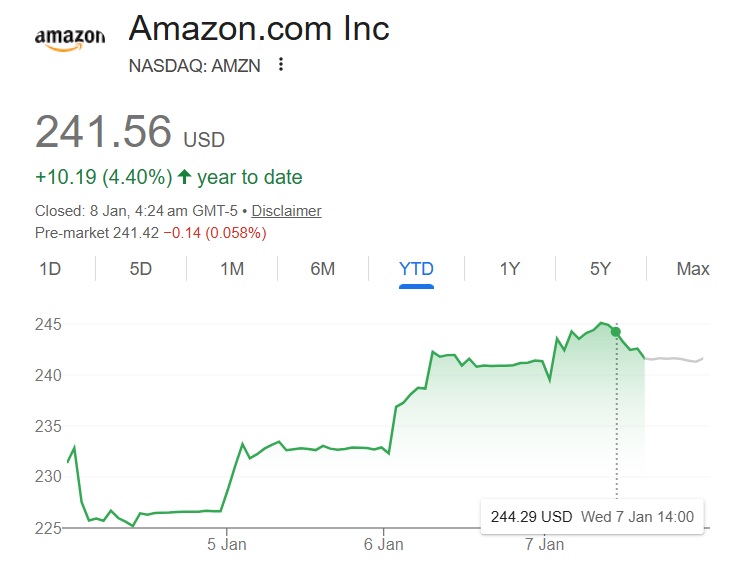

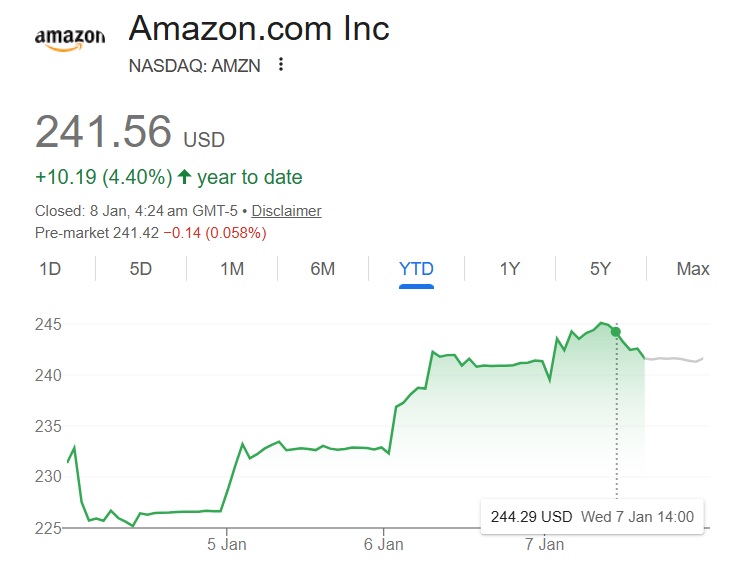

Bank of America has set Amazon stock (NASDAQ: AMZN) price target for 2026. AMZN entered the year on the front foot, rising close to 4.5% in a week. It rose more than 10 points in the last seven days and is among the top-performing assets this year. Several Wall Street analysts are bullish on AMZN, giving the equity a buy rating.

Amazon stock is among the most talked-about equities as the firm is investing billions in the AI sector, and Bank of America remains bullish on its prospects. The tech giant announced to invest $10 billion in OpenAI’s ChatGPT and also $35 billion to build an AI hyperscale data center in India. They plan to create 1 million jobs by 2030 and are aggressive in advancing the next-generation technology.

Also Read: S&P 500 Index to Boom Thanks to Key Dow Jones Metric

Amazon Stock: Bank of America Gives Bullish Price Target

Bank of America Securities analyst Justin Post has given a buy rating for Amazon stock. He set a price target of $303 for AMZN, citing the company’s solid position in cloud computing and AI. He wrote that the giant is expanding AI services in most of the sectors that it operates, including workloads on Amazon Web Services (AWS).

If Bank of America’s price target of $303 turns accurate, an investment of $1,000 could turn into $1,260. That would be an uptick and return on investment (ROI) of approximately 26%. That’s decent returns despite the market bracing for trade wars, tariffs, and the Venezuelan crisis.

The first target for AMZN was $240, and the equity breached it on Wednesday, closing at $241. It went nearly 0.30% higher, even after Dow Jones slumped by 466 points and the S&P 500 index slumped nearly 25 points. AMZN held on strong in the charts and barely dipped into the red this year. Therefore, Amazon stock is a must-watch equity this year, according to Bank of America.