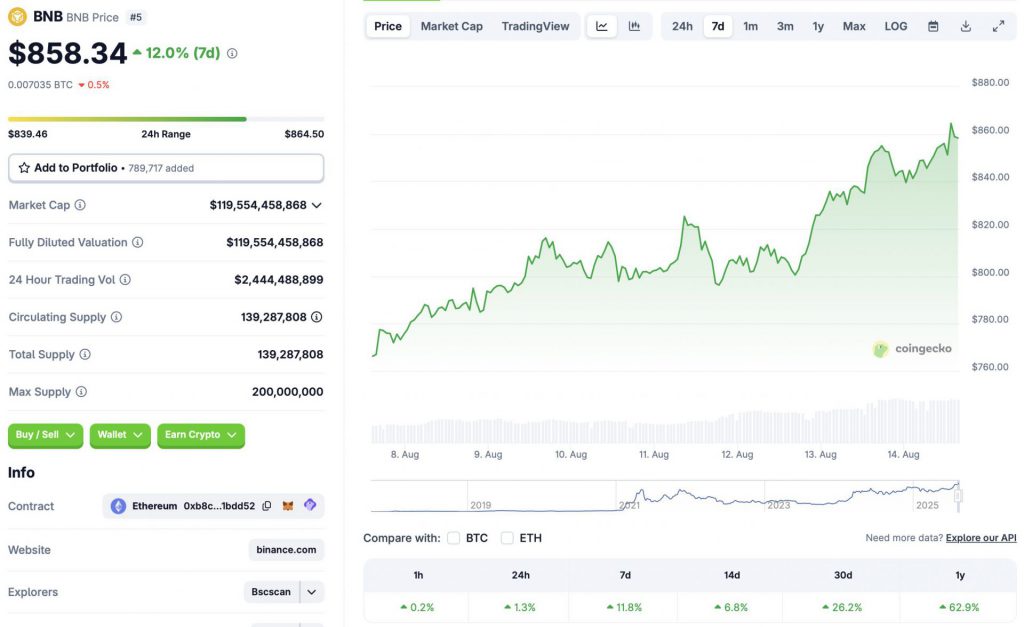

Following Bitcoin’s (BTC) ascent to a new all-time high of $124,128 earlier today, Binance Coin (BNB) has also hit a new peak. BNB attained a new all-time high of $864.50, rallying 1.3% in the last 24 hours. According to CoinGecko’s BNB data, BNB is up 11.8% in the last week, 6.8% in the 14-day charts, 26.2% in the monthly charts, and 62.9% since August 2024. BNB’s price has fallen by 0.7% since its peak earlier today.

Will Binance Coin Continue Surging After Hitting a New All-Time High?

BNB and the larger cryptocurrency market seem to be recovering from their slight dip last week. The recovery is likely due to low Consumer Price Index (CPI) numbers. Lower CPI figures have boosted investor sentiment. The chances of an interest rate cut have substantially increased due to the low CPI numbers. Lower interest rates may lead to a continued rally for BNB and the larger crypto market. Lower interest rates often lead to investors taking on more risks. Cryptocurrencies are among the riskiest of assets.

BNB is likely following Bitcoin’s (BTC) trajectory right now. BNB may continue to rally if BTC maintains its momentum. According to a BNB report by Hash Global, it may be gearing up for a rally to the $2039.58 price point. Binance founder Changpeng Zhao stated that while he is not an expert on valuation models, Hash Global has been accurate with its earlier forecasts.

Also Read: $1000 in Binance Coin (BNB) Has Yielded $7 Million In 8 Years

While BNB’s outlook is quite bullish, there is always a possibility that the market will face a correction. September has historically been a bearish month for Bitcoin (BTC). If the original crypto follows its historical pattern, we may face a market-wide correction. The possibility of an interest rate cut could provide some cushioning to potential falling prices. How things unfold will be clear over the coming weeks.