In the period from 2 January to 7 January, Bitcoin registered six consecutive red candles on its price chart. A host of factors, right from the markets across the board not performing well, to the broader sell-pressure and the Fed’s hawkish inclination, affected the same.

Post that when it looked like Bitcoin would start recovering, it ended up falling below $40k on 10 January. Notably, the aforementioned level was visited for the first time since September last year.

Nonetheless, things seemed to look better at the time of the press. After witnessing a 3% incline in the past 24-hours, the market’s largest coin was trading at the brink of $43k.

Strong fundamentals to Bitcoin’s rescue?

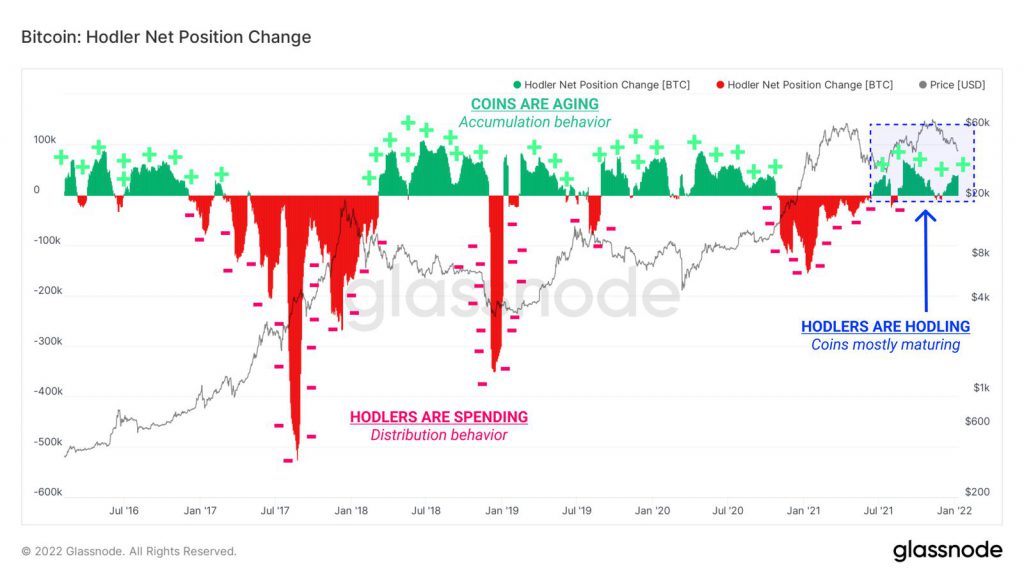

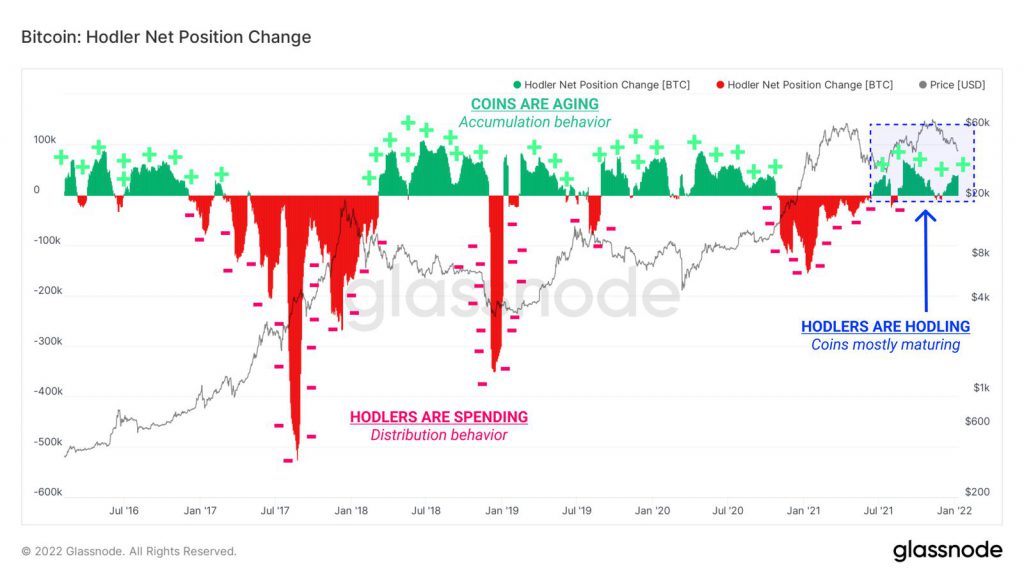

At this point in time, most strong hands continue to cling to their holdings. Glassnode’s HODLer net position change metric supported the aforementioned narrative.

Positive values [green] on the chart usually indicate that coins are aging and maturing at a higher rate than spending. Quite conversely, negative values [red] tend to resonate with elevated rates of spending, particularly by older coins. In such cases, the spending usually outpaces the accumulation.

Now, as can be seen from the chart attached below, the coin maturation phase is currently in play amidst the current price action and typically signifies that “tourists” have started leaving the market already.

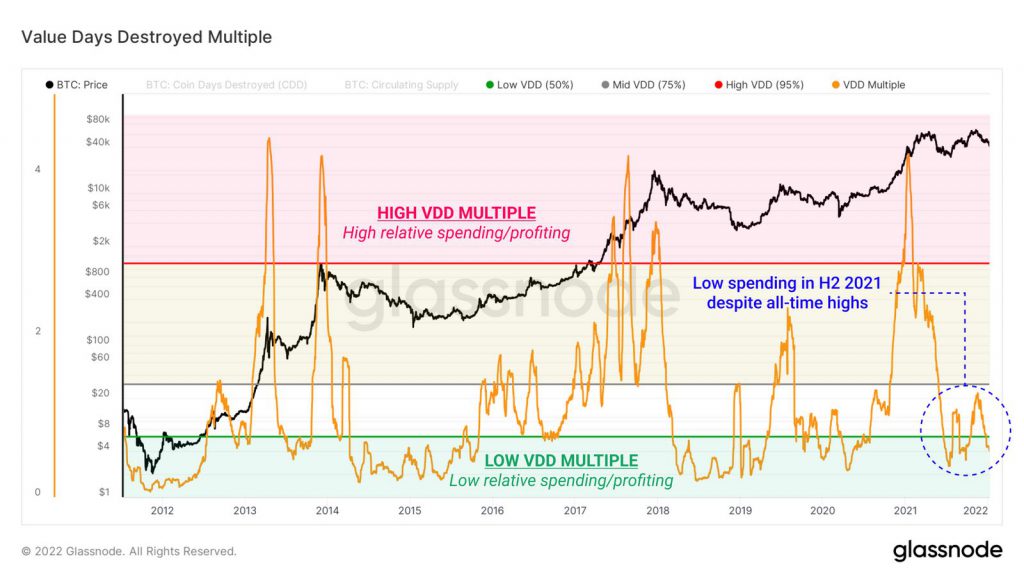

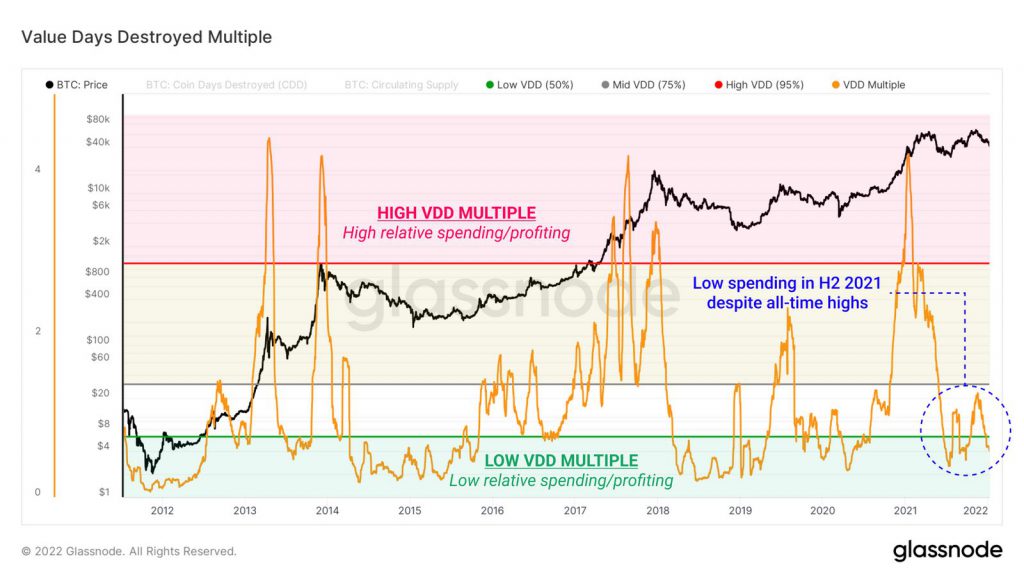

In fact, the Value Days Destroyed Multiple pointed out a similar trend. Before proceeding to the inference part, readers should note that the VDD metric compares the monthly sum valuation of coin destruction to the yearly average to measure the spending velocity.

High VDD readings imply elevated coin destruction behavior when compared to the past year. Parallelly, low VDD multiple numbers signify a quiet HODLer market with calm relative coin destruction.

The VDD multiple has evidently been spending more downside time of late, painting a picture of a HODLer dominated market and low relative retail interest.

Bitcoin entering ‘buy zone’?

Additionally, renowned crypto analyst Will Clemente highlighted that Bitcoin was on the verge of entering on buy zone on the dormancy flow. As can be seen from the chart attached in his tweet, the said signal has flashed only 5 times so far. Bitcoin’s price, in all cases, ended up rallying post the visit to the aforementioned zone.

So as long as HOLDers continue staying in the market, Bitcoin’s price should continue to sustain above $40k. Nonetheless, other macro-factors, like the inflation numbers and the state of the traditional financial landscape, can play spoilsport.