Amid the ongoing crypto market crash, the industry is experiencing the trend of consistently increasing crypto custody partnerships with banks across the globe. The latest update saw the UK banking giant, Barclays invest in crypto custody firm, Copper’s much-anticipated Series C funding round.

While the investment amount remains unknown, according to Sky News, Barclays has reportedly invested “millions of dollars” as part of the round. Following this, the fundraising is expected to be finalized within days.

This is not the first crypto custody partnership with a traditional banking platform during an extended bear period. Earlier this month, the French international banking group, BNP Paribas (BNP) was also reported to have signed a crypto custody partnership with Swiss digital asset safekeeping firm Metaco. Nevertheless, neither the bank nor Metaco confirmed the news.

Only 7 Out Of 178 Banks Have Direct Crypto Exposure

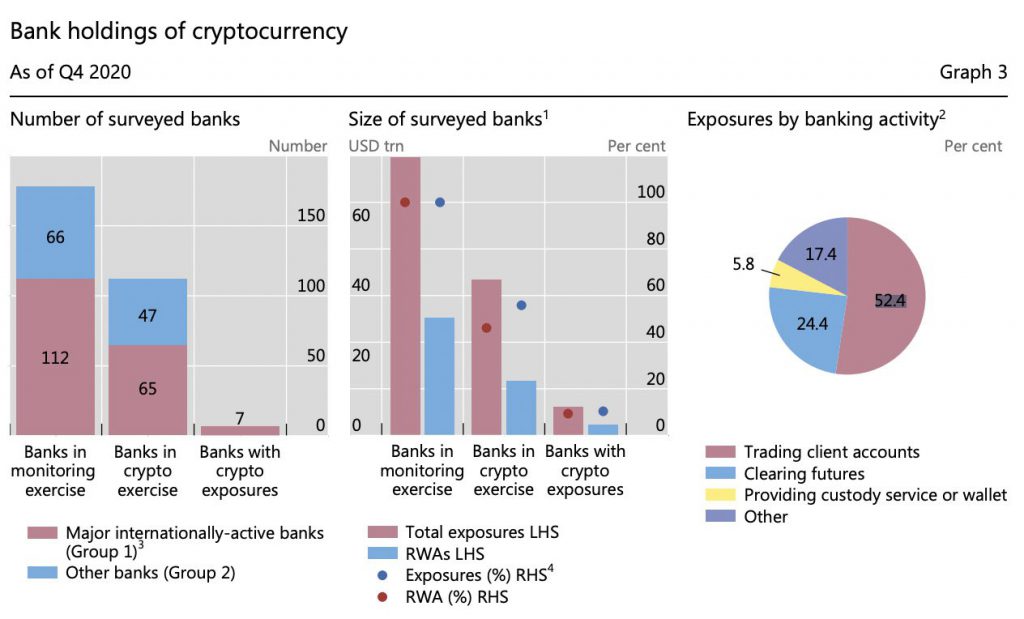

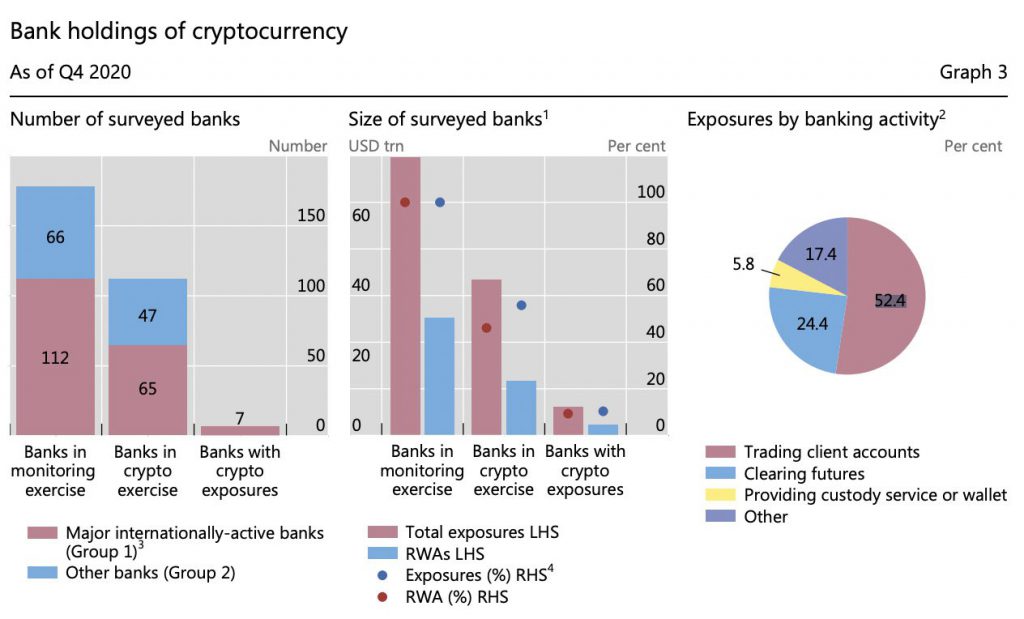

On one hand, banking giants are moving into crypto custody services during the crypto crash. On the other hand, according to data from Basel Committee on Banking Supervision (BCBS), only 7 out of 178 private global banks have direct cryptocurrency exposure.

This May, a BCBS survey-based report with 178 global banks as a sample size noted that only 7 out of the 178 banks had any direct exposure to cryptocurrency, all of which belonged to the Tier-1 category with more than $3 billion in assets.

Following this, even though banks with low asset valuations did not have direct exposure to crypto, about 112 banks still performed some kind of crypto exercise. This included client-led activities such as — trading on clients’ accounts, clearing of futures referencing cryptocurrencies, providing custody service or wallet, proprietary trading, and securities financing transactions.

BCBS report noted that 52.4% of the crypto assets under management were used by banks in trading client accounts, followed by 24.4% in clearing futures. Furthermore, banks did not report direct cryptocurrency holdings as long-term investments or proprietary trading. Subsequently, banks also denied cryptocurrency holdings for the purpose of intra-bank operations.