Apple is set to unveil its Q4 earnings reports on October 31st. As the unveiling date nears, the investors are divided as to whether they should continue investing in Apple (APPL) stock or pivot towards other alternatives. Will this report prove lucrative for the stock in the long haul? Let’s find out.

Also Read: Solana Is Outpacing Major Altcoins: Will It Claim $200 In November?

Apple Q4 Earnings Report: What To Expect

Apple is a strong contender in the technical domain. The firm’s iPhone production continues to attract heavy momentum worldwide, helping it stabilize its revenue streams. Per TradingView, Apple’s Q3 forecast was bullish, which the firm also intends to replicate in its Q4 report. In Q3, Apple reported a jump of 5% in its revenue year over year to $85.8 billion. At the same time, EPS climbed to $1.40.

The firm’s large array of products is the core of Apple’s revenue, a sturdy pillar that the company relies on heavily. Its Q3 earnings report stunning metrics, stating that its product sales rose 1.6% to $61.6 billion and sales revenues surged 14.1% to $24.2 billion. Analysts forecast that Apple will continue replicating its stellar metrics this quarter, with its service segment reflecting a better profit output.

Per TradingView, the iPhone giant may expect its profit margins to range between 45.5% and 46.5%. At the same time, with the launch of the iPhone 16, the firm’s revenue may report a high jump in revenue statistics. Analysts are also expecting an increase in stock value.

“Analysts are expecting Apple to report Q4 earnings of $1.54 per share, with revenue at $94.23 billion.”

Also Read: Ripple: AI Sets XRP Price for Halloween 2024

APPL Targets $300: When Will It Claim This Mark?

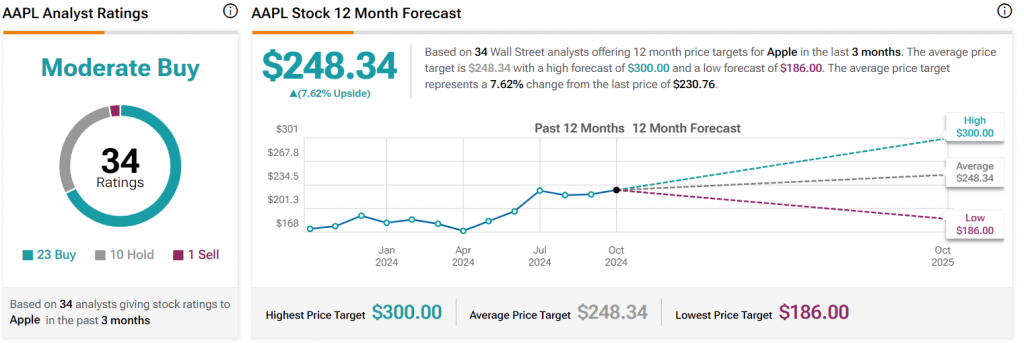

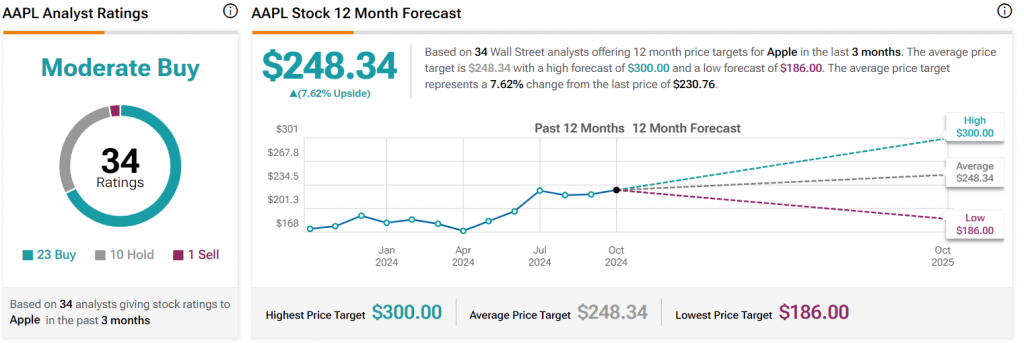

Apple’s stock continues attracting heavy momentum with the Q4 release date. According to TipRanks, APPL’s immediate stock target is $248. At the same time, it can hit an ambitious $300 mark in the next 12 months.

“The average price target for Apple is $248.34. This is based on 34 Wall Street analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $300.00; the lowest forecast is $186.00. The average price target represents a 7.62% increase from the current price of $230.76. Apple’s analyst rating consensus is a moderate buy. This is based on the ratings of 34 Wall Street analysts.”

Also Read: Michael Saylor’s Bold U-Turn: Embracing Self-Custody Amid Backlash