Amazon stock faces a pivotal moment as Q3 2024 earnings approach, with investors focused on AWS impact and ads revenue performance. The stock is trading at $189.16, and technical analysis reveals a critical resistance zone appearing between $190 and $200, while valuation models suggest a fair value of $188.88.

Recent market dynamics and analyst sentiment paint an intriguing picture for potential investors. Let’s explore this topic further! Scroll down for more info.

Also Read: Russia Officially Launches the Roadmap For De-Dollarization

Evaluating Amazon’s (AMZN) Q3 Earnings: AWS, Ads Revenue, and Market Trends

AMZN Q3 Expectations and Growth Metrics

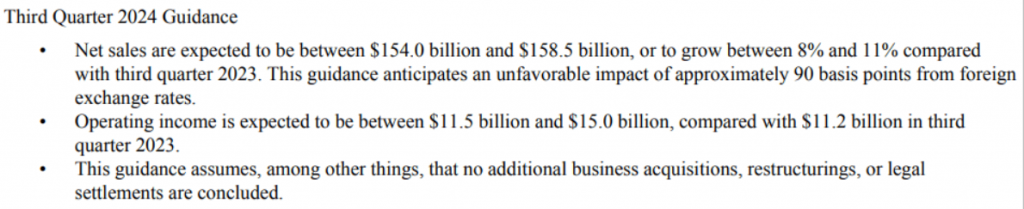

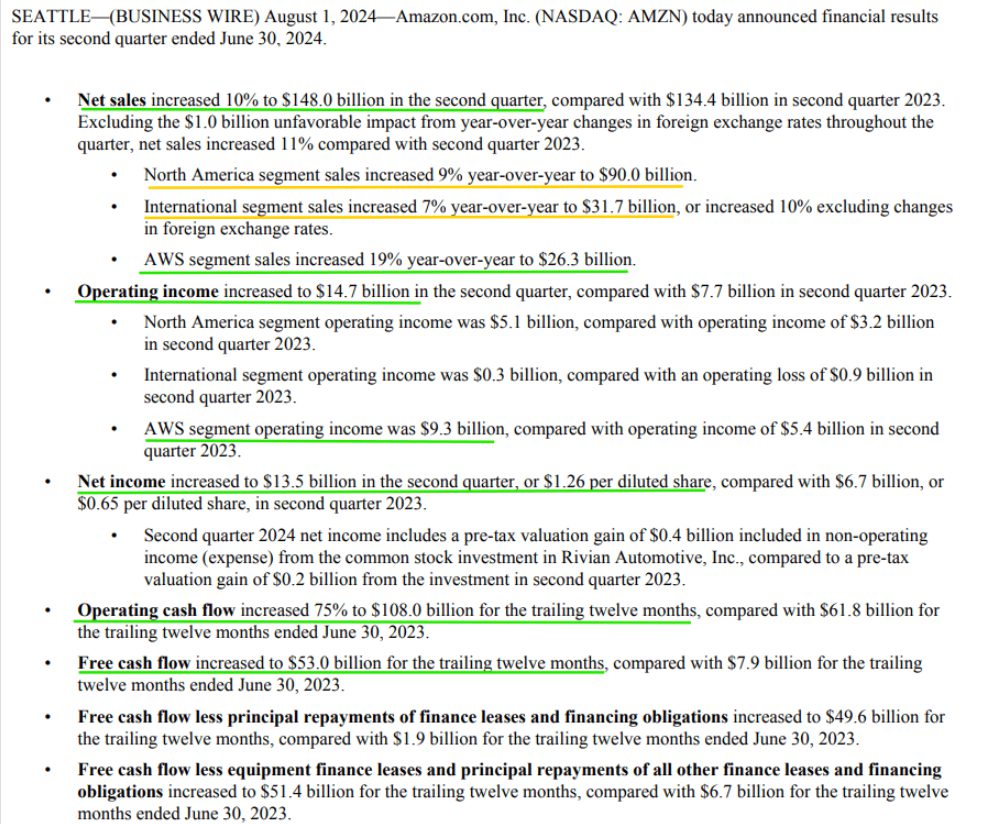

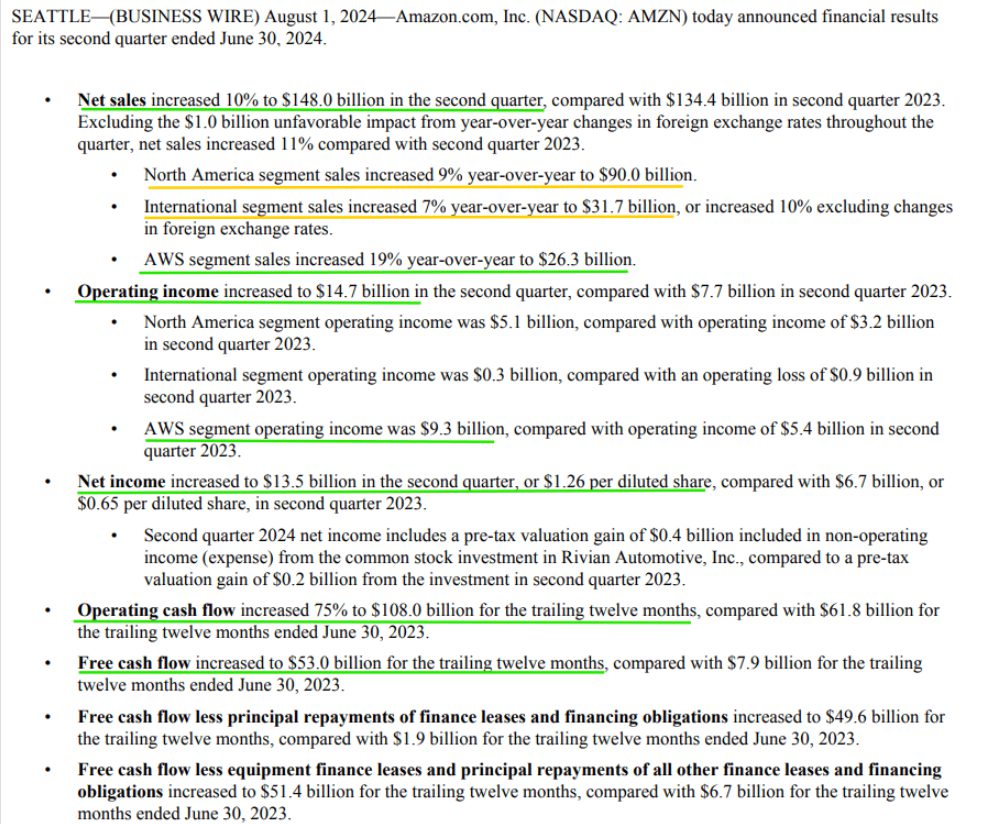

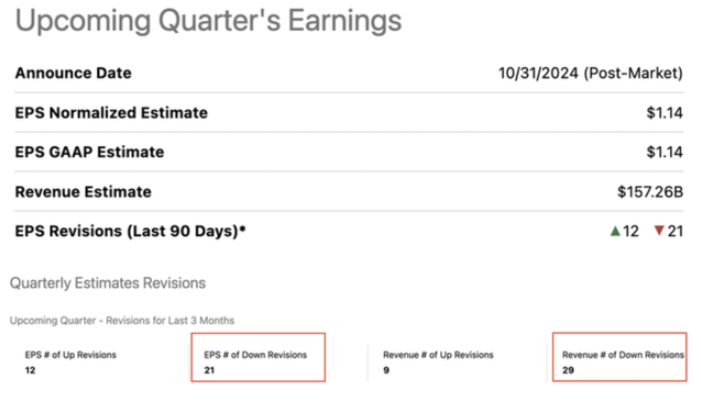

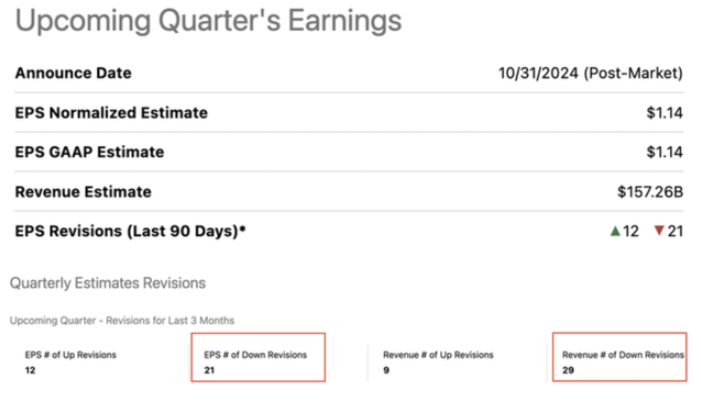

For the period of Q3 2024, Amazon projects net sales between $154.0 and $158.5 billion. These are representing 8-11% year-over-year growth. Operating income targets range from a value of $11.5 to 15.0 billion.

There is also a 90 basis point headwind expected from foreign exchange rates. Analyst consensus remains cautiously optimistic despite recent market volatility, and we agree. What do you think?

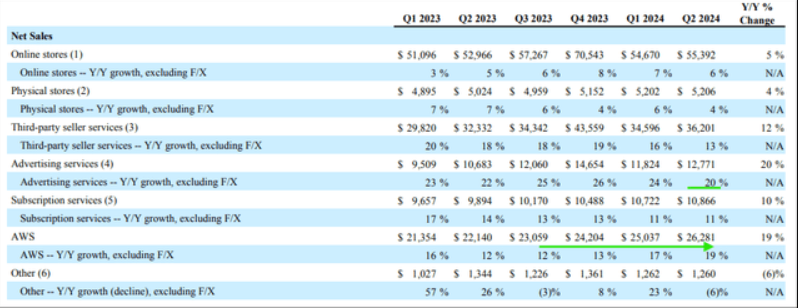

AMZN Stock Segment Performance Analysis

AWS maintains strong momentum with 16% year-over-year growth, while advertising services advance 20%. Online stores show 6.4% growth, complemented by a 13% expansion in third-party services. North American sales reached $90.0 billion, up 9%, as international markets grew 7%.

Also Read: Bitcoin: BlackRock Buys $322 Million BTC: New Peak Incoming?

Revenue Projections and Analyst Sentiment

Consensus estimates through 2025 indicate sustained growth, with Q4 2024 projected at $166.21B and Q3 2025 reaching $173.90B. Recent revision trends show 29 downward and nine upward adjustments, reflecting measured optimism among analysts.

Market watchers note particular strength in cloud computing and advertising segments.

AMZN Stock Operating Performance Highlights

Q2 2024 demonstrated exceptional performance, with operating income reaching $14.7 billion, nearly doubling year over year. North America’s operating income surged to $5.1 billion, while International segments achieved profitability at $0.3 billion.

AWS contributed $9.3 billion, representing 63.2% of total operating income. These results underscore the company’s successful execution of strategic initiatives.

Also Read: Buy Boeing (BA) Stock: It’s Available at a Discounted Price: Analyst

Valuation and Return Potential

Base-case projections show a value of 14.75% CAGR with a $376.33 price target. At the same time bull-case scenarios indicate potential 19.99% returns reaching a value of $470.41.

The model assumes 10% revenue growth and 20% optimized FCF margin over five years. Current metrics support a balanced risk-reward profile.

Amazon Stock Market Position and Technical Setup

The latest RSI readings near the value of 56.86 and suggest that the market might experience a balanced momentum. The price action is also showing potential for both breakout and reversal scenarios. The stock keeps its position above the key moving averages for now, while also supporting technical strength. Pattern formation indicates a possible decisive move following earnings.

Also Read: Analyst Shares New Date For Cardano (ADA) Price Hike: ADA To Rise Soon

AMZN Stock Analyst Consensus and Ratings

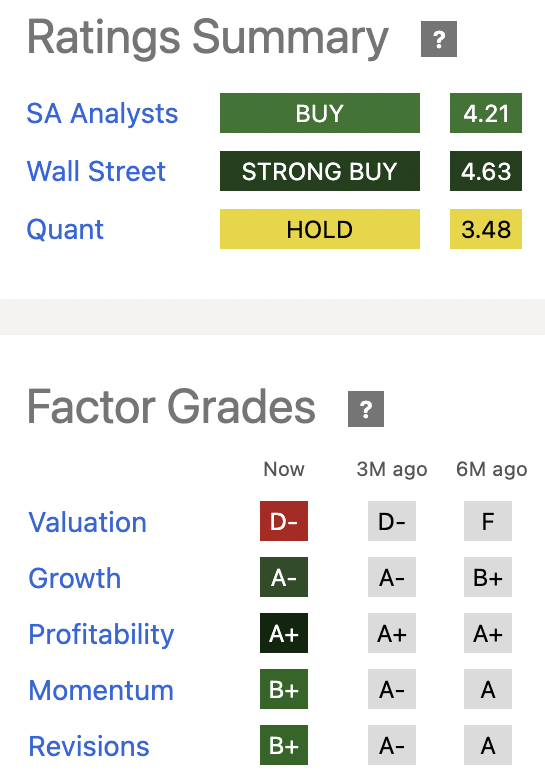

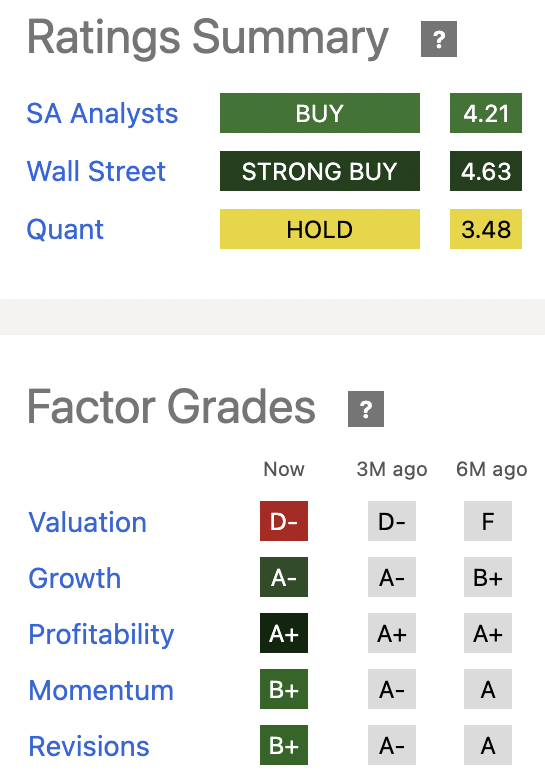

Wall Street maintains strong bullish sentiment with a 4.63 rating, while SA Analysts assign a 4.21 Buy rating. Quant metrics reveal exceptional grades in Growth (A-) and Profitability (A+), though Valuation receives a D- grade. The divergence in valuation metrics warrants attention but hasn’t dampened overall positive sentiment.

Analyst Ahan Vashi noted in a previous analysis for Q2:

“With the unemployment rate creeping up, and the treasury yield curve set to uninvert, the fears of an imminent recession are rising. However, the Fed is all set to embark on a rate-cutting cycle, and lower interest rates could support a flailing consumer and motivate aggressive business spending.”

The convergence of robust fundamentals, positive analyst sentiment, and compelling valuation metrics positions Amazon stock for sustained growth. AWS’s market leadership and accelerating advertising revenue provide strong catalysts, while improved operating leverage and international profitability demonstrate effective execution.

Also Read: Top 3 Cryptocurrencies That You Should Watch In Q4 2024

Despite near-term challenges, Amazon’s diversified revenue streams and market dominance support a BUY recommendation at current levels, particularly for investors with extended time horizons. Stay tuned for more useful information.