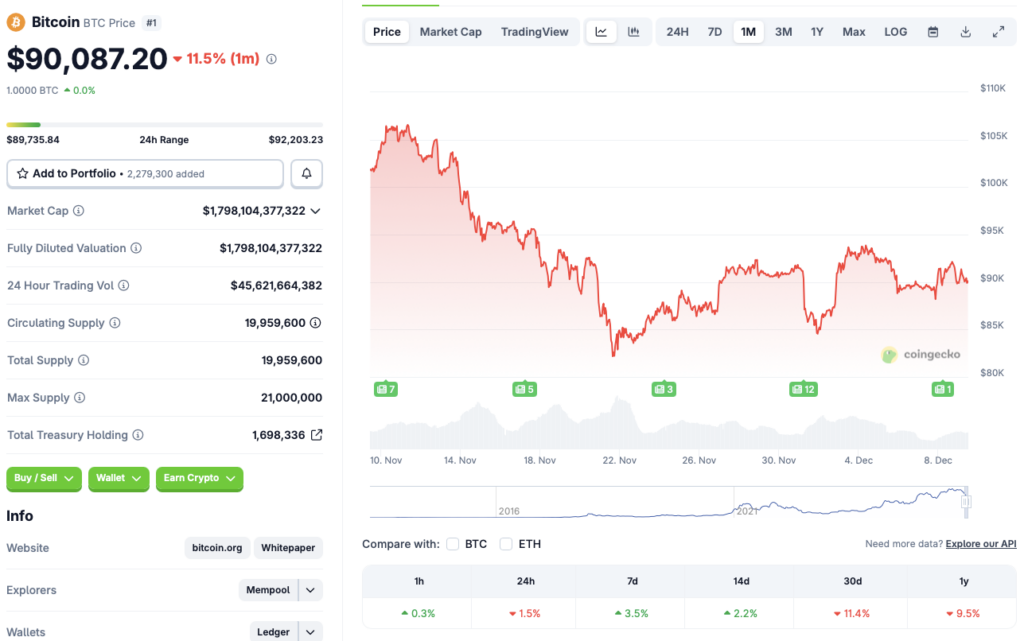

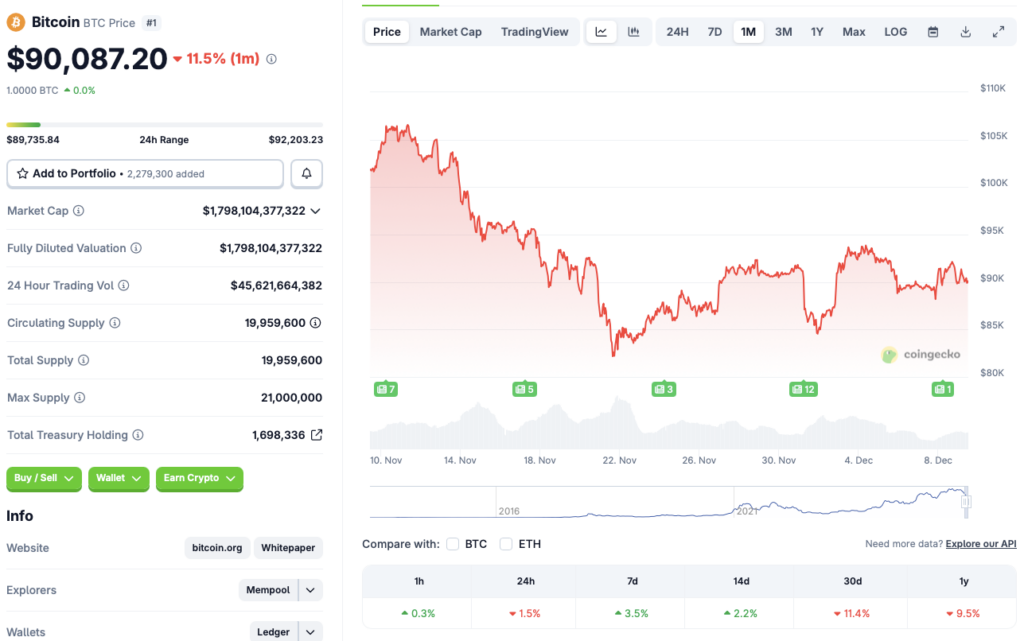

Bitcoin’s (BTC) price fell from a peak of $126,080 in early October to the $82,000 mark in November. The sharp price correction over the last few months has led many to believe that we may be entering a crypto winter. BTC’s price is currently facing substantial resistance at the $91,000 mark. According to CoinGecko data, BTC has rallied 3.5% in the weekly charts and 2.2% in the 14-day charts. However, the original crypto is down by 1.5% in the last 24 hours, 11.4% in the last month, and 9.5% since December 2024. While many may believe that we are entering another bear market, financial institution Bernstein believes Bitcoin (BTC) is on its way to a new all-time high soon. Let’s discuss.

Bernstein Predicts New All-Time High For Bitcoin

According to an X post by VanEck’s head of digital asset research, Matthew Sigel, Bernstein believes that Bitcoin (BTC) has broken its 4-year cycle. The asset is “now in an e;pngated bull-cycle, with more sticky institutional buying offsetting any retain panic selling.“

Berntstein highlights that although Bitcoin’s (BTC) price has faced a 30% correction, BTC ETFs saw less than 5% outflows. The financial institution predicts Bitcoin (BTC) will climb to a new all-time high of $150,000 in 2026. The firm does not anticipate BTC to stop at just $150,000, predicting the asset to hit a peak of $200,000 in 2027. Hitting $200,000 from current price levels will entail a rally of about 122%.

Also Read: Bitcoin Will Play a Role In Savings Hierarchy: Fidelity CEO

Bernstein is not the only firm that believes Bitcoin (BTC) has broken its 4-year cycle. Grayscale also released a report with a thesis that claims that BTC is currently following a 5-year cycle. This means that the original crypto will climb to a new peak in 2026, five years after its 2021 peak.