Avalanche was the top gainer amongst the market’s top 25 large-cap coins on Wednesday. After rising by 8% on the daily window, AVAX was seen trading north of $94 at the time of press.

AVAX’s prospects looked, even more, better on the price chart. As such, the 9th largest altcoin kick-started its uptrend journey towards the end of January itself. It, however, deviated from the said trend towards the end of last week. Even so, it managed to stay above its 200 Day Moving Average [DMA].

Bulls managed to regain control on Tuesday. With their help, Avalanche managed to push behind another roadblock yesterday – the 50 DMA. And now, the token is standing at the door of the 38.2% Fib level.

As can be seen from the chart attached below, Avalanche has managed to re-create a fractal congruent to what was seen in December. Back then, AVAX managed to climb past the 38.2% Fib level and incline by nearly 35%. A similar hike this time would pull AVAX back up to $127.

Having said that, it should also be noted that Avalanche’s short-term rally could pre-maturely end post a 20% hike itself, for the 23.6% level has not always acted support-friendly.

Temperature check

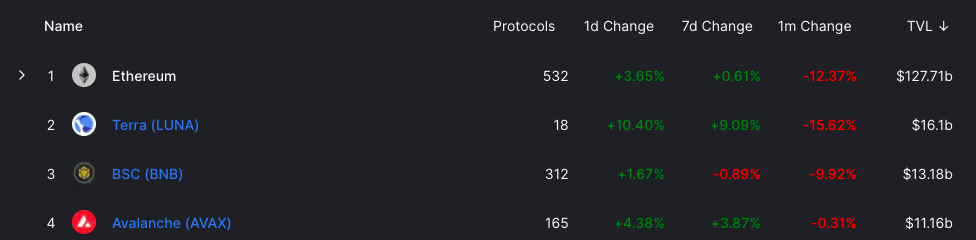

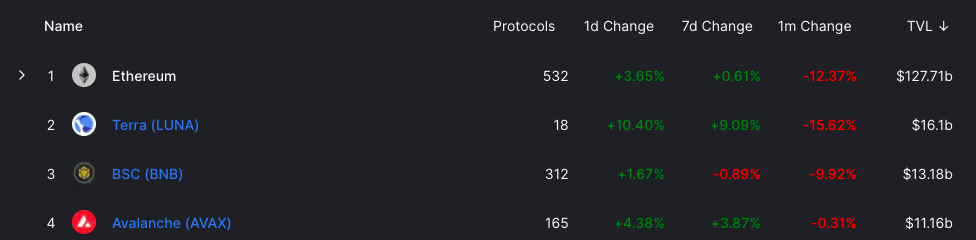

The fundamentals of Avalanche continue to remain strong. The total value locked on the protocol just surpassed the $11 billion mark. At press time, it precisely stood at $11.16 billion.

Its closest competitor, BNB currently holds $13 billion in total value locked but has witnessed a notable 10% monthly haircut with respect to the same. In fact, even the top-ranked Ethereum and Terra have seen 12% and 16% fund outflows. Avalanche’s funds, on the other hand, by and large, continue to remain undeterred MoM.

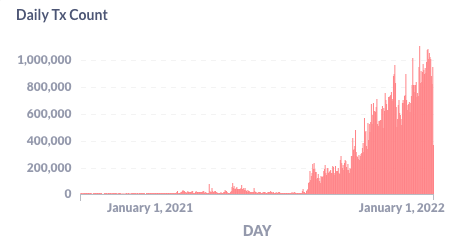

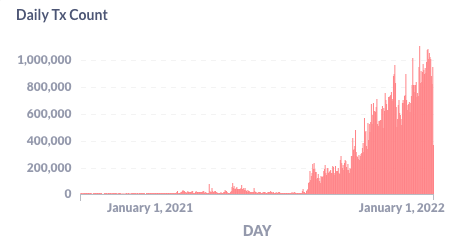

In fact, other metrics too, right from the daily transaction count to the active addresses, continue to revolve around their highs at the moment, indicating that Avalanche’s rally is growth-driven this time.