Amazon is leading the stock wave amid bullish stock markers, pushing financial giants like Bernstein to issue new price targets for the firm for 2025. Here’s how high AMZN may go in the year 2025.

Also Read: Why Is Bitcoin (BTC) Falling Today?

Amazon New Stock Trajectory: What’s Happening?

Bernstein has raised its Amazon price target for next year. The firm has now issued a new stock price target of $265 for next year, driven by strong expectations concerning long-term growth and development over a diverse AMZN ecosystem and sectors.

Bernstein also issued how it maintains the “outperform” rating for AMZN, increasing its price target from $235 to $265.

The firm outlined how certain key factors and elements have played a crucial role in determining Amazon’s future stock goal. For instance, Amazon’s bolstered performance in its core retail business segment, followed by booming AWS and advertising business, has led the financial firm to amp up AMZN’s stock value for 2025.

Also Read: Top 3 Cryptocurrencies To Watch This Weekend

The brokerage firm later shared how Amazon’s cost-cutting initiatives have added value to the firm. While detailing the specifics, Bernstein stated how Amazon’s focus on lowering inbound fees and enhancing seller adoption has worked particularly well for the brand in general.

For 2025, Bernstein predicts Amazon project margins to rise to 11.5%. The brokerage firm later predicted that Amazon’s advertising revenue might spike annually, showing signs of credible success.

TipRanks Forecast For The Retail Giant

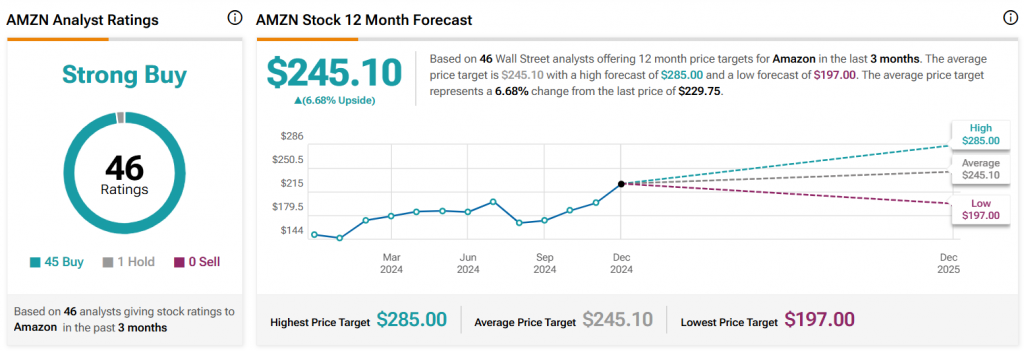

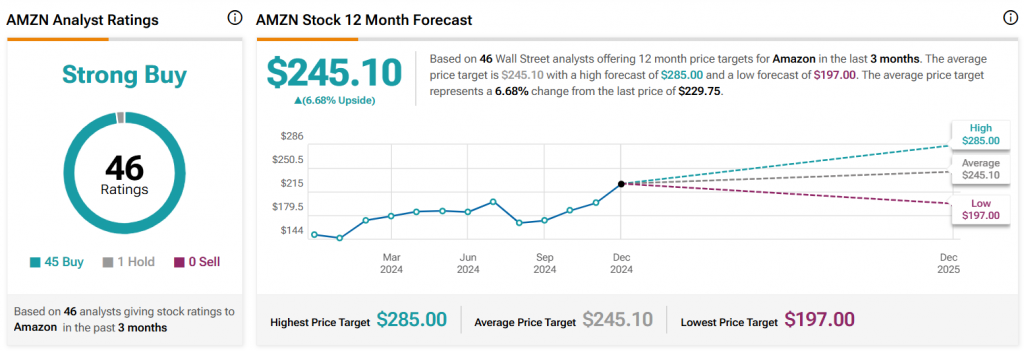

Per TipRanks, Amazon may surge to hit a new high price spot of $285 in the next 12 months.

“The average price target for Amazon is $245.10. This is based on 46 Wall Street analysts 12-month price targets, issued in the past 3 months. The highest analyst price target is $285.00; the lowest forecast is $197.00. The average price target represents an 11.15% increase from the current price of $220.52. Amazon has a consensus rating of Strong Buy, which is based on 45 buy ratings, 1 hold rating, and 0 sell ratings.”

Also Read: Microsoft: Why MSFT Is Bound for $500 All-Time High in 2025