During a volatile week for cryptocurrencies, Solana, one of the largest blockchain networks, was struck by instabilities.

According to a note on the Solana website dated Jan. 22, the difficulty observed by validators who utilize their processing capacity to assist validate the network was caused by numerous duplicate transactions.

Notice from Solana engineers

According to the notice, engineers have issued version 1.8.14, which “will attempt to mitigate the worst effects of this issue.” More upgrades are due in the next eight to twelve weeks, according to the company, and many of those features are being “rigorously tested.”

“Solana mainnet beta is experiencing high levels of network congestion,” the notice went on to say. “The last 24 hours have shown these systems need to be improved to meet the demands of users and support the more complex transactions now common on the network.”

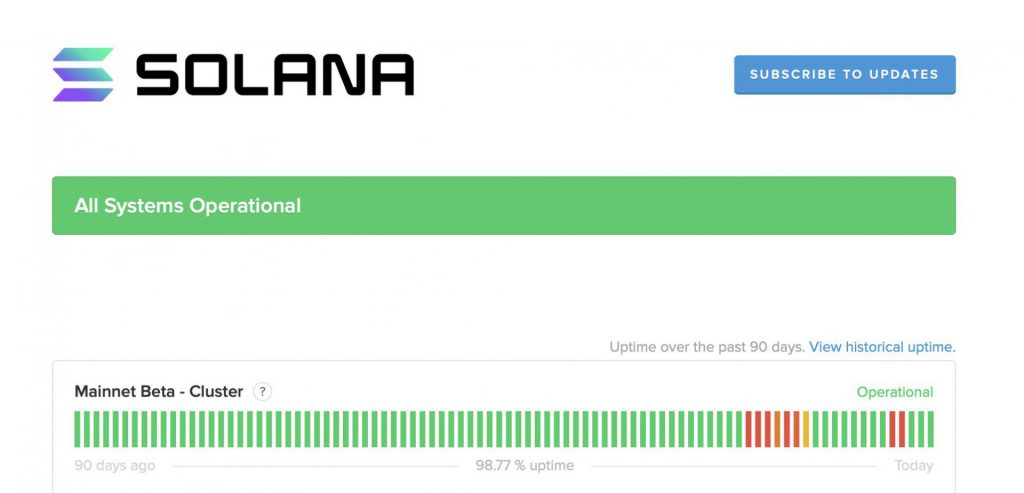

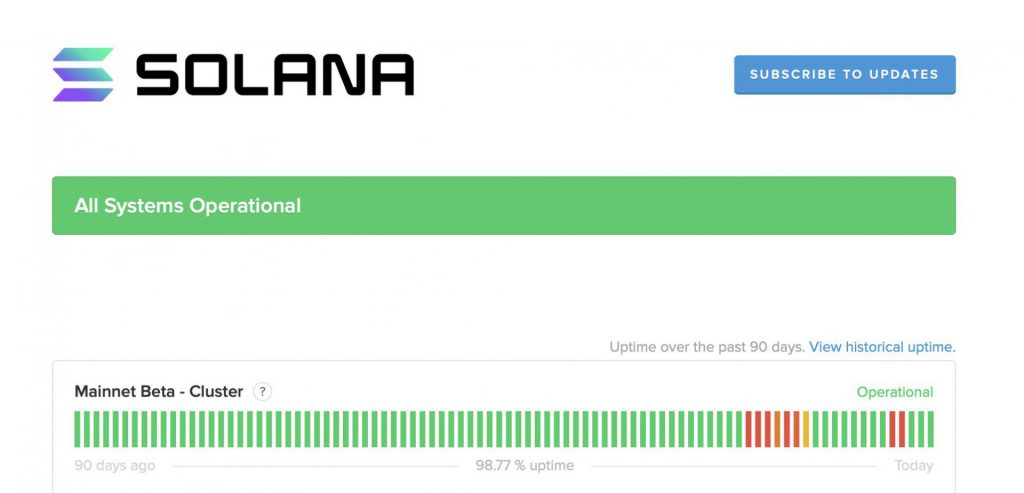

As of Monday, Solana’s network status web page declared all of its systems as completely operating.

Solana Labs co-founder Anatoly Yakovenko retweeted a post by an unverified user that blamed the network’s problems on “present market volatility”. Solana has had previous run-ins with insecurity: in September, for example, it experienced a 17-hour outage due to “resource exhaustion.”

Recent developments hindering SOL’s growth?

Solana’s problems coincided with a broad sell-off in tokens ranging from Bitcoin and Ether to Polkadot — and SOL itself, which has dropped more than 30% in the last seven days, according to CoinGecko pricing. From its highs, the cryptocurrency world has lost approximately $1 trillion in market value, with Bitcoin down about 50% from a November high.

In the previous week, SOL registered $11 million tokens for liquidation within a span of 12 hours. However, before last week’s slump, Solana appeared to receive an institutional nod and outperformed Bitcoin and Ethereum in terms of institutional inflows.