Axie Infinity’s price had been on a downtrend since November last year. The gaming token tumbled from the peak of $166.09 to the lower $40 range. With the market faring comparatively well over the last couple of days, this token has started showing signs of revival and is in quite a critical juncture at this stage.

The $47 to $55 range has acted like a pretty good demand zone in the past. Apart from fostering AXS to break above its multi-month downtrend back in February, this level had also fostered the token’s growth during the pre-rally phase last year.

Despite being in a favorable zone at this point, things might get tricky for AXS over the next few hours, for the 50-day MA has the potential to act as a roadblock. At the time of press, it was noted that the AXS momentarily broke above the said level, but soon tip-toed back under.

Is there enough momentum to make Axie Infinity’s next attempt successul?

AXS’s RSI was seen well above 40 at press time. This indicated that the token did have the potential to bounce back if bulls continued making their presence felt.

Nonetheless, there were signs of weakness on the shorter time frame charts, and neither did the metrics support an immediate bullish narrative.

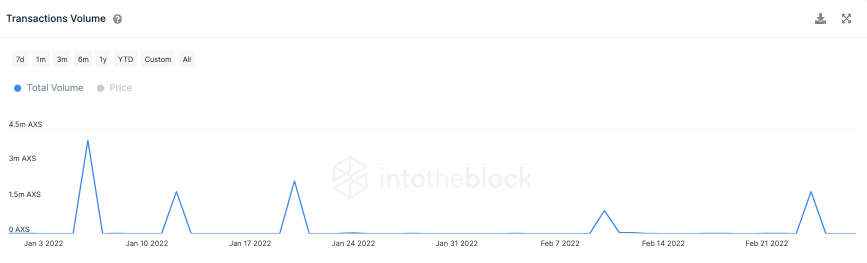

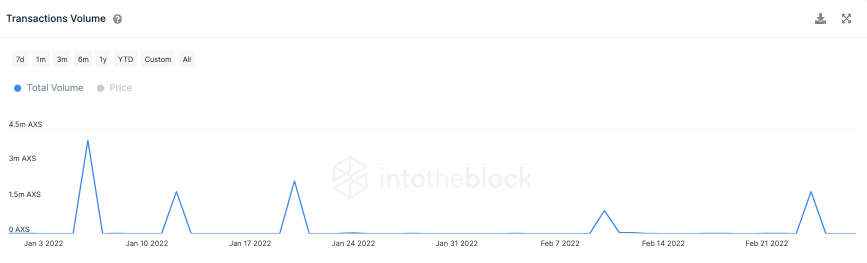

Consider the transactional volume itself, for starters. The indicator has essentially been flashing bare minimum readings. Despite a local peak noted at 1.8 million tokens during the last week of February, this metric revolved around its rock bottom at the time of press.

In fact, amid the registered transactions too, the bulls had been overshadowed by the bears. Per the buyer-seller trades difference metric from ITB, over the past 12-hours, more than 82k additional AXS tokens had been sold than bought.

So, if the said conditions continue to prevail, we might witness Axie Infinity consolidate around its current range for some more time before taking off. However, if favorable momentum finds its way back into the market, AXS would be able to overcome its barriers and kickstart a fresh rally.