On Monday, owing to the broader market dump, Ethereum had stooped down to $2950. From there on, the asset’s price gradually inclined over the next couple of days and was already sitting north of $3.1k at press time.

Is an Ethereum bounce on the cards?

Over the last three days, Ethereum saw major signs of capitulation. The same essentially triggered the latest bounce. According to Santiment’s ratio of on-chain transaction volume in profit/loss, Ethereum traders were selling at the bottom. The same is “a solid sign of an upcoming bounce,” per the analysis platform.

As illustrated below, ETH has usually bottomed out whenever this ratio has dunked down. Conversely, the asset’s price has peaked alongside ratio escalations. Thus, the current state of this metric does open the door to a potential Ethereum price hike.

With the selling spree now gradually fading away, market participants have started re-diverting their funds towards this asset. According to the order-book data from ITB, the number of ETH tokens bought had exceeded the number sold by more than 4.73k over the past 12 hours.

In fact, the state of the exchange net flows further gave credence to the said narrative. On 11 April, this metric reflected a positive value of 151k ETH. However, at press time, it stood at -81k. The transition of the flows from the positive to the negative territory highlights that the sell-spree has fizzled out and buying momentum has found its way back into the Ethereum market.

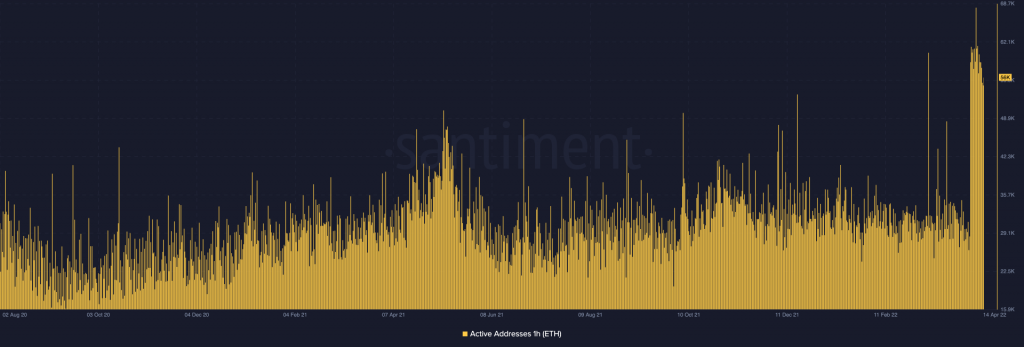

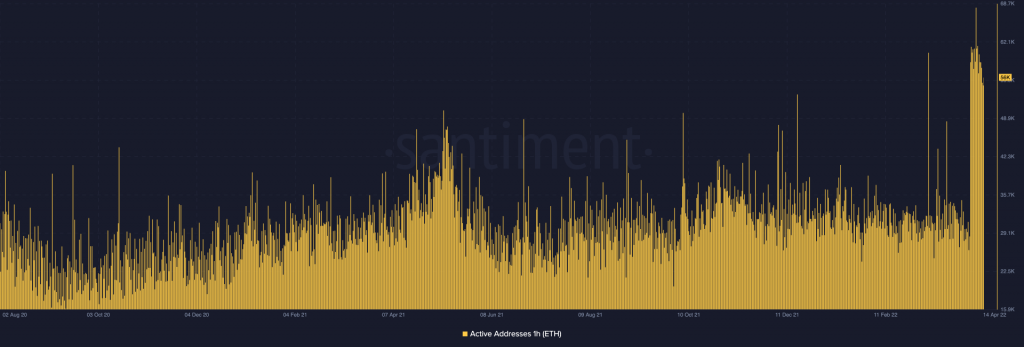

Further, per data from Santiment, the number of active addresses, on the hourly frame, was at a multi-year high. For the most of this year, this metric hovered in and around the 30k mark. At press time, however, it flashed a reading of 56k and rekindled optimism.

As a result, the macro landscape of Ethereum remained mostly bullish, favoring a bounceback.