After affirmatively rallying by over 250% during the initial half of January this year, BabyDoge Coin commenced its downtrend. As a result, the coin engulfed itself within a descending channel and either kept registering local lows or moving horizontally over the next few weeks.

However, by March, BabyDoge managed to break above the upper trendline of its descending channel. Since then, the very same line has single-handedly been holding up the coin’s price.

BabyDoge on a slippery slope

Despite breaking above the descending channel, BabyDoge seems to be in a tricky position at the moment. There are signs of weakness all across the board.

As can be seen from the chart below, the coin is currently trading midway between the 78.6% and 61.8% levels. The same essentially lies around $0.0000000023100 and $0.000000003164.

When viewed even closely, it can be noted that the latter level acted as a strong resistance multiple times last week and hindered the BabyDoge’s price from climbing above. Additionally, the coin’s SMA also played spoilsport during the same period and might continue hindering the coin’s uptrend prospects going forward.

The trade volume numbers have also been quite undernourished of late, implying that market participants currently lack vitality.

If the said conditions continue to prevail and if the market broader market doesn’t provide some respite anytime soon alongside, BabyDoge Coin would continue tumbling down. In such a case, market participants can expect the coin to find solace around $0.000000002300. The same would translate into a 13% dip from current levels. On the upside, if the coin manages to break past its hurdles, it could seamlessly glide up by at least 20% before being tested again.

The positive take-away

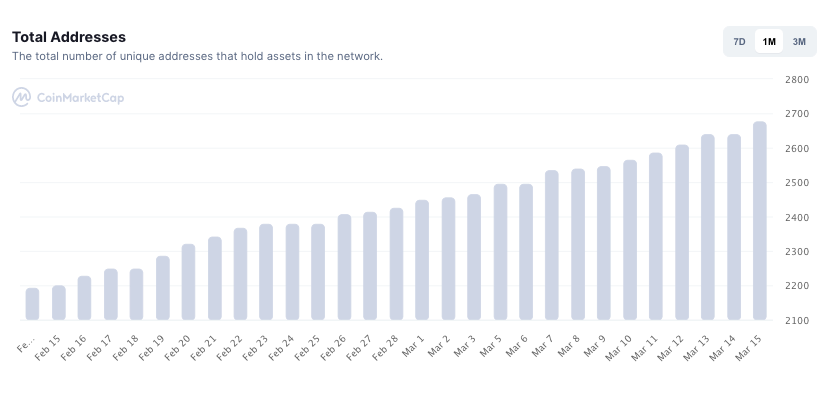

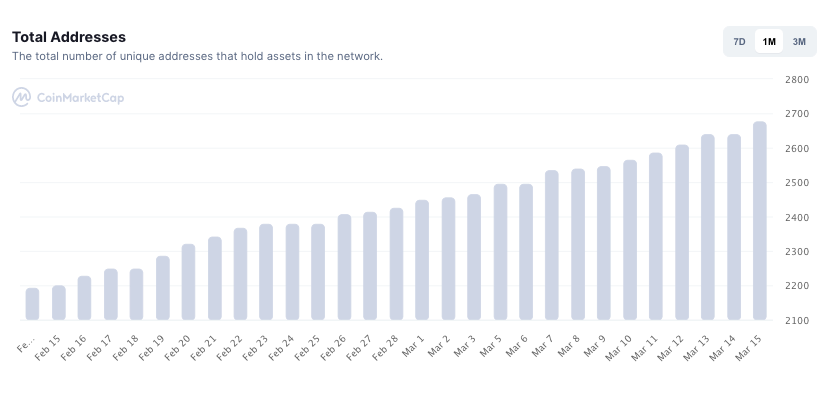

Despite the ongoing correction phase, it shouldn’t be forgotten that the number of unique addresses HODLing assets in the network have been inclining consistently. The current 2677 is relatively higher than last month’s 2192 and is essentially a sign of growth.