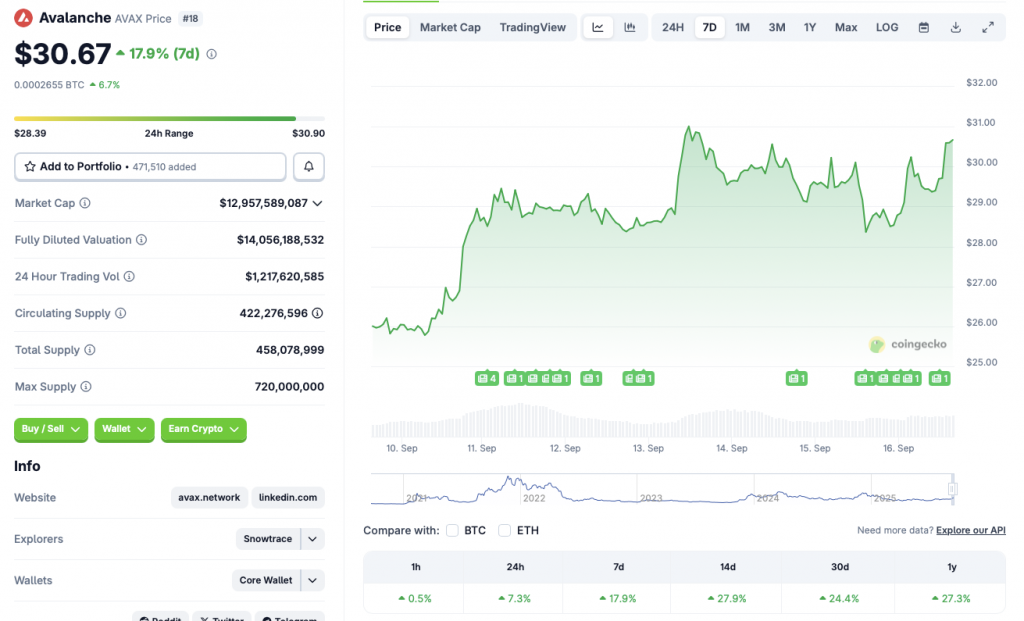

Avalanche (AVAX) is experiencing quite a price surge, while the larger crypto market consolidates after the recent correction. According to CoinGecko statistics, AVAX’s price has surged 7.3% in the daily charts, 17.9% in the weekly charts, 27.9% in the 14-day charts, and 24.4% over the previous month. AVAX’s price seems to be moving contrary to Bitcoin (BTC), which seems to be plateauing at the $115,000 mark. Avalanche’s (AVAX) latest upswing follows Bitwise’s recent S1 application to the SEC for a spot ETF.

Will Avalanche Hit a New All-Time High Amid Bitwise’s ETF Application?

ETFs have played a vital role in the current crypto market cycle. Bitcoin (BTC) has hit multiple all-time highs after the SEC approved 11 spot ETFs last year. Ethereum (ETH) also hit a new all-time high earlier this year, thanks to corporate treasuries and ETF inflows. A similar pattern could emerge for Avalanche (AVAX) as well, if the SEC approves the ETF application.

There is a high chance that the SEC will approve Bitwise’s Avalanche ETF application, given that the agency is helmed by a pro-crypto candidate. SEC Chair Paul Atkins has stated that he aims to further propel the US crypto industry. We may get several new crypto-based ETFs over the coming months.

Also Read: Avalanche Skyrockets After $1 Billion Treasury Announcement

Avalanche’s (AVAX) rally may have been further supported by the announcement of two crypto treasuries raising $1 billion to buy AVAX tokens. As mentioned above, corporate treasuries and ETFs have led to substantial price spikes for Bitcoin (BTC) and Ethereum (ETH). Avalanche (AVAX) may follow a similar trajectory if all things go according to plan.

There is also a possibility that the SEC will delay its decision on Bitwise’s Avalanche ETF application, as has been the case for many other applicants. A delayed decision could lead to the online buzz fizzing out.