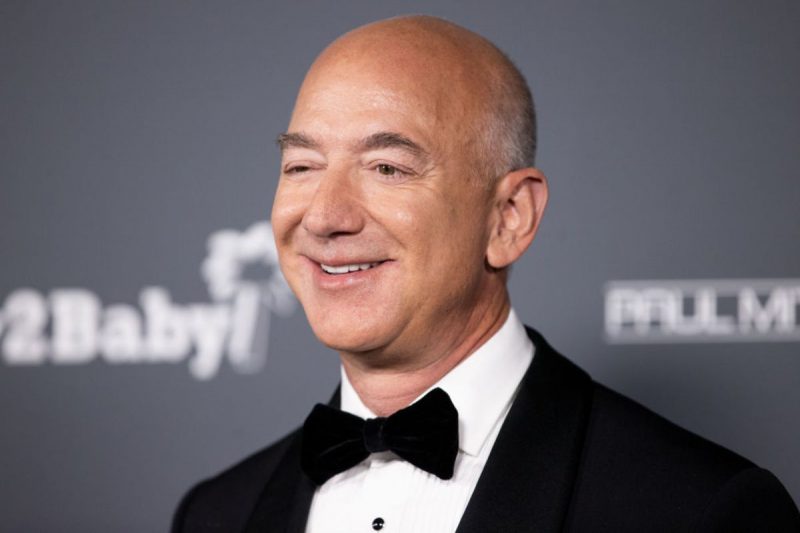

In a rather surprising development for the company, Jeff Bezos has sold $3 billion worth of his position in Amazon (AMZN) stock. Indeed, the founder of the e-commerce titan has reduced his stake in the company, with him now selling a total of $13 billion worth of the stock throughout 2024.

The move is rather surprising considering the dominant position that Amazon currently finds itself. The company has been thriving in the AI and cloud-based computing sectors, which have enjoyed increased demand this year. Moreover, it is projected to continue growing in value with a positive trajectory forming for 2025.

Also Read: Amazon Stock up 7% as AI Growth Drives AMZN Surge

Amazon Founder Dumps Stock: Bezos Offloads $13 Billion in 2024

There are few companies better positioned to take advantage of current stock market trends than Amazon. It has seen its Amazon Web Services (AWS) business become one of its primary functions. Moreover, its foray into AI has been a success to this point, with its e-commerce success curtailing the spending issues that have affected competitors like Meta.

Yet, that hasn’t stopped some rather interesting insider trading from taking place. Indeed, Amazon founder Jeff Bezos has sold another $3 billion worth of his stake in AMZN. That has spooked some investors, with the stock dropping more than 1.5% in the last 24 hours.

Also Read: Amazon (AMZN) Q3 Earnings: Rufus AI Launch Sparks After-Hours Stock Rise

There is no concrete reason behind the sale, but there are theories. Primarily, investors believe that Bezos sold off his position to fund his own alternative projects. The money that he gets from the sale of AMZN stock often funds his side projects. Those include Blue Origin, his space exploration endeavor.

Additionally, the sale has not hindered his position as the primary holder of the company’s shares. Indeed, Bezos is still one of the largest Amazon holders, with more than 10.8% of the company’s shares. He may have stepped down as the firm’s CEO in 2021, but remains its chairman. The sale is likely connected to his other businesses, and capitalizing on the company’s tremendous success and outlook currently.