Back in May, Terra’s native stablecoin UST, lost its peg and was trading under the $1 mark. A few days later, other stablecoins followed suit, including Tether’s USDT. Around that time, it did seem like USDC was stepping up, and in fact, there were also talks going on about a potential flippening.

Read More: Is USD Coin posing threat to stablecoin king, Tether?

The fund shuffle

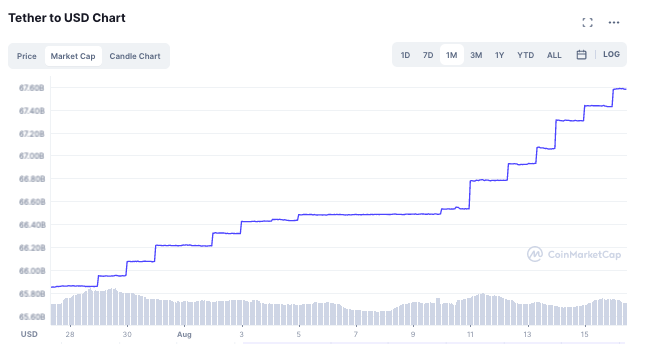

The market cap of the #1 ranked stablecoin—USDT—reflected a value of $67.5 billion at press time, while that of the #2 ranked coin—USDC—stood at $53.5 billion. However, the market cap of both the assets has been moving in opposite directions lately.

Per data from CMC, on 28 June, the aggregate value of all USD Coins stood well above $55 billion. Currently, it’s down by around $1.5 billion from the said number.

USDT’s number, on the other hand, inflated in the said period. During the end of July, the total valuation of USDT tokens was around $65.8 billion. However, now, it is already up by around $1.8 billion.

The rise in the market cap of USDT coinciding with the fall in the market cap of USDC—by roughly the same amount—gives weightage to claims that investors are moving funds from Circle’s stablecoin and transferring it to Tether’s.

But why?

Last week, the US Treasury Department imposed sanctions on crypto mixer Tornado Cash. Alongside, Circle froze more than several thousand coins at addresses listed by Treasury officials. As a result, there are speculations that the said set of crackdown-centric events have added fuel to the fire.

In fact, per people from the space, investors will soon be triggered to put a safety net on their funds by pulling them out of US-based companies. Here it is worth noting that Circle is a Boston-based company, while Tether is headquartered in Hong Kong and is owned by iFinex.

Play to Earn rewards app Points Ville’s founder Gabor Gurbacs recently tweeted,

“After the recent regulatory push in the U.S. against crypto companies and tokens, I wouldn’t be surprised if institutions and larger players felt safer with their money outside the U.S.”

So, are we now witnessing the beginning of the end of USDC?

Of course not. It’d only be an exaggeration to say so. Per on-chain data, USDC hasn’t been abandoned as such.

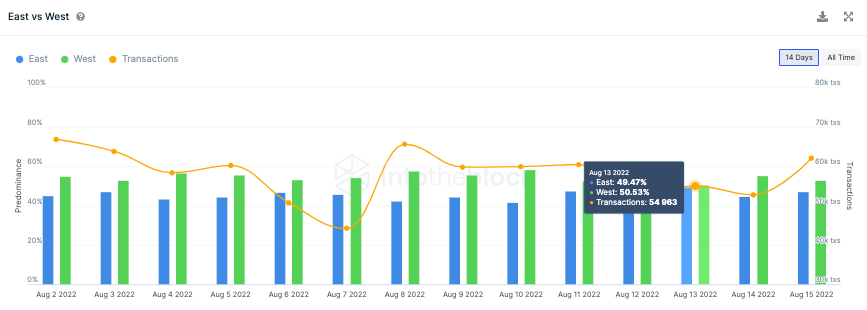

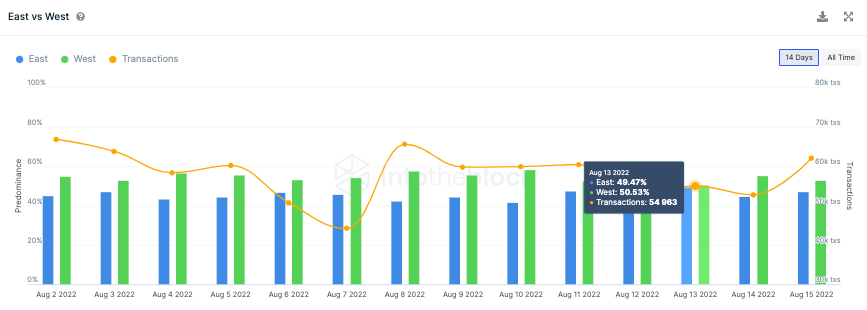

Over the past few days, there has been an investor base shift for USDC. In a rare occurrence, on 13 August, the West-East transactions stood at roughly 50% each. Now, it’s a known fact that the west accounts for the lion’s share of global volume.

However, since the sanctions were imposed, the other half of the hemisphere has risen to the occasion. Thus, it can be contended that non-US traders are continuing to engage in USDC trades. And the moment, it’s just the fear in the minds of US investors that is keeping them away from USDC. And, when things cool down, USDC would start becoming relevant again among US traders.

Also Read: Why Tether USDT Dropping To $0.94 Was More Than Just Market panic