The Spot gold prices for the US dollar climbed above the $2,000 level this month and are gearing up to hit $2,100 next. The XAU/USD gold prices are now hovering around the $2,034 mark amid the softening of the US dollar. The Federal Reserve is looking to pause interest rate hikes and gold prices are benefiting from the development. Low interest rates weaken the US dollar making gold prices cheaper for institutional financial establishments.

Also Read: BRICS: China Aggressively Dumps US Dollars For 3 Days Straight

However, one should not expect gold prices to stop at $2,000 levels due to the development. The precious metal is attracting bullish sentiments worldwide and could sustainably scale up in price. The conflict in the Middle East between Israel and Palestine is also helping gold prices to shoot up in the charts.

Gold: Analyst Predicts a 50% Rise in Prices Next

Senior Bloomberg commodity strategist Mike McGlone made a huge announcement by predicting that gold could soar next year in 2024 reaching a new all-time high. According to McGlone, gold could spike by another 50% in 2024 and touch a new high of $3,000 next. That’s a big gain for the gold markets if the analyst’s prediction turns out to be accurate.

Also Read: BRICS: 150 Countries To Pay Chinese Yuan, Not USD for Loan Repayment?

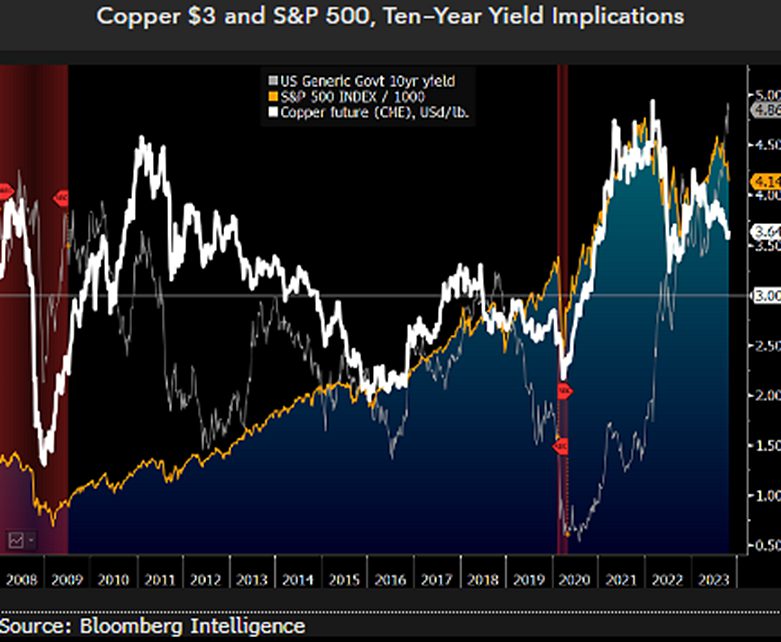

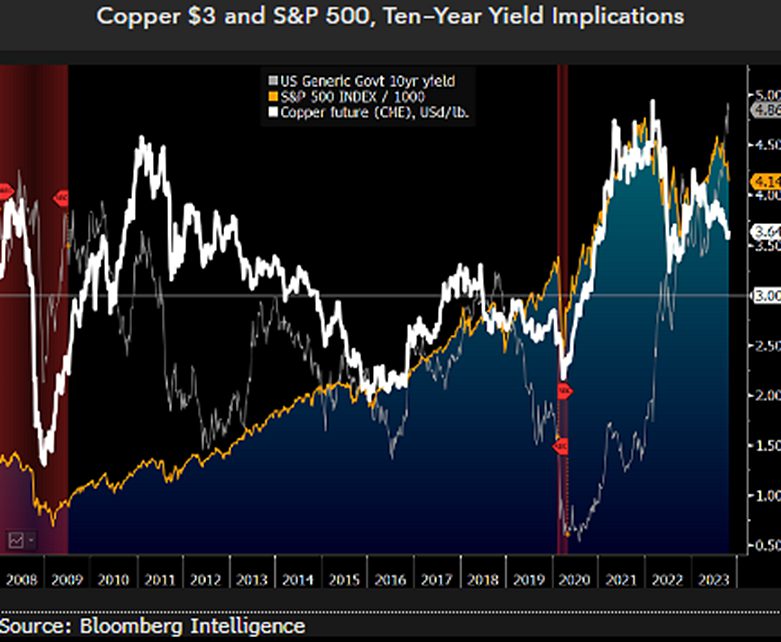

McGlone explained that gold prices are currently consolidating and could kick-start a rally next year in 2024. The softening of the US dollar and the inflow of funds into the commodity markets will be the key reason for gold to shine. The development could weaken the global stock markets making gold a safe haven for institutional investors.

Also Read: US Dollar First Casualty When Trade Between BRICS Countries Rise

In addition, reports of an upcoming recession in 2024 are making gold receive a large inflow of funds. Financial institutions are looking to protect their funds and gold is the best option to guard from the market downturn. The fortunes of the precious metal could move in a new direction next year.