With losses extending to 17% since 10 March, Avalanche has been unable to go toe to toe with DeFi competitor, LUNA. The latter’s gains in March are slowly becoming a highlight within a rangebound broader market. Safe to say that AVAX bulls need to put in a great deal of work to catch up to LUNA.

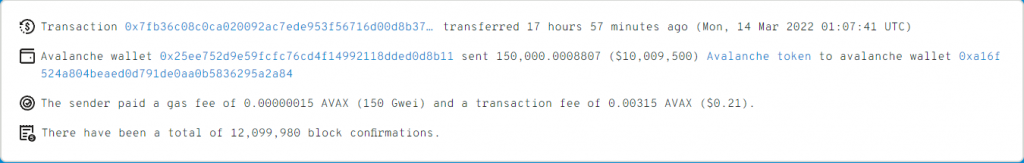

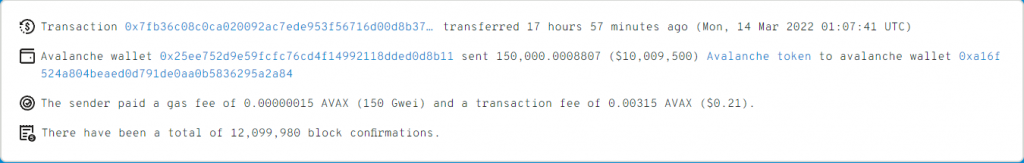

However, a symmetrical triangle breakout was available for the taking and bulls had a chance to turn the tide in their favor. Whale purchases were picking up pace as well, with a single transaction touching $10 Million. AVAX traded at $66, down by 3% over the last 24 hours at the time of writing.

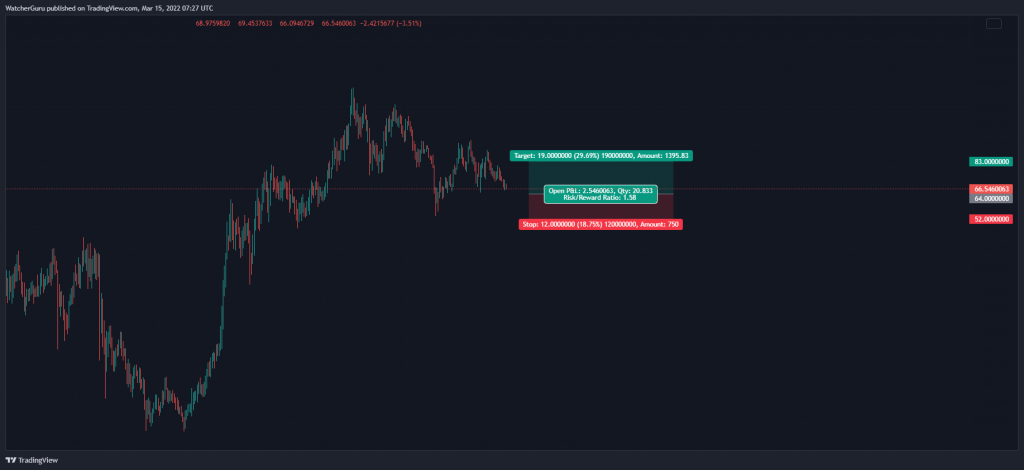

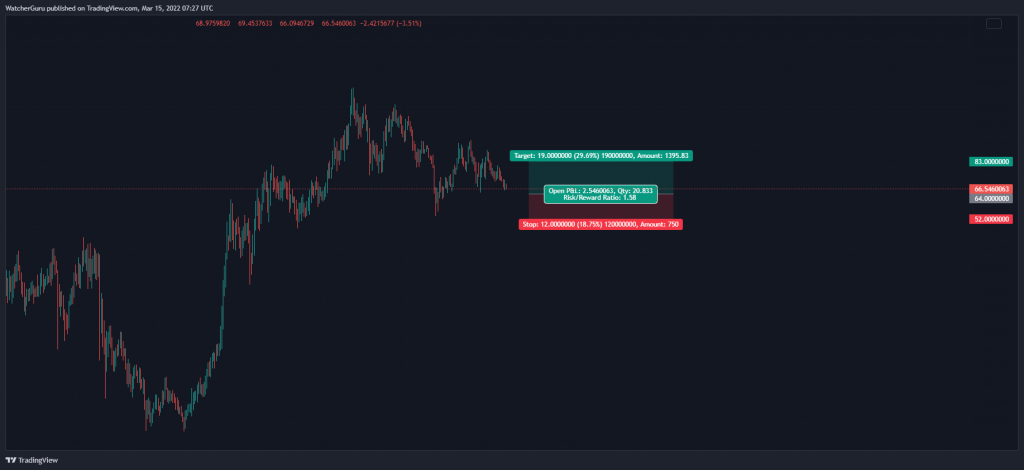

Avalanche Daily Chart

Avalanche’s price was locked within a symmetrical triangle, outlined by two converging trendlines. In technical analysis, symmetrical triangles are precursors to large price swings and carry a near equal chance of a breakout in either direction.

Keeping aside external factors, it’s not hard to understand why AVAX would break south from its triangle. The candles were trading below their daily 200-SMA (green) – a sign that AVAX’s trend was bearish. The daily indicators were not too encouraging either. Both the MACD and RSI were trading at a 1-month low after constantly declining since AVAX’s 16 February peak.

Whales Stack Up on AVAX

On a positive note, Avalanche whales were not faint-hearted with such readings. Data from Whalestats showed that the top 100 Avalanche wallets increased their AVAX accumulation over the last 24 hours, with the token second among the most purchased coins and third among the most used smart contracts. A single transaction even went as high as $10 Million, with the wallet now holding a total of 376,900.9 AVAX valued at $25.2 Million.

Additionally, the token was also trending on LunarCrush, noting a 42% surge in its daily social dominance and a 98% jump in social volumes.

Price Strategy

Normally, the combination of whale purchases and a healthy social media score is enough to pump the price by itself. However, the divergence between such readings and the price action was quite significant. For the moment, a simple trade can be executed within the confines of a symmetrical triangle instead of trading for a breakout.

A buy order can be placed at $64 and take-profit can be set at $83 – at the upper trendline. Since a bearish outcome cannot be discounted, stop-loss needs to be tight and maintained at $52. The trade setup carries a 1.58 risk/reward ratio.