A recent report by Boston Consulting Group (BCG) researchers predicted that cryptocurrency users may reach 1 billion by 2030. The joint analysis by BCG, Bitget, and Foresight Ventures, data ascertained that the crypto industry is still in the initial phase of the adoption curve.

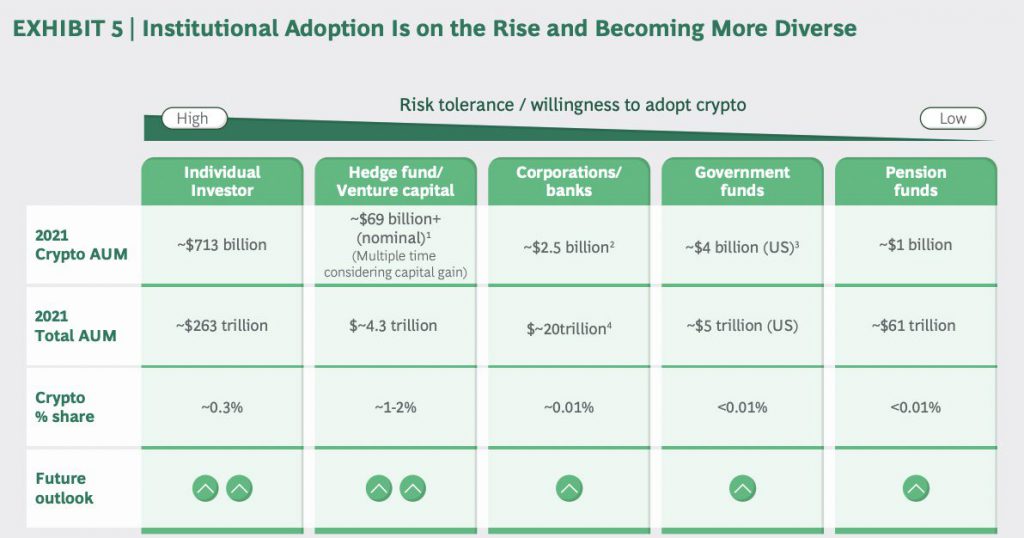

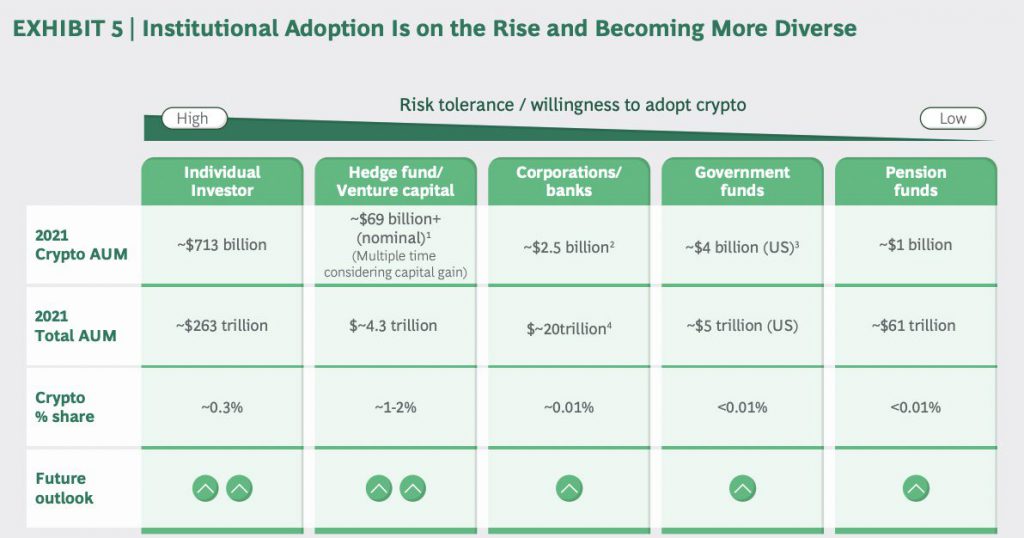

The report stated that only 0.3% of individual wealth is invested in crypto, as opposed to the 25% that is put into equities. However, it predicted that the relatively shallow penetration only indicates that there is headroom for growth. This is similar to the conclusion in a report published by the US-based banking giant, Wells Fargo.

Earlier this year, in its report titled ‘Understanding Cryptocurrency’, the bank’s Global Investment Strategy Team asserted that crypto’s ongoing phase was similar to that of the Internet during the mid-to-late 1990s, further noting that the industry was in its “hyper-adoption phase”.

The BCG report took the Wells Fargo paper’s comparison of crypto to the former stages of the internet to the up-and-coming digital evolution — Web 3.0. It stated that “if we use the number of cryptocurrency holders as a proxy for Web 3 users, and benchmark it against the adoption rate of internet users in the 1990s, the message is clear: there is plenty of growth to come”. The report added that “while it is difficult to predict if the trendline of crypto adoption continues, the total number of crypto users is likely to reach 1 billion by 2030”.

Crypto Native Funds Picking Up Momentum

While arguing in favor of foreseeable cryptocurrency adoption, the BCG report also highlighted that individual investors are the biggest holders of crypto, further emphasizing the rise in institutional interest for crypto. The report noted that institutional crypto investors include hedge funds and VCs, detailing that these players had almost “doubled their exposure to $70 billion from Q4 2020 to the end of 2021”.

Following this, ECB’s analysis predicted: that “allocations to continue to rise”. Additionally, the report noted that “an expanding class of crypto native funds such as Paradigm and Hashed that are picking up momentum”. However, these are the same VCs that bore the brunt of the Terra-Luna fiasco.

According to Watcher Guru’s exclusive reportage on Crunch base’s report, VC investments in crypto companies were down to just $9.3 billion in the first six months of 2022, as opposed to $12.5 billion in the first half of last year. Subsequently, the publication’s article also pointed out that the South Korean early-stage VC, Hashed secured a spot amongst the financially knocked down VCs globally. The Hashed wallet lost over $3.5 billion in the black swan event according to CoinMarketCap data from April.