The DeFi market is perhaps one of the worst affected casualties of the broader market correction phase. Right from Uniswap and SushiSwap to Compound and Aave, most top tokens from this space have had massive price haircuts. In fact, the whole concept of ‘DeFi summer’ now seems to be a thing of the distant past.

Remember DeFi well? Yeah, me neither!

Back in November last year, the DeFi market’s capitalization hit the $200 billion mark. However, after shrinking by almost 40%, the same reflects a value of merely $128 billion at the moment.

In fact, the total value locked on all the protocols has followed a similar downward trajectory. As per DeFiPulse’s data, the TVL has dipped down to $75 billion from its peak of $110 billion registered last November.

The current low levels were, in fact, last observed in 2021’s August. The deteriorating state of the TVL points towards the fact that DeFi users/market participants are refraining from diverting their assets into the ecosystem. The same isn’t a fundamentally strong sign.

Is Uniswap sailing on two boats?

Despite the macro DeFi sluggishness, Uniswap’s TVL has started climbing up gradually of late. The same was substantially elaborated upon in a recent article. To add to the icing on the cake, the protocol’s development activity has been going on at quite a swift pace as well.

Leaving behind the likes of Ethereum, Polkadot, Chainlink, Cardano, and Solana, Uniswap currently leads the GitHub development activity front.

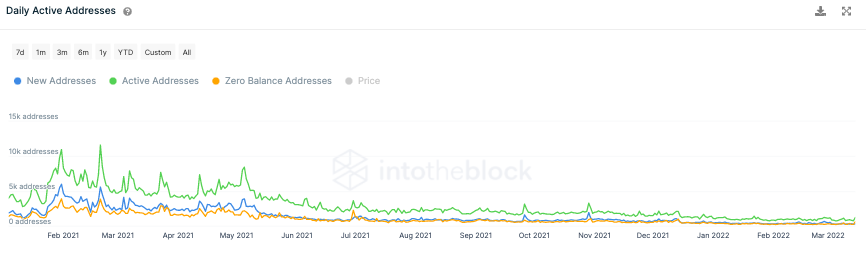

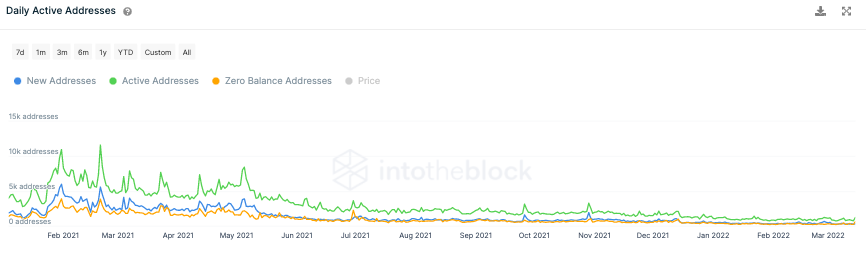

Nevertheless, its other fundamentals legs ain’t that strong. The active, new, and zero balance addresses continue to remain suppressed and are nowhere close to the levels registered last year.

Uniswap, at this stage, is evidently depicting mixed signals on the fundamental front. The deteriorating state of the addresses would have to improve and additional participants would have to step into the arena for UNI to prosper.

At the time of writing, the apex DeFi token was seen trading at $8.88, up by 8% on the daily window.