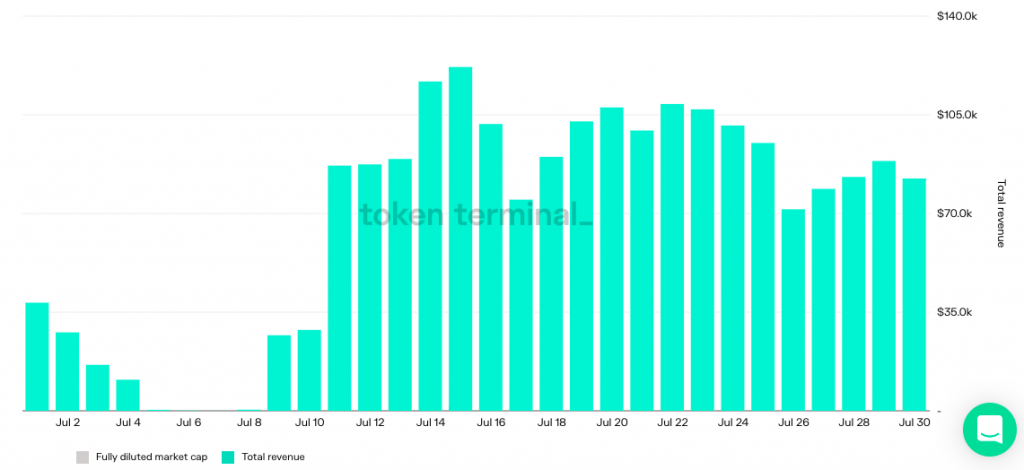

Alongside FIL’s rally, Filecoin has noted some improvements on other fronts. The protocol’s revenue, for starters, revolved around the higher side during the last three weeks of July compared to the initial week. Seven days back, Filecoin’s protocol revenue stood at $101.2k. However, by 26 July, it dropped down to $71k. Since then, nonetheless, there has been notable improvement, for the same stood at $82.4k at press time.

Grayscale’s Filecoin Trust shares have also been notching up in the value of late. Since the beginning of July, it has risen by more than 102% and stood at a monthly peak of $18.2 during Friday’s close. Given FIL’s weekend rally and the prevalent positive sentiment, the trust’s shares can likely be expected to open on a green note today.