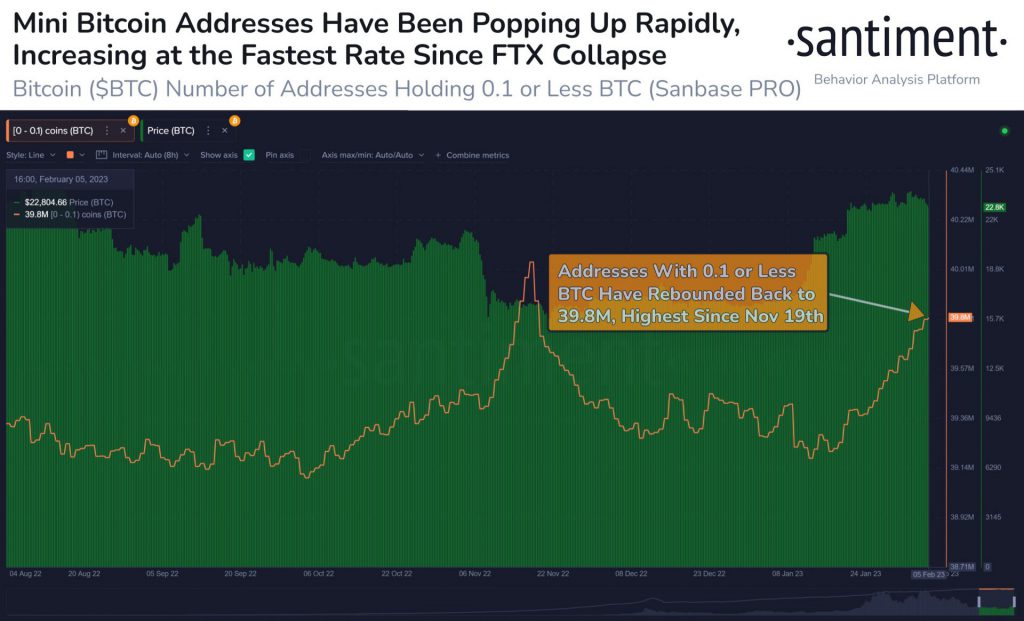

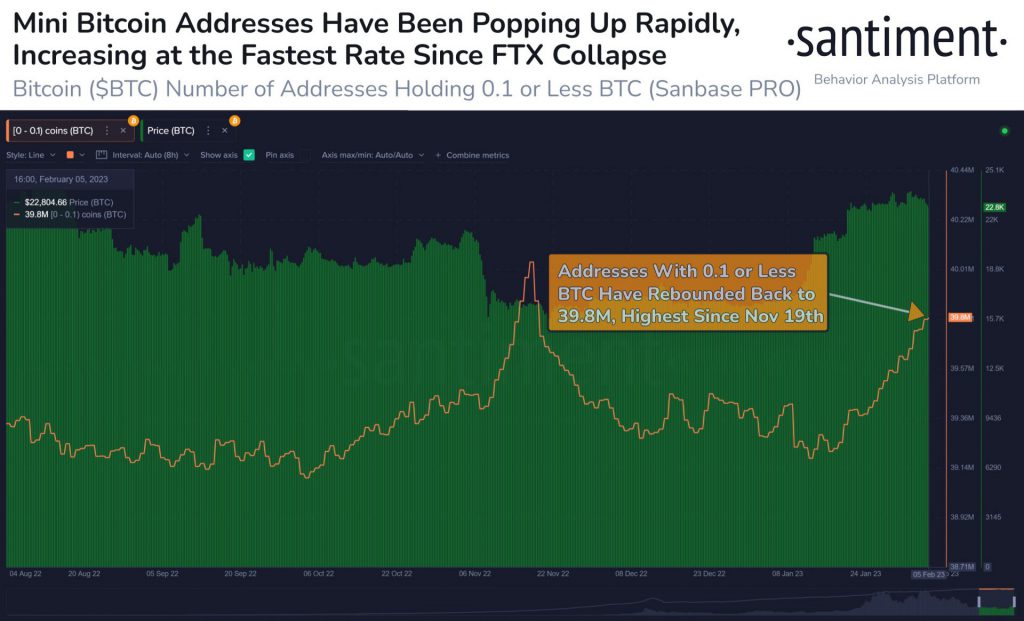

As seen throughout the last month, BTC rose to a high of over $24K. While it witnessed a slight setback and is currently trading for $22,872.88, retail investors could be loading up on the asset. According to Santiment, the total number of small Bitcoin addresses has been increasingly “popping up” since the collapse of FTX.

Elaborating on the same, the firm wrote,

“There have been ~620k small #Bitcoin addresses that have popped back up on the network since #FOMO returned on January 13th when price regained $20k. These 0.1 $BTC or less addresses grew slowly in 2022, but 2023 is showing a return of trader optimism.”

These mini addresses could be linked to retail investors. This group seems to be pocketing Bitcoin at discounted prices hoping for an upswing in the near future.

At press time, a whopping 60% of Bitcoin’s holders were making profits at its current price. Only 36% were enduring losses.

Can Bitcoin hit $30K sooner than expected?

Bitcoin’s next move is highly speculated among community members. While several believe that the asset entails the capability of hitting $30,000, a few others were figuring out BTC’s bottom. Analyst Kevin Svenson shared a video prediction stressing the former.

Bringing Relative Strength Index [RSI] into play, he said,

“We are now in a bullish trend shift… But what is interesting to me is the daily RSI. We’re bouncing off the 70 level on the daily RSI. We’re bouncing off the overbought zone, the unthinkable. The bears never thought this was going to be possible. But it has happened before.”

It should be noted that BTC stayed in the overbought zone for quite some time back when BTC breached the $20K level. Svenson thinks that Bitcoin is likely headed toward $30,000 before the asset has any significant correction because it is now trading above the diagonal resistance of the falling wedge formation.