Just a day back, the US Fed announced an interest rate hike of 75 basis points. With respect to the future outlook, Chair Jerome Powell went on to state that the Federal Open Market Committee was split between an aggregate of 100 bps to 125 bps for the rest of the year.

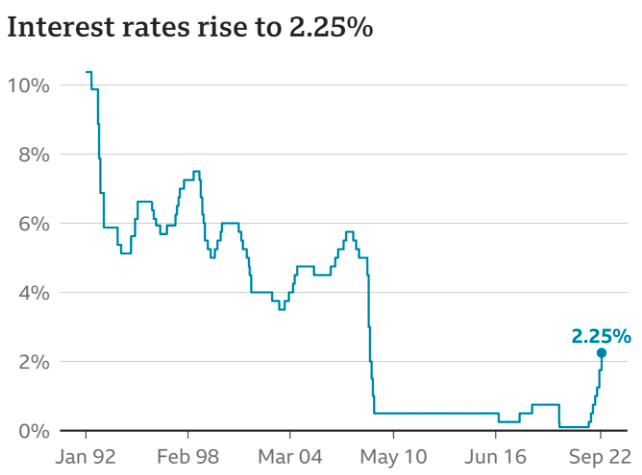

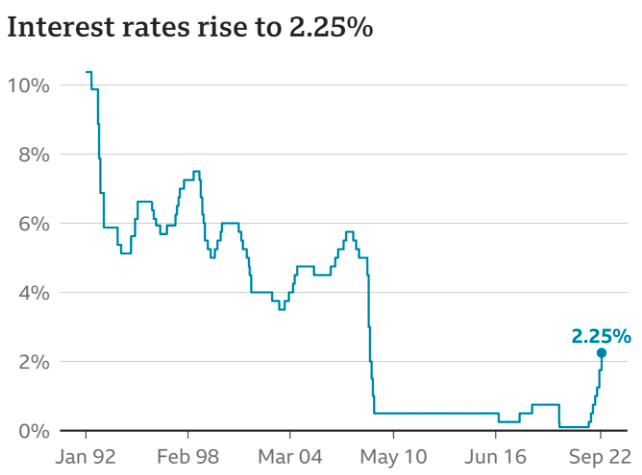

Now, in what is the latest development, the Bank of England announced an interest rate hike of 50 bps to 2.25%. Notably, the Monetary Policy Committee voted by a majority of 5-4 to notch up the rate.

This change from 1.75% to 2.25% now puts the bank rate at a 14-year high level. Notably, this is the bank’s seventh rate rise in a row.

Alongside announcing the rate hike, the Bank’s Monetary Policy Committee forecast that the UK economy was already in recession.

US’s Powell, on the other hand, stated during his speech yesterday that no one knows whether or not the US will get into a recession.

The BoE’s Monetary Policy Committee said that bank holidays linked to Queen Elizabeth II had toned down growth. Furthermore, the additional bank holiday in September for the Queen’s state funeral would also hurt the economy, per the committee. Contrastingly, it further added that there had been a smaller-than-expected bounce back in July from the June bank holiday to celebrate the Queen’s Platinum Jubilee.

Looking beyond the US, UK

Canada’s annual inflation rate, notably, eased more than expected in August. This is despite the pace of food prices rising sharply. Resultantly, smaller rate hikes are being eyed, with economists advocating the same.

After 12 back-to-back increases, Brazil’s central bank—on the other hand—chose to keep interest rates unchanged on Wednesday, applying a brake to an aggressive monetary tightening cycle.

The Swiss national bank too, on its part, finally bid adieu to its negative rate era, with a 0.75% hike on Thursday. Per Reuters, the purpose of the move is in order to combat resurgent inflation.

Sweden, on the other hand, lifted the rates by 100 basis points earlier this week. The country claims that inflation was “too high”.

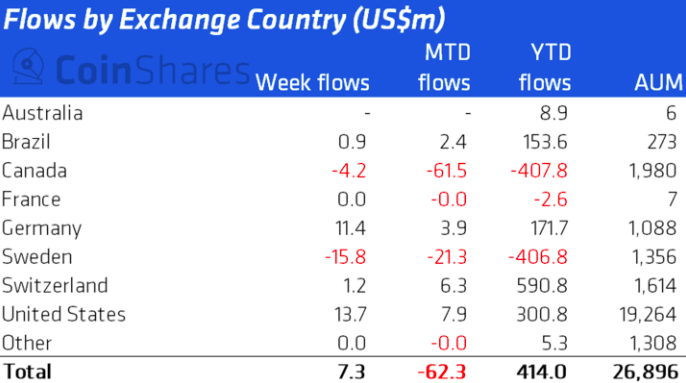

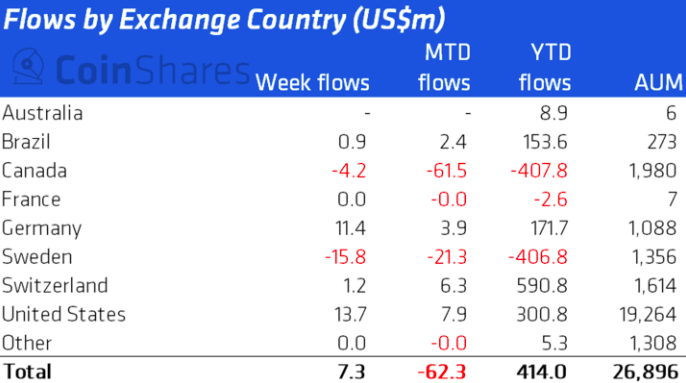

As different countries take different approaches to bring back their respective economies on track, crypto investors continue to be divided. As illustrated above, inflows have been regionally concentrated in nations like US, Switzerland, and Brazil last week. On the other hand, outflows are noted in Canada and Sweden.