ATOM is well-positioned to extend its hike after breaking above a horizontal channel pattern. Once a throwback is complete, healthy buy volumes would help ATOM add another 17% to its value before sellers hit back at $44.6. At the time of writing, ATOM traded at $38.3, up by 6.5% over the last 24 hours.

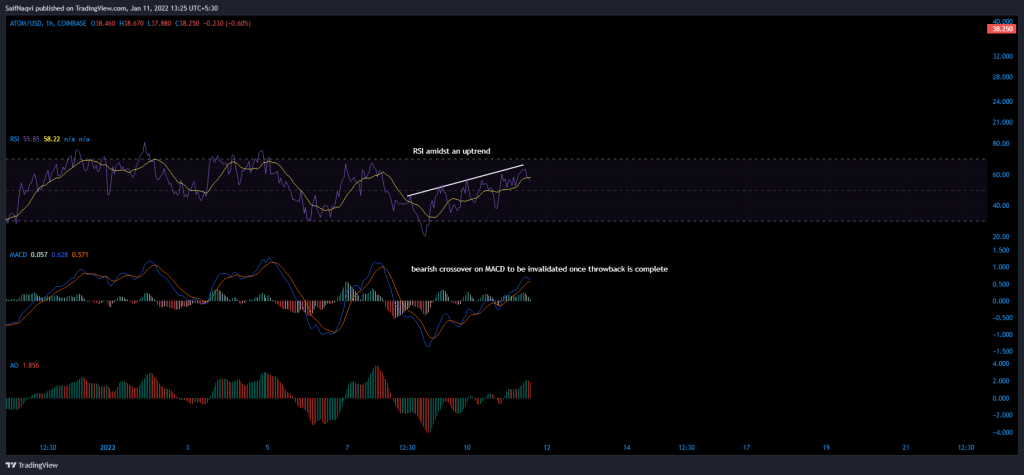

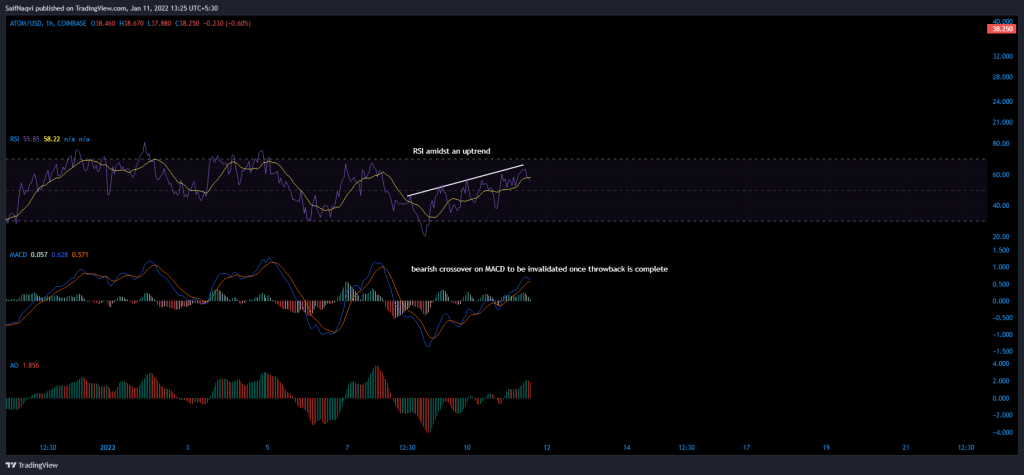

ATOM 4-hour time frame

ATOM looks good to advance by another 17% after its price closed above the upper boundary of a horizontal channel. The pattern took shape over the last three days as ATOM formed a series of highs at $38 and lows at $34. A throwback was presently in effect as sellers attempted to reject the breakout. However, ATOM had an ace up its sleeve. According to CoinMarketCap, ATOM’s 24-hour volumes clocked in at $2.7 Billion, up by a healthy 52% in the last 24 hours. A breakout on strong volumes is a good sign for any asset as it allows for a more organic progression on the chart.

Once more buy orders are set up around $38.2 and the 200-SMA (green), ATOM would look to continue its climb and challenge sellers at $41.6. An extension above this resistance would rack up a further 7% increase. Overall, the outcome would complete a full 17% run-up from $38.1 to $44.7.

However, the breakout can be voided if ATOM slips below its 200-SMA (green) on diminishing buy volumes. A new low can then be expected at $34.4.

Indicators

The 4-hour RSI backed a bullish outcome. The index has climbed steadily for the past two days and held a favorable position above 55. No immediate threats were visible until the overbought territory is breached.

Even though the Awesome Oscillator registered two red bars, the index was in a healthy state and traded above its half-line. ATOM’s breakout was safe till the index continues to trade above the equilibrium mark.

While the MACD was largely in agreement with the RSI and Awesome Oscillator, the index was closing in on a bearish crossover. However, such readings are mostly invalidated once a throwback is complete.

Conclusion

Those wishing to trade ATOM’s breakout can long at its current price level. Take-profit can be set at $44.7 and a stop-loss can be maintained below ATOM’s 200-SMA (green) at $37.7. If timed correctly, traders can accumulate a 17% profit once the breakout target is met.