BlackRock & Vanguard antitrust concerns have escalated dramatically as the asset management giants controlling over $27 trillion face a high-stakes Texas lawsuit right now. State Street collusion allegations and growing regulatory uncertainty are creating significant market volatility, and also, cryptocurrency markets are experiencing turbulence amid intensifying United States news coverage of the federal investigation.

Also Read: Elon Musk’s xAI Taps Morgan Stanley for $5B Debt Amid Trump Feud

Regulatory Uncertainty Grows as BlackRock, Vanguard & State Street Face Collusion Claims

The BlackRock & Vanguard antitrust case reached the Federal Court as lawyers argued for dismissal of claims that the firms coordinated to suppress coal production. State Street collusion allegations center on whether the asset managers used their massive holdings to influence corporate decisions, and this is creating unprecedented regulatory uncertainty across financial markets.

Gregg Costa, representing BlackRock, stated:

“The antitrust claims in this case are unprecedented, they’re unsound and they’re unsupported. The claims just don’t add up.”

Coal Industry at Center of Legal Battle

Texas Attorney General Ken Paxton’s lawsuit alleges that the three firms coordinated to pressure coal producers to reduce output while also profiting from soaring energy prices. The BlackRock Vanguard antitrust case claims environmental goals provided cover for anticompetitive behavior affecting American consumers, and at the time of writing, this remains a contentious point.

Brian Barnes, representing the states, argued:

“When management gets a call from one of the largest, if not the largest, shareholder in the company, management listens. Jawboning by these defendants as to decisions about market strategy just very clearly have the potential to influence output decisions at the coal companies.”

The regulatory uncertainty extends beyond energy markets, and it could potentially affect how passive funds interact with companies across all sectors, including the rapidly growing cryptocurrency investments.

Federal Support Strengthens State Case

The Justice Department and Federal Trade Commission backed the lawsuit, signaling that State Street collusion claims have federal support right now. DOJ lawyer David Lawrence participated in court arguments, emphasizing that asset management firms should not be exempt from antitrust scrutiny, and also highlighting the government’s commitment to this case.

Robert Wick, representing Vanguard, initially clarified his firm’s approach:

“Vanguard was essentially a rubber stamp for coal company management.”

However, after a brief recess, Wick returned and said:

“I would not want the news media to report that Vanguard was a rubber stamp for coal companies.”

Broader Market Implications

The BlackRock Vanguard antitrust case highlights an emerging “common ownership” theory, where institutional shareholders own large stakes across competing companies. This regulatory uncertainty could reshape how asset managers approach investments in cryptocurrency and also traditional markets alike.

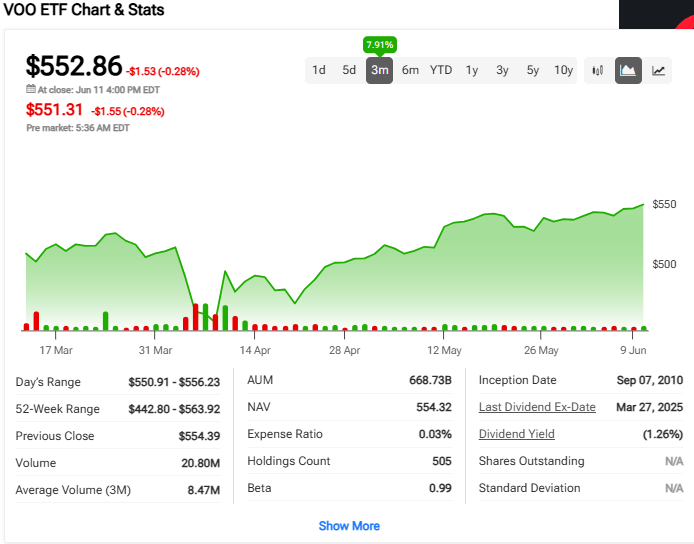

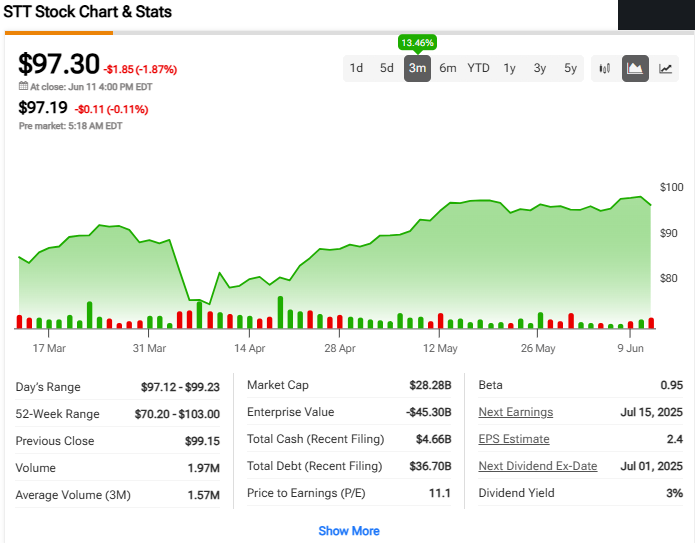

The three firms control about $25 trillion in combined assets and hold top positions in almost every S&P 500 company. Their influence extends into emerging sectors like cryptocurrency, where similar State Street collusion concerns could arise as digital asset adoption grows, and also as these firms expand their crypto offerings.

US District Judge Jeremy Kernodle disclosed owning shares in three Vanguard index funds and one BlackRock fund but indicated he doesn’t plan to recuse himself. This transparency adds another layer to the regulatory uncertainty surrounding the case, and also raises questions about potential conflicts of interest.

Also Read: Ripple’s BlackRock Alliance Strengthens as Deutsche Bank Backs $75 XRP