Mortgage rates have actually decreased a bit recently, dropping to about 6.81% from 6.83% last week according to the latest data from Freddie Mac. This small but notable reduction happens to coincide with falling gas prices and also interest rates, creating what Treasury Secretary Scott Bessent has referred to as a more affordable economic environment right now. These changes are already starting to impact the housing market and everyday consumer finances in several ways.

JUST IN: 🇺🇸 Treasury Secretary Bessent says "Interest rates are down, mortgage rates are down, gasoline and energy prices are down, and we're expecting further decreases." pic.twitter.com/LA7In0wkwN

— Watcher.Guru (@WatcherGuru) April 29, 2025

Also Read: China Exempts Key U.S. Goods From 125% Tariff—What’s on the List?

How Lower Mortgage Rates, Gas Prices, and Interest Rates Impact You

Mortgage Rates Show Modest Relief

The latest mortgage rates have provided positive signals to the housing market when they slightly lowered during the recent weeks. Mortgage rates for 30-year loans decreased to 6.81% as of this writing while they had been at 6.83% the previous week and 7.17% last year during this month. Fifteen-year fixed-rate mortgages have experienced a reduction to 5.94% while maintaining the same percentage rate as compared to 6.03%.

Hannah Jones, senior economic research analyst at Realtor.com, said:

“The recent back and forth on tariffs and other economic policy has led to market turmoil and a general sense of unease, which can be felt in stubbornly high mortgage rates.”

While mortgage rates are certainly still elevated, these small decreases could potentially improve home financing options for many buyers who have been waiting on the sidelines for quite some time now.

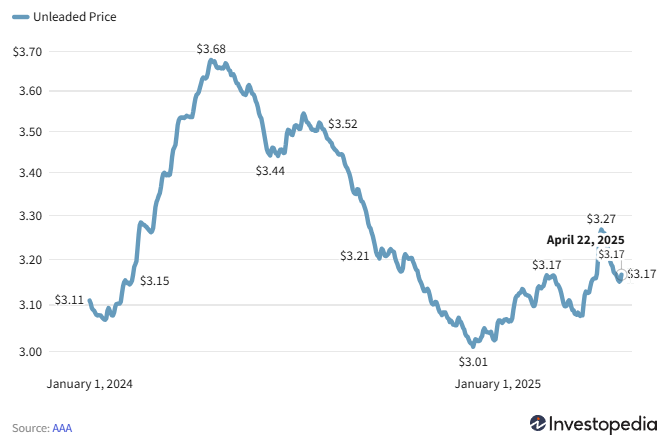

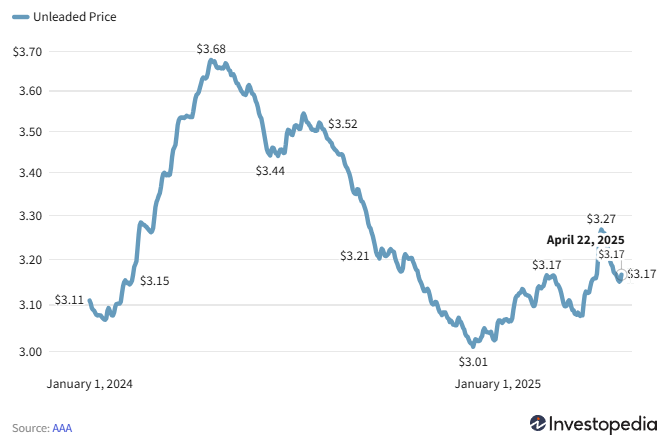

Gas Prices Fall Against Seasonal Trends

Gas prices have actually dropped considerably lately, which is kind of unusual since they typically increase during the spring. Right now, drivers are paying an average of about $3.17 per gallon as of April 23, 2025, and that’s significantly lower than the roughly $3.67 per gallon average we saw at this time last year.

Patrick De Haan, head of petroleum analysis at GasBuddy, said:

“So far, 2025 has been relatively calm at the pump for most Americans, thanks in part to OPEC’s ongoing restoration of oil production and continued uncertainty surrounding tariff policy and its potential impact on the global economy.”

These savings at the pump are providing some immediate financial relief for many households that are still dealing with various other economic pressures.

Also Read: Broadcom (AVGO) Has 600% Jump in 5 Years: $2T Potential?

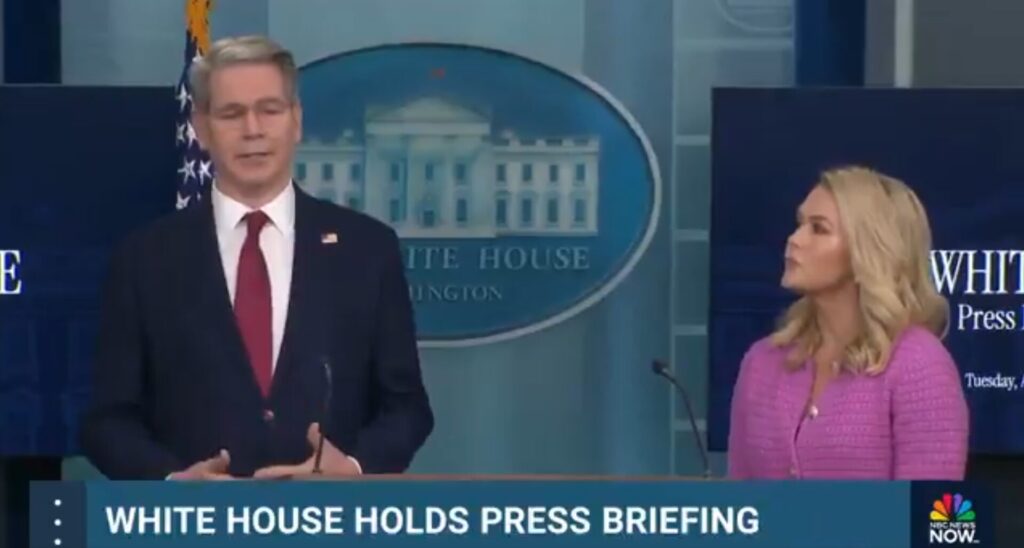

Treasury Secretary Highlights Economic Improvements

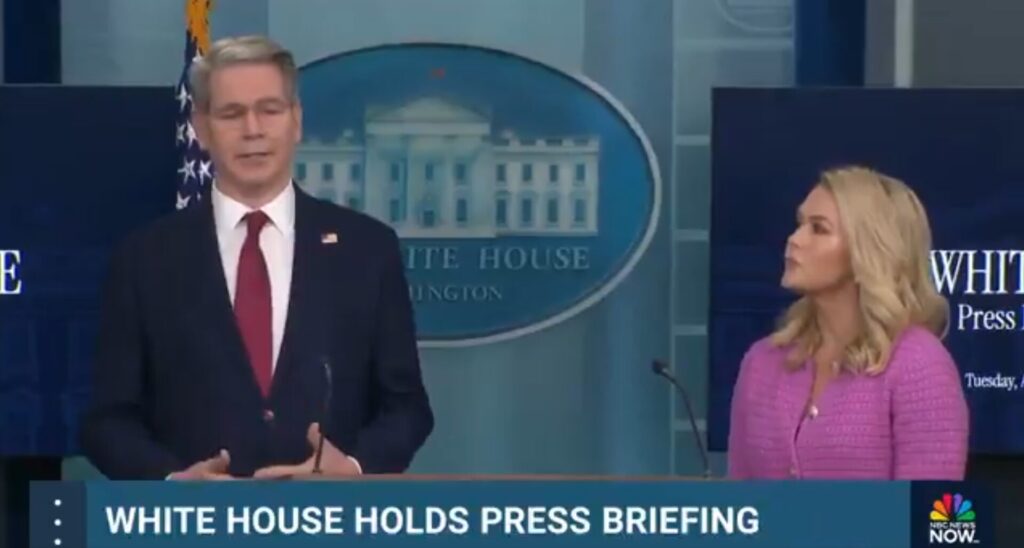

During the recent White House press briefing Secretary of Treasury Scott Bessent presented encouraging signs about the economy.

Scott Bessent, Treasury Secretary, stated:

“Interest rates are down, mortgage rates are down, gasoline and energy prices are down, and we’re expecting further decreases.”

This official acknowledgment seems to signal the administration’s ongoing focus on addressing some of the cost-of-living concerns that have affected so many Americans lately.

Impact on Housing Market

The housing market continues to face certain challenges despite the modest mortgage rate decrease we’re seeing. Home sales activity remains somewhat below typical spring levels, and many experts suggest that rates probably need to fall a bit further to really stimulate significant buyer interest in the current market.

MBA CEO Bob Broeksmit had this to say:

“With rates now close to 7%, many potential borrowers will likely stay on the sidelines until they have a better idea of the direction that rates, and the economy, are headed.”

Most economists expect mortgage rates to hover around 6.5% or so for the remainder of the year, potentially providing some stability for the housing market and various home financing options going forward.

Bringing down persistent Bidenflation has been a priority for the first 100 days of the Trump Administration, and @POTUS has done a great job of leading that effort.

— Treasury Secretary Scott Bessent (@SecScottBessent) April 29, 2025

Interest rates are down, mortgage rates are down, gasoline and energy prices are down, and we’re expecting… pic.twitter.com/MOlGATj7PQ

Also Read: Meta Platforms Continues AI Push: Launches New Standalone App

Lower mortgage rates, gas prices, and interest rates are creating what appears to be a somewhat more favorable environment for consumer finances at this point in time. For both current homeowners and also prospective buyers, these economic shifts might present some opportunities that weren’t really available during the higher rate environment we saw earlier this year.