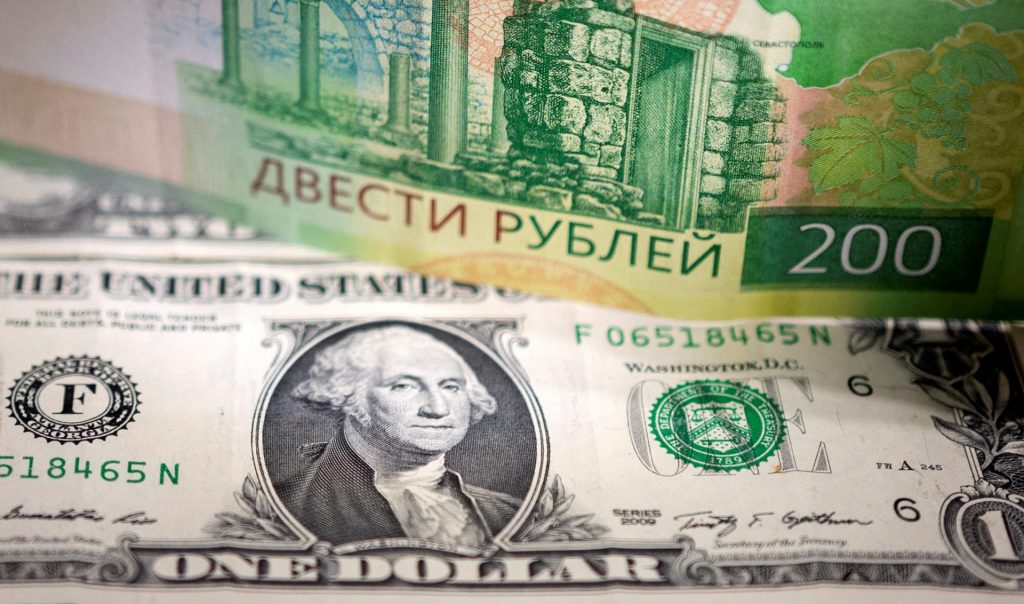

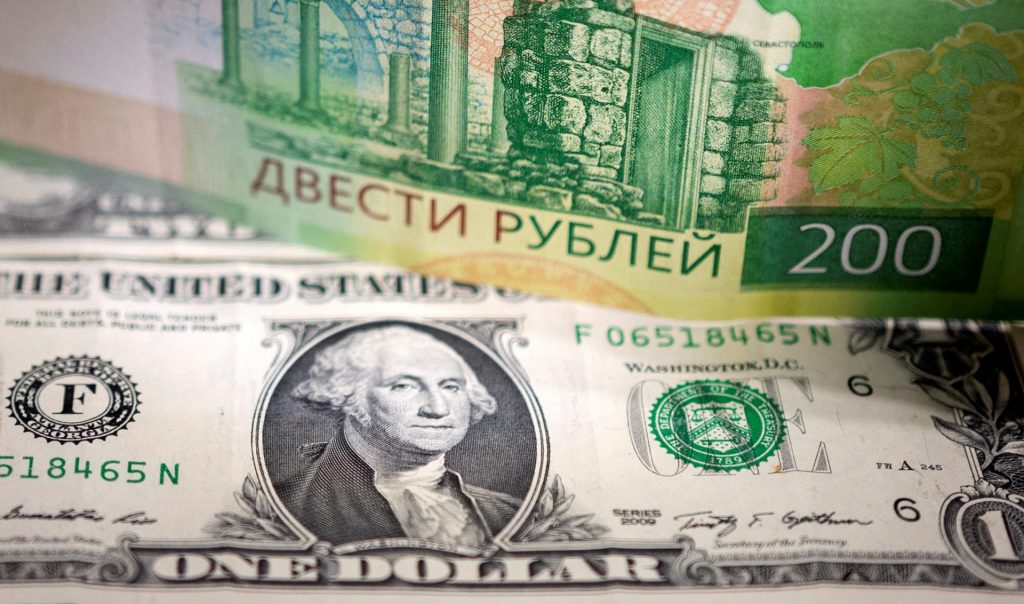

The currency dynamics have started to diversify as the world now inches closer to a multipolar currency world. The current world is now largely dictated by a group of currencies emerging at the top of the radar, all while challenging the US dollar hegemony by striking at its core. With versatile trade mechanisms emerging, multiple countries are now trading in dollars, giving power to the rising USD competitors. Shockingly, US sanctions on Russia were supposed to weaken its global positioning, but the move has reportedly backfired. Russia’s ruble is now one of the top-performing assets of 2025, despite being embroiled and caught up in an intense war with the US. How did the ruble emerge stronger than most of its peers? Let’s find out.

Also Read: New Currency Steals the US Dollar’s ‘Crown’ in 2025

Bank of America Crowns Ruble as the Ultimate 2025 Currency Winner

Bank of America, in its recent report, has crowned the Russian ruble as the best-performing currency of 2025. The ruble is up 40%, reversing the collective damage and disdain that the currency had encountered two years ago. Tightened market and policy controls have driven the Russian currency’s spike, allowing the ruble to outshine all its currency peers recently.

“The central bank has opted to keep rates relatively elevated, capital controls and other FX restrictions have tightened a bit, and there’s been some progress or attempt at progress in finding a peace between Russia and Ukraine.” Brendan McKenna, international economist and foreign exchange strategist at Wells Fargo, later shared.

Furthermore, Russian experts have also been contributing to this surge by converting dollars into rubles, spiking the local currency demand.

“The ruble has demonstrated staggering growth in 2025, becoming the most dynamic currency in the world. According to Bank of America, this is the most efficient currency since the beginning of the year.” BoFa shared with CNBC

USD Wobbles Amid Escalating Trade War Tensions

The US dollar, on the other hand, continues to display a weak value stance. USD is flailing currently, with the DXY index sitting at its lowest at 98.20 at press time. The rising trade war narrative, as President Trump continues to impose tariffs on nations, has weakened investors’ sentiment towards the American currency.

The US president has delivered a fresh statement recently, adding that he may send letters to countries outlining new tariff regimens and policies.

“[Trump’s] comment certainly points to renewed escalation in trade tensions ahead of the official deadline date,” said Derek Halpenny, an analyst at MUFG.

Also Read: Safe Haven No More: 3 Alarming US Dollar (USD) Realities