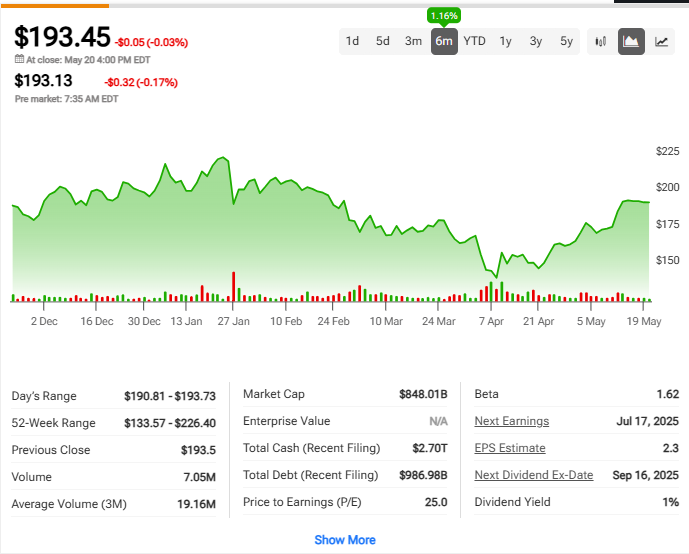

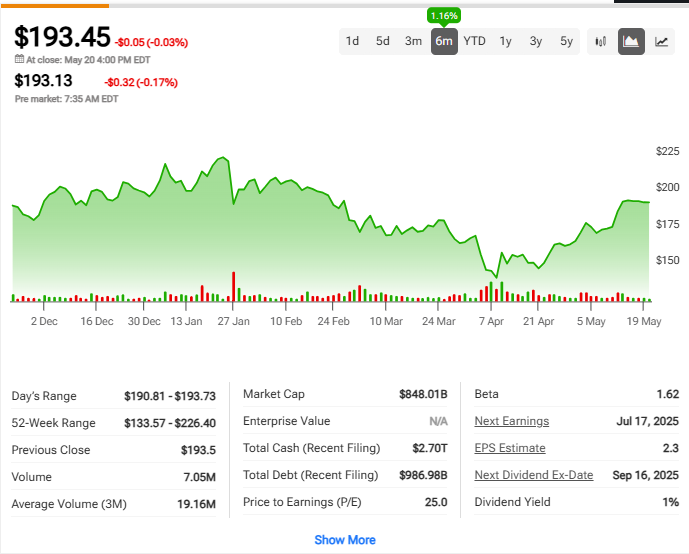

ARK Invest has just recently purchased around $34.5M worth of TSMC stock at approximately $174, suggesting some renewed confidence in the semiconductor sector amid ongoing volatility that’s currently affecting Nvidia stock and various cryptocurrency markets as well. Cathie Wood’s investment firm has added what appears to be roughly 198,275 TSMC shares while the company trades near $193.45, which represents a small decline of about 0.03% in the most recent trading session that we’ve seen.

Also Read: Top Crypto to Buy Now as Ripple Eyes Circle Acquisition

Is ARK Invest’s $34.5M TSMC Buy a Bet on a Semiconductor Comeback?

The TSMC stock acquisition, which happened just recently, comes at a time when semiconductor manufacturers are facing somewhat mixed market signals right now. ARK Invest’s move seems to indicate potential optimism about TSMC’s important role in the AI chip supply chain that also supports Nvidia stock and the broader NASDAQ: NVDA ecosystem growth that we’ve been monitoring for some time now.

ARK’s Strategic Position in Semiconductor Market

ARK Invest has, for quite a while now, consistently targeted companies that are supporting the technology infrastructure boom. The firm’s TSMC purchase appears to align with its investment thesis that is focused on innovation drivers, such as semiconductor manufacturers that are essential to cryptocurrency mining and also AI development in general.

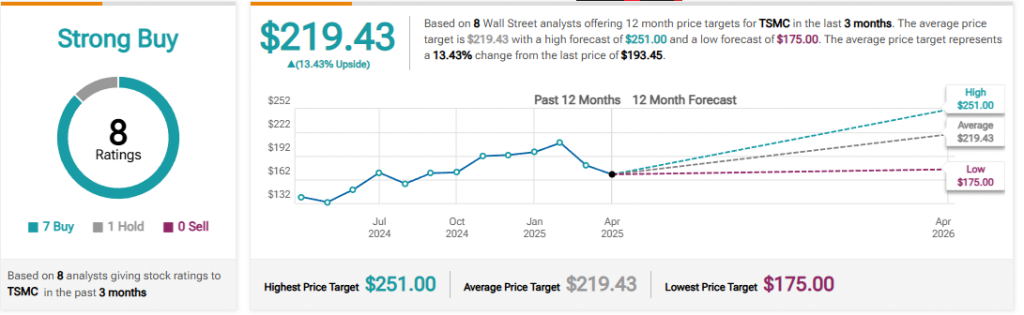

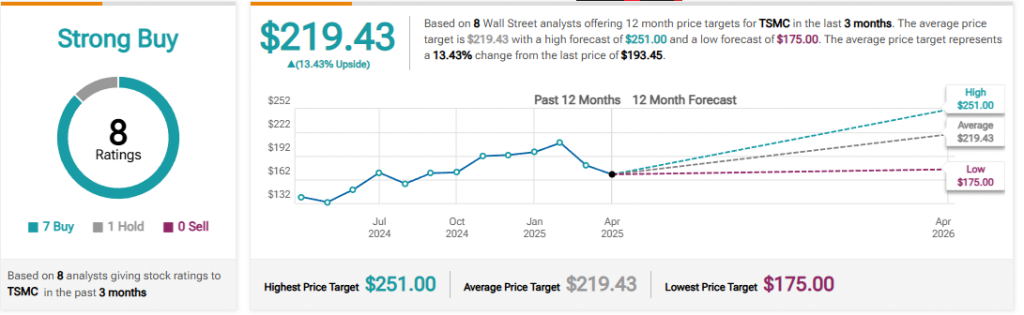

At the time of writing, Wall Street analysts maintain a “Strong Buy” consensus on TSMC stock with an average price target of around $219.43, which represents approximately a 13.43% upside from current levels, give or take.

Also Read: Friedland Sees Copper as the ‘New Oil’ for Miners

TSMC’s Market Position Versus Competitors

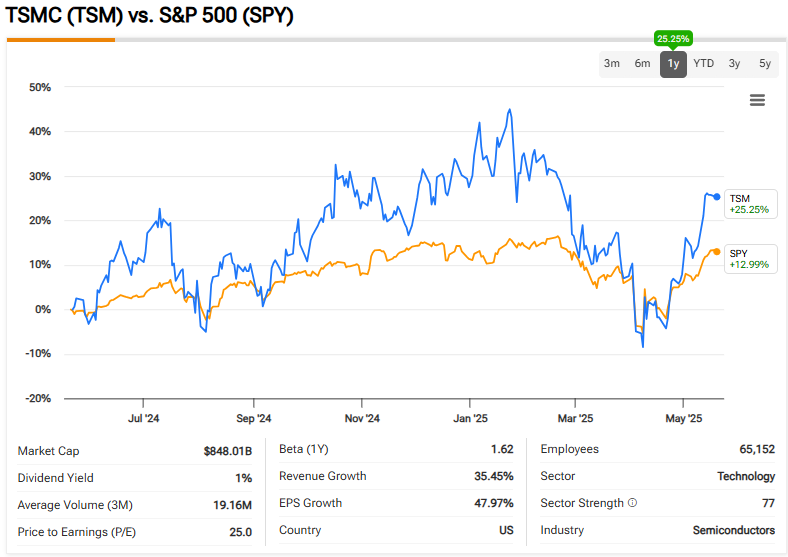

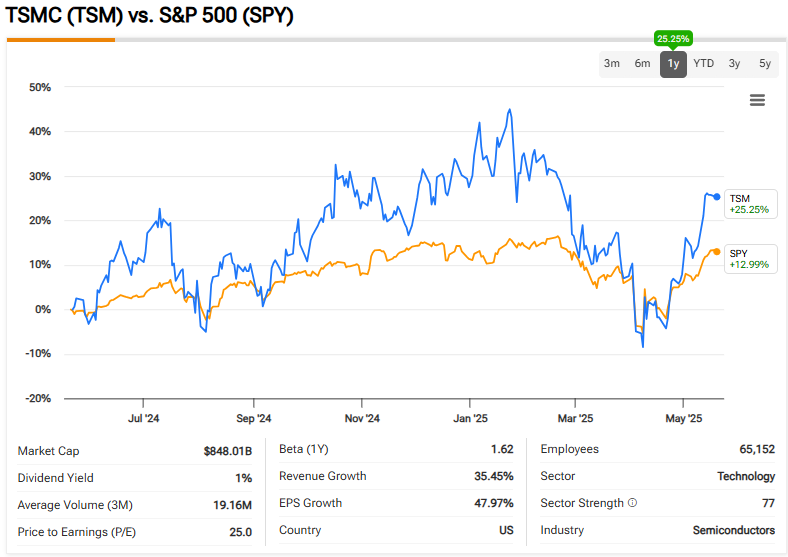

TSMC has, by and large, outperformed the broader market with shares gaining about 25.25% year-over-year compared to the S&P 500’s 12.99%. The company’s dominant manufacturing position continues to support key clients including those producing Nvidia stock components and various cryptocurrency mining hardware as well.

ARK Invest’s founder Cathie Wood stated:

“The semiconductor industry represents one of the most significant innovation platforms in the world today.”

Also Read: Ethereum (ETH) Could Hit $3,000 Sooner Than Expected, Here’s Why

Growth Outlook for Semiconductor Investments

The semiconductor industry cycle appears to be, from what we can tell, reaching something of an inflection point, with ARK Invest positioning for a potential sector recovery in the near future. TSMC’s ongoing manufacturing expansion and advanced node development directly impact the availability of chips that are used in cryptocurrency applications and also high-performance computing in general.

With NASDAQ: NVDA and TSMC stock serving as rather critical barometers for tech hardware trends nowadays, ARK Invest’s substantial position increase seems to signal confidence despite the current market uncertainty that we’re experiencing.

The next TSMC earnings report, which investors expect around July 17, 2025, will likely provide some crucial insights into whether ARK Invest actually justified its semiconductor sector optimism through its recent TSMC stock purchase or not.

Also Read: Shiba Inu Claps Back at Saylor’s Bitcoin Flex With Meme Power