Arm Holdings AI stock has caught the attention of quite a few investors interested in artificial intelligence stocks. The chip design company, which went public back in September 2023, is already known in the AI world. With some market analysts projecting a potential 44.93% surge in its value in the coming months, should you add this promising tech stock to your investment portfolio?

Also Read: When Will Bitcoin Hit $150,000? Analyst Reveals Timeline

Here’s What You Need to Know Before Buying Arm Holdings

Arm Holdings AI stock benefits from the company’s rather unique approach to the semiconductor industry. Unlike traditional chip manufacturers, Arm designs components and then licenses these designs to various partners including Nvidia and also cloud infrastructure providers.

This kind of business model has positioned Arm Holdings AI stock quite favorably in the market. The company’s power-efficient architecture is particularly valuable for AI applications such as ChatGPT, which require substantial computing power while also trying to minimize energy consumption.

Bank of America analysts stated:

We expect AI to transition from a ‘tell me’ to a ‘show me’ story, with any disconnect between investments and revenue generation to come under increased scrutiny.

Arm Holdings AI stock stands out partly due to the company’s competitive advantage in power-efficient CPU architecture, which essentially outperforms the X86 architecture used by Intel and AMD. This efficiency becomes increasingly important as AI applications continue to demand more and more power.

The company has been strengthening its position by launching Arm Compute Subsystems (CSS), which are specialized chip designs that can be brought to market faster and customized for specific users. These innovations have contributed to increased license revenue as demand for AI-capable chips grows in various industries.

While Arm Holdings AI stock shows a lot of promise, the broader AI stock market has faced some turbulence in early 2025. Major players including Nvidia and others have seen corrections after substantial gains in previous years.

Also Read: PI Coin: 82.8 Billion Controlled by Core Team—Is Pi Network Truly Decentralized?

Evaluating Arm Holdings AI stock

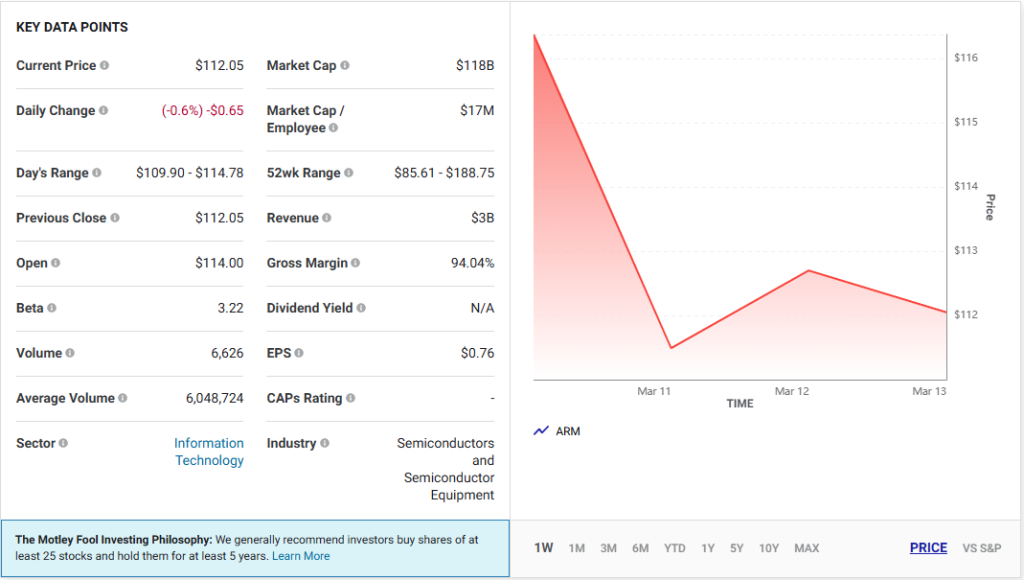

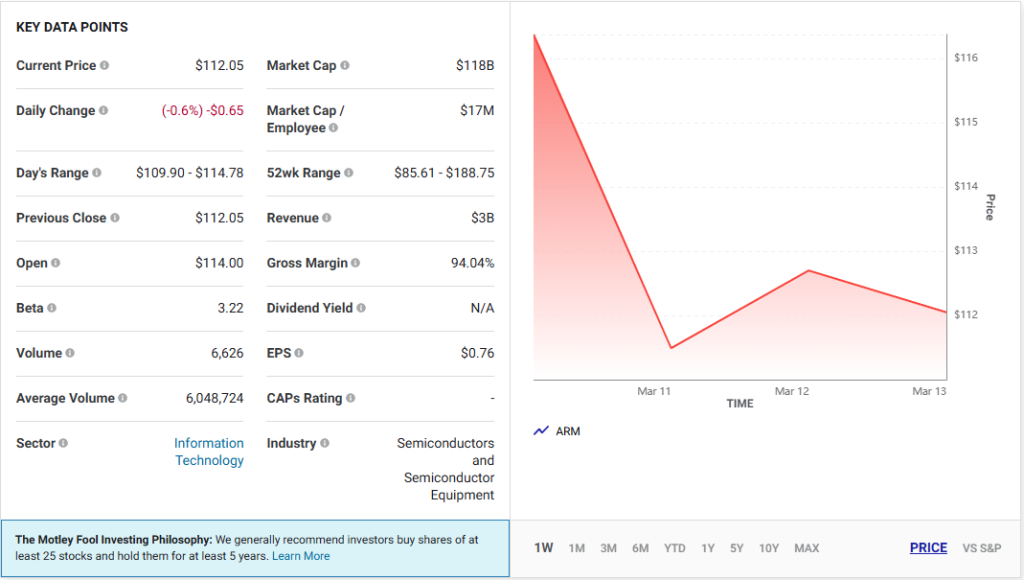

When evaluating Arm Holdings AI stock as a potential investment, there are quite a few factors that must be considered carefully. The company’s market cap of $118 billion is a sign of strong confidence in its growth trajectory. However, with a premium valuation at the moment, investors must determine if future growth really justifies current prices.

Even more, U.S. chip export restrictions are an unpredictable factor for many semiconductor companies, potentially affecting supply chains and international sales in the near future. As for emerging competitors like China’s DeepSeek, they have recently disrupted market expectations about AI development costs.

The robust capital spending plans of cloud computing giants for 2025 suggest continued strong demand for Arm’s chip designs. As AI applications shift from training models to “inferencing” (essentially running AI applications in real-world settings), Arm’s efficient architecture becomes increasingly valuable and sought after.

Morgan Stanley projects:

Meta’s generative AI-related revenue will grow at a 67% compound annual growth rate to $101 billion in 2028, up from $13 billion last year.

The AI market changes rapidly. Software companies might emerge as the next wave of winners if they can successfully monetize new AI products and services. For chip designers like Arm Holdings, this presents both challenges and also opportunities as demand shifts from general-purpose computing to more specialized AI workloads.

Also Read: GTA 6 Insane Detail: Store Heists, Car Chases & Cash in Underwear?

Arm Holdings AI stock may benefit from increasing interest in “edge AI”. This is basically on-device processing that requires the power efficiency that Arm is known for. This trend could drive further adoption of Arm’s designs across various devices beyond just data centers.