Manta Network, a privacy protocol backed by Binance Launchpool, confronted serious controversy right out of the gate with its recent exchange listing. Accusations hovered on X of potential money laundering amid the token’s wild debut trading on Korean platform Bithumb.

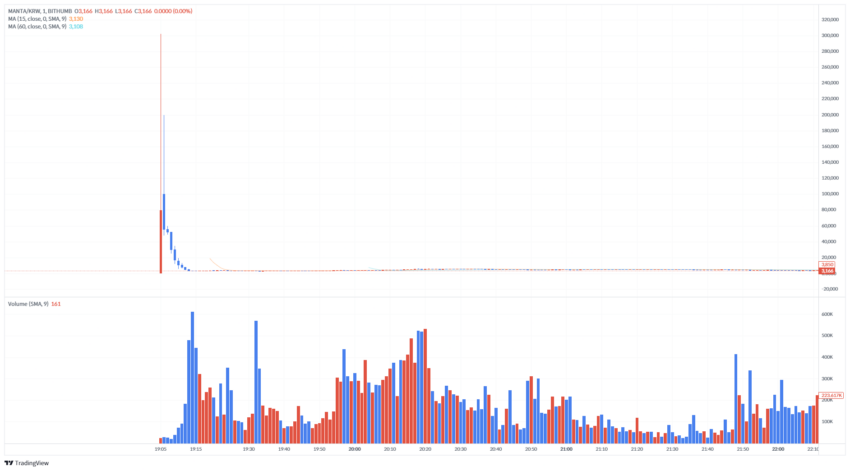

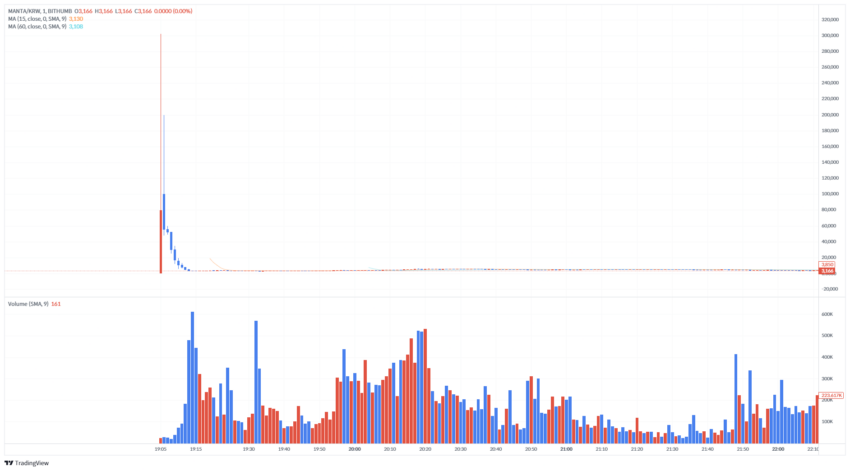

Manta’s native token, MANTA, spiked nearly 77,000% minutes after going live on Bithumb Thursday. However, just as swiftly, prices crashed 85%, leading to speculation of suspicious trading activity involving Manta insiders.

Most of the scrutiny centers on an alleged 2 million MANTA transfer to the personal wallet of Manta’s Korean business lead shortly before launch. Soon after, over 75% of the Bithumb trading volume consisted of those tokens being deposited.

Also read: Ripple: Analyst Expects XRP To Hit $2.8 If This Happens

MANTA experiences high fluctuations in price

Within five minutes, the MANTA price skyrocketed from around $1 to nearly $230 per token. Then, after peaking, the entire stash of tokens was suddenly sold, netting an estimated $5 million worth of ether.

The rapid pump and dump has commentators accusing the recipient wallet address of front-running and market manipulation. While unverified, the claims spark concerns around how crypto projects handle token distributions.

Manta Network was also hit with a crippling DDoS attack around the same time as its rocky Bithumb listing event. The barrage of malicious requests prevented transaction validation, but the blockchain has since resumed normal operations, according to developers.

Also read: Cryptocurrency: Top 5 Altcoins That Could Yield Maximum Profit In 2024

Controversies around exchange listings increasingly put crypto projects under the microscope. Binance’s Launchpool initiative itself has dealt with instances of scam token listings attempting to deceive investors.

The allegations against Manta Network, whether proven or not, will likely damage confidence in the project during a critical growth phase.