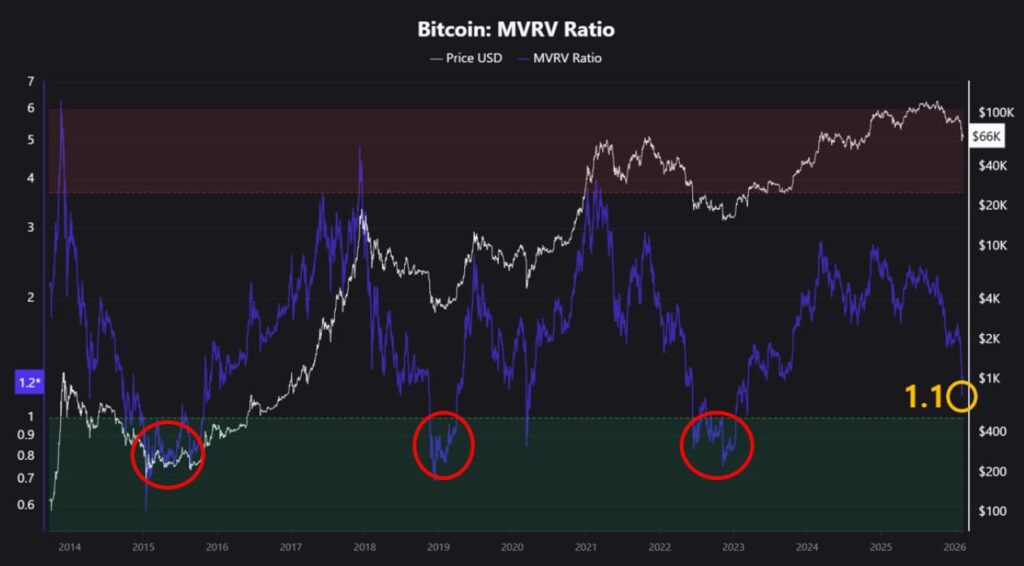

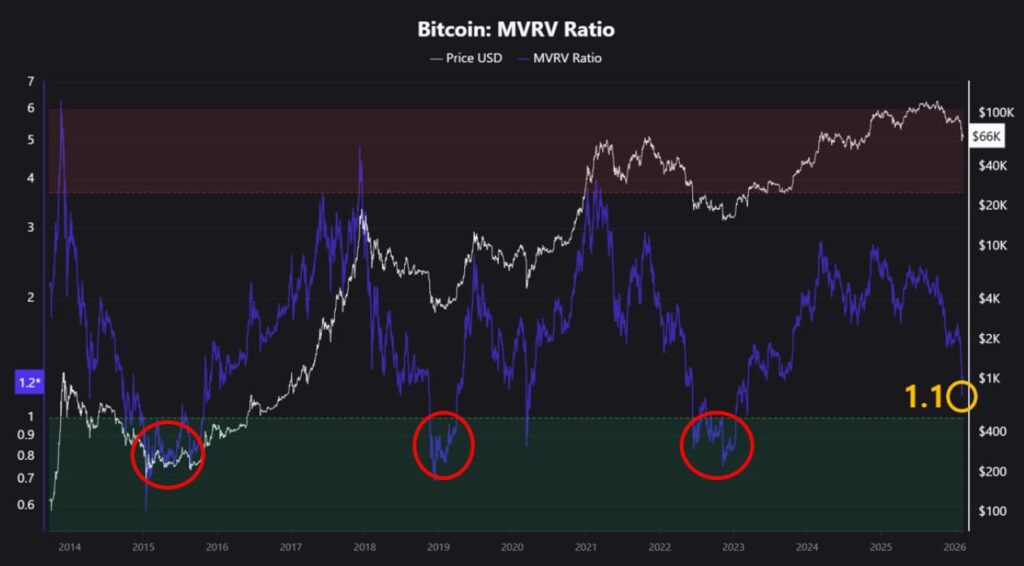

According to CryptoQuant’s BTC data, Bitcoin is nearing undervalued levels. BTC’s MVRV (Market Value to Realized Value) ratio is currently at 1.2. An asset is considered undervalued if the MVRV ratio dips below 1. The MVRV falling below 1 is also a sign that the average BTC holder is at a loss. With BTC nearing its undervalued level, let’s discuss if we are at the market bottom.

Will Bitcoin Rally As It Nears Undervalued Levels?

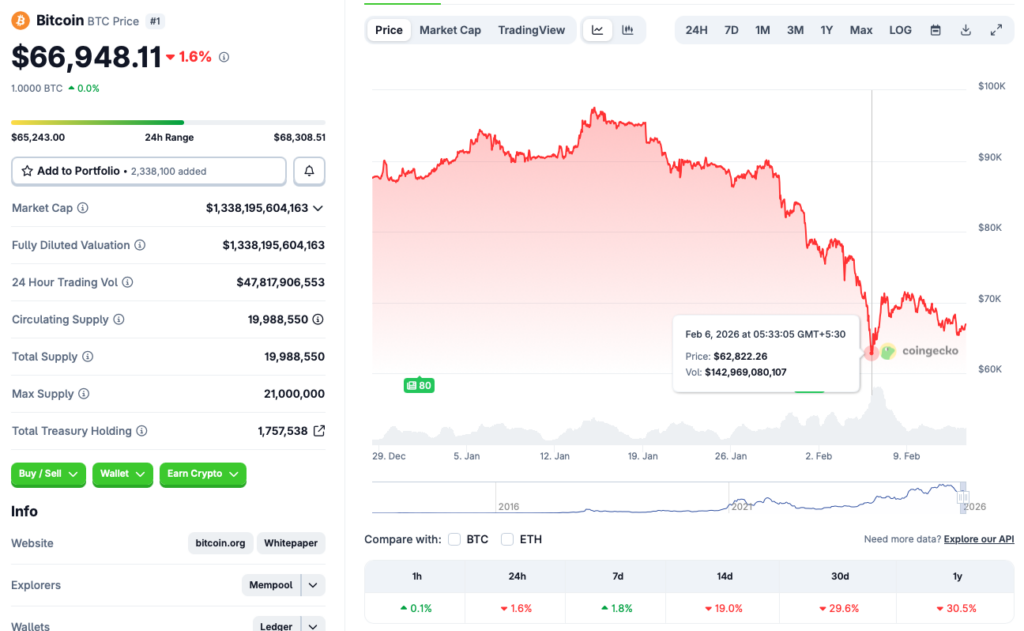

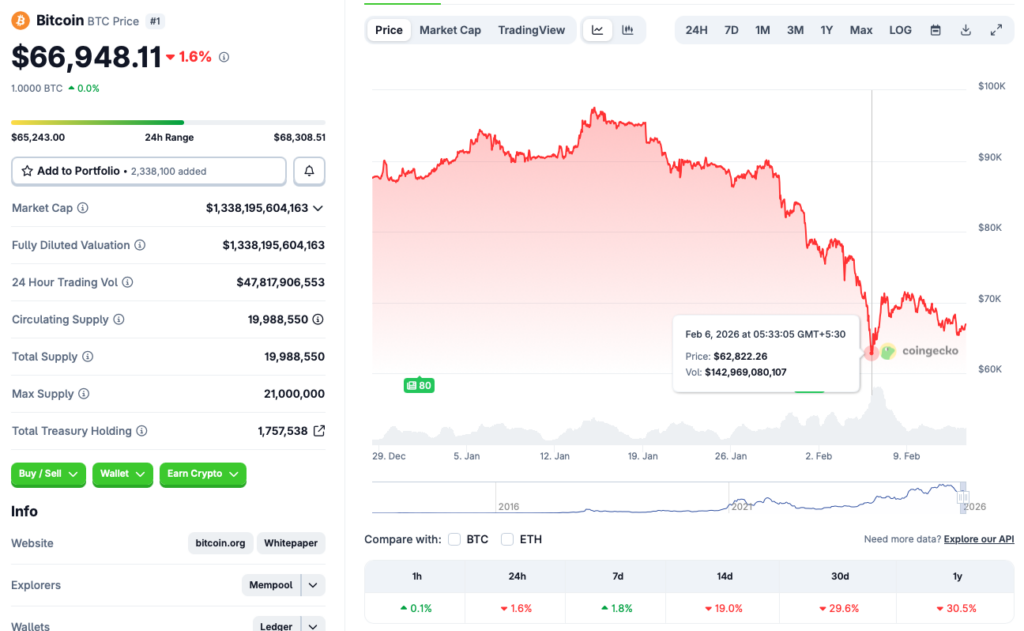

Bitcoin (BTC) recently fell to the $62,000 price level earlier this month. However, the original crypto reclaimed the $71,000 level before facing a rejection. According to CoinGecko data, BTC is down 1.6% in the last 24 hours, 19% in the 14-day charts, and nearly 30% over the previous month. However, the asset has made a 1.8% gain over the last week.

There is a possibility that Bitcoin (BTC) is at its bottom and things will pick up once it attains undervalued levels. Investors may take the opportunity to buy BTC for cheap. However, on the other hand, there is also a possibility that BTC will continue to fall further. Some believe Bitcoin’s (BTC) price could dip to the $50,000 level. Stifel presents an even more bearish outlook, predicting the original crypto to fall to $38,000.

Also Read: Binance buys 4,545 Bitcoin worth $305M for “SAFU” fund

CoinCodex analysts also anticipate Bitcoin (BTC) to rally here on. The platform predicts the original crypto to hit $88,047 on May 11, 2026. Hitting $88,047 from current price levels will entail a rally of about 31.5%.

Despite the bullish outlook, there is always a chance that the crypto market will victim to fresh volatility. Market participants are still staying away from risky assets amid a liquidity crunch and macroeconomic uncertainties. How things unfold for Bitcoin (BTC) is yet to be seen.