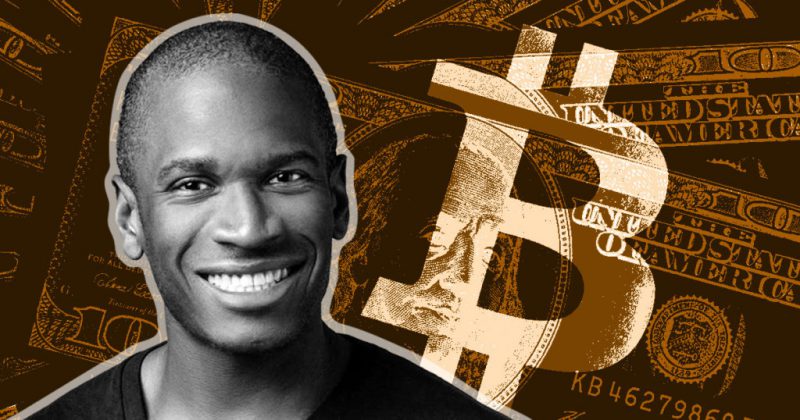

Arthur Hayes, Crypto and trading enthusiast, and co-founder of 100x, has published a Medium blog, where he shares his thoughts on the ongoing economic and political situation of the world. Not only that, but he also predicts the price of Ethereum (ETH) and Bitcoin (BTC).

Hayes argues that when the West decided to confiscate the fiat assets of the Russian Central Bank it ushered in an era in which any sovereign that isn’t the United States or an EU country can “save” in gold and, eventually, Bitcoin (BTC). This scenario will lead to Bitcoin reaching $1 million and gold hitting $10,000 during the next three to five years, according to Hayes.

Hayes continues by stating that Bitcoin (BTC) and Ethereum (ETH) are significantly connected with the Nasdaq 100 index. If the NDX falls, the crypto market will fall with it.

Falling interest rates boost NDX, as they do other long-duration assets. Because the Fed and all other central banks are battling inflation, they must tighten rather than loosen monetary policy. The NDX’s recovery failed at the 61.8% Fibonacci Retracement level, indicating that the index would continue to fall toward and below 10,000. The Fed’s bet is on US corporate credit markets, which are still healthy-ish, rather than equities.

Crypto capital markets, according to Hayes, are the only free markets remaining on the planet. As a result, they will drive equities lower as we move deeper into the slump and higher as we emerge from it. Bitcoin and Ethereum will reach the bottom long before the Fed acts and reverses its tightening policy.

He says,

“The great thing about a 24/7 market accessible to all humans with an internet connection is that things happen quickly.”

Hayes anticipates Bitcoin and Ethereum to have tested $30,000 and $2,500 respectively by the conclusion of the second quarter in June of this year.

However, he does say that there is not much science behind these numbers and that it’s more of a gut feeling.