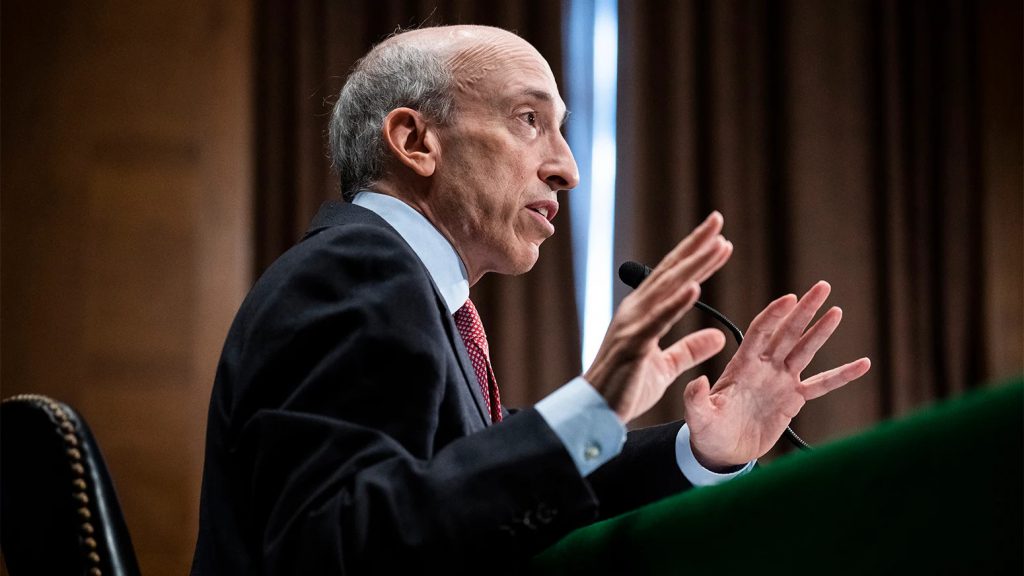

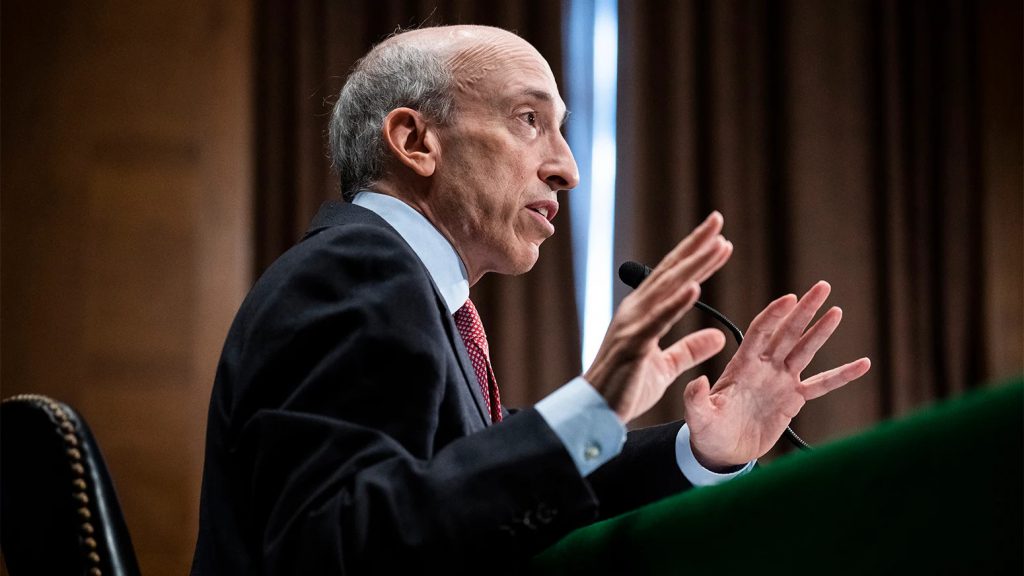

The past few weeks have seen the financial sector riddled with news of Gary Gensler’s undeniable crusade against the digital asset industry. Yet, amidst the SEC’s best efforts, Bitcoin (BTC) is proof of crypto’s resilience.

Understandably, the price for all digital assets has fallen in recent weeks. Yet, with the industry falling below $1 trillion in market cap for the first time in a while, the performance of the most prominent cryptocurrency is viable evidence as to why Operation ChokePoint 2.0 may be no match for the industry’s current state.

Regulators Target Crypto

There can be a very little argument made to US regulators attempting to silence crypto as an industry. Forbes’ own Clem Chambers said it perfectly regarding the SEC’s view of crypto. They are content on “at least driving it underground or at best crushing it into a pocket of confounded, regulated to death nice financial service.”

When observing the criminal activity that has run rampant in the industry, it is an understandable development. Moreover, the FTX fraud uncovered last year is reason enough for all regulators to seek the protection of citizens from the technology they may not fully understand.

Yet, for most sophisticated observers, the digital asset sector and blockchain technology have both a dark side and a revolutionary one. Conversely, regulators often only see one and don’t seem to fully understand either. Thus, they seemingly have opted for a tried and true tactic — to snuff it out completely. A tactic countered by Bitcoin’s continued relevance.

Operation Chokepoint 2.0

Something that Chambers Forbes’ story does brilliantly is highlight the reality of Operation ChokePoint 2.0. No, it is not a fable created to worry the mavericks of industry; it is a very real tactic executed in a vast array of industries to maintain control over negative outcomes.

Additionally, the same story points to some of the industries “marked for financial termination by the U.S.” Those that were targeted in the past include: Ammunition sales, ATM operators, scale box de-scramblers, credit card schemes, dating services, drug consolidation scams, firework sales, home-based charities, Pyramid Schemes, Ponzi Schemes, lottery sales, online gambling, pawn shops, payday loans, telemarketing, and even tobacco sales.

Now, there is merit to the decimation of some of these industries. Yet, fireworks sales? Dating services? Concludingly, the influence of the current operation to destroy crypto is riddled with inconsistencies. However, what is not inconsistent, is that the same behavior is occurring in crypto. Surprisingly, Bitcoin is showing it may be able to withstand it.

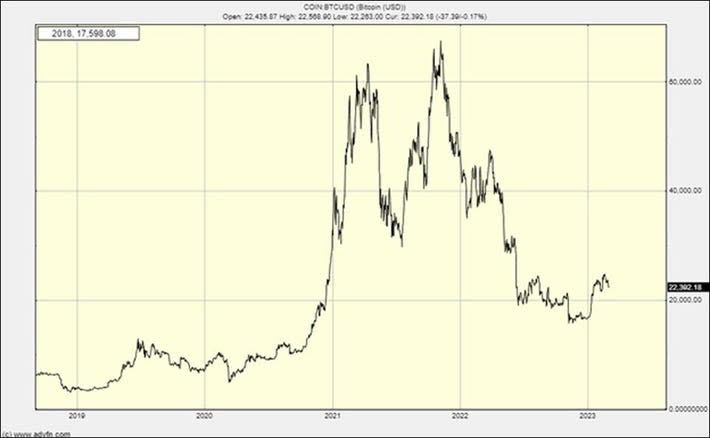

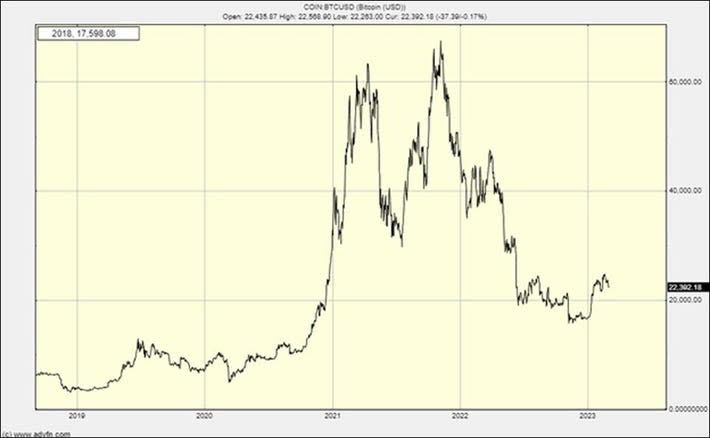

The Proof is in the Plotting

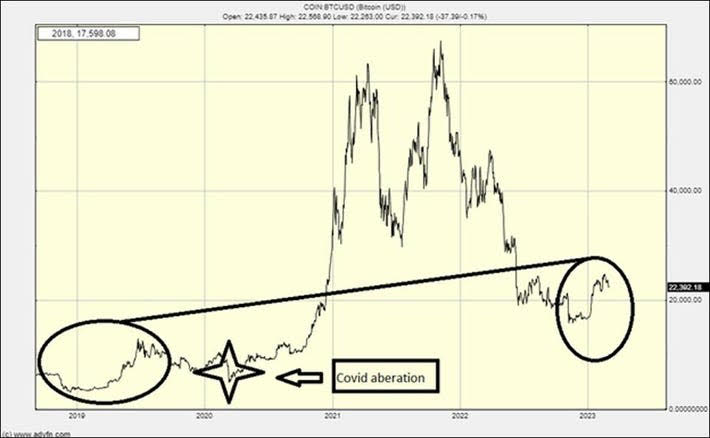

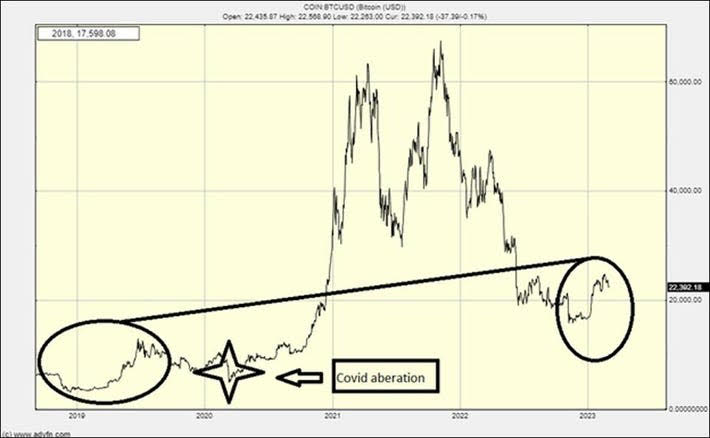

That same Forbes story identifies the ways in which classic choke point tactics can be seen in the digital asset industry. Specifically in an identities chart. Thus, showcasing that a Bitcoin chart analysis has shown the resilience of the crypto. Specifically, despite its banning in China and the current US regulator conflict, it is still in the $20,000s.

The Silvergate bank crisis had seen the steady demise of a key entity in the industry. Alternatively, despite a 5% correction, BTC did not fall below the $20,000 mark. Moreover, despite the logical standing of an industry under attack, Bitcoin doesn’t show the bearish sentiment you’d expect.

Ultimately, Forbes identifies the reasoning behind Bitcoin’s stance as “mystifying”. Noting that “It is the industry itself that is supporting the price an that outside of the parallel universe of the blockchain, the real world price of Bitcoin is represented by the Greyscale Bitcoin Trust price,” the piece stated. Additionally noting that the price is about half as listed on a crypto exchange.

Subsequently, amidst the SEC’s best efforts, Bitcoin (BTC) is proof of crypto’s resistance. The industry has shown that it will protect itself. Moreover, as blockchain technology evolves and progresses, it is the industry that understands how best to protect this technology. Still, how the regulatory attack influences mainstream adoption, is something that remains to be seen.