Axie Infinity has not had the greatest start to 2022. The popular gaming token suffered a near 20% decline between 5-7 January and lost out to a key demand zone which now featured as resistance. A down-channel breakout did bring about some gains but AXS had a lot more ground to cover to overcome its bearish bias. At the time of writing, AXS traded at $78.5, up by 5.3% over the last 24 hours.

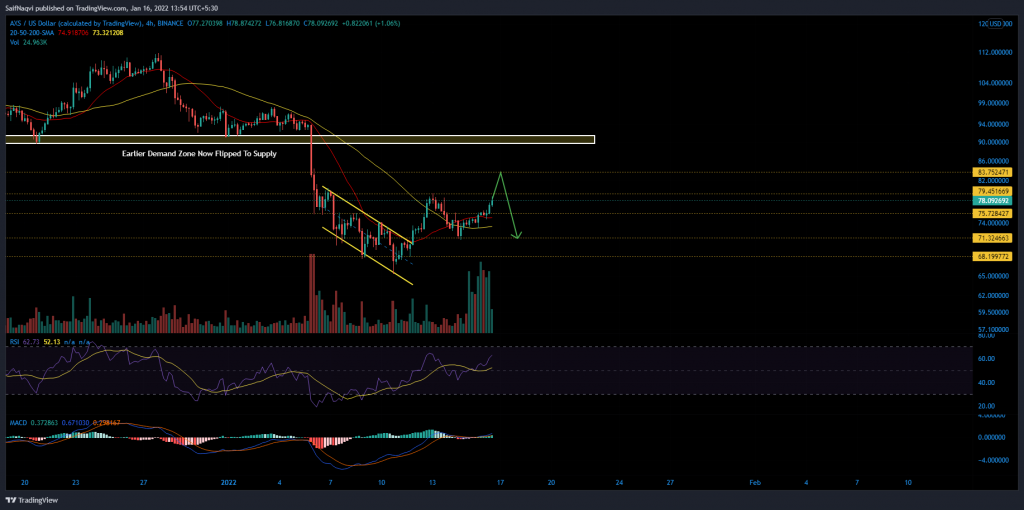

Axie Infinity 4-hour Time Frame

Axie Infinity has recuperated some losses after securing support at $71.3. The token’s value has risen by 10% over the last 48 hours amid healthy buy volumes. Should these volumes remain consistent, AXS would likely overcome a double top at $79.6 and target an additional 15% ascent back to a demand zone of $89-$91.5.

Any near-term pullback attempts would be met with buying spree at $75.3 and $71.3 support levels. Meanwhile, the 4-hour RSI had more room to grow before touching the overbought zone. An above-par MACD also worked in favor of those looking to initiate new longs.

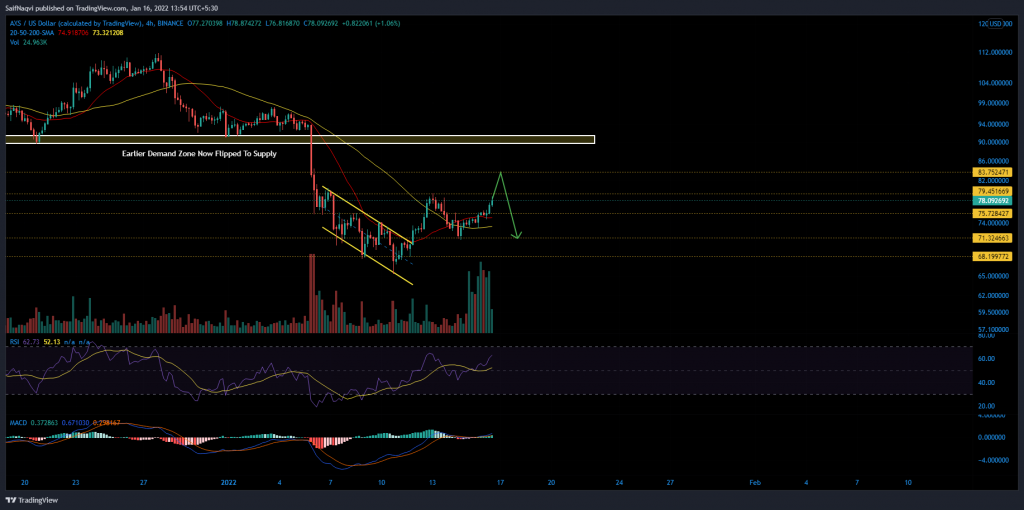

Axie Infinity Daily Time Frame

While AXS maintained a favorable near-term outlook, the situation was quite different on the daily chart. A death cross between the daily 20 (red) and 200 (green) SMA’s occurred on 14 January and the same could delay a comeback above AXS’ demand zone. Although an early buy signal did alleviate some pressure, the RSI was yet to secure bullish ground above 55.

Conclusion

Axie Infinity’s trajectory was more transparent after tallying both its daily and 4-hour charts. The summation indicated that while AXS’ present rally carried weight, its price would not extend above $89-$91.5 until the daily indicators shifted to favorable positions. Nonetheless, AXS could amass an additional 15% hike in a best-case outcome. Those who are riding the AXS bull run and want to cash out early can set take-profits at the daily 20-SMA (red) and $84-resistance.