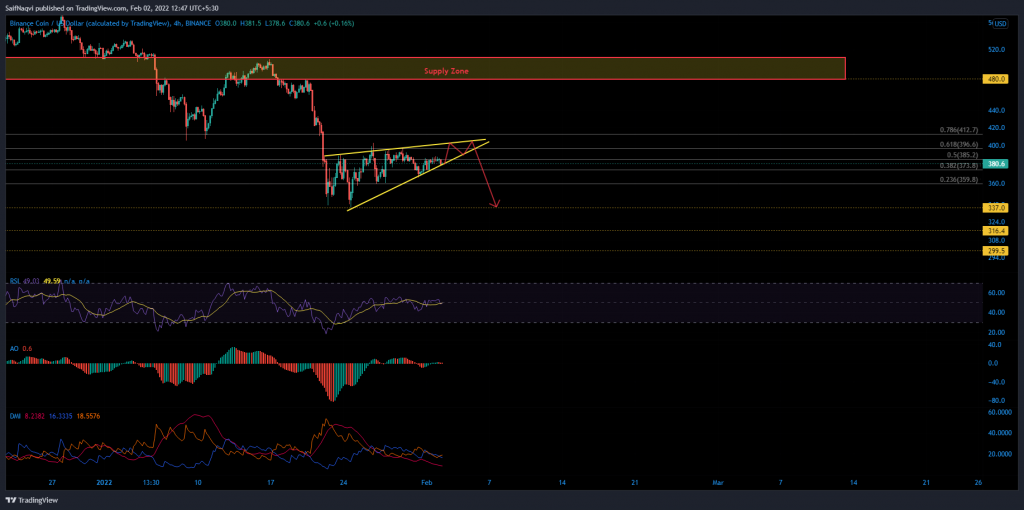

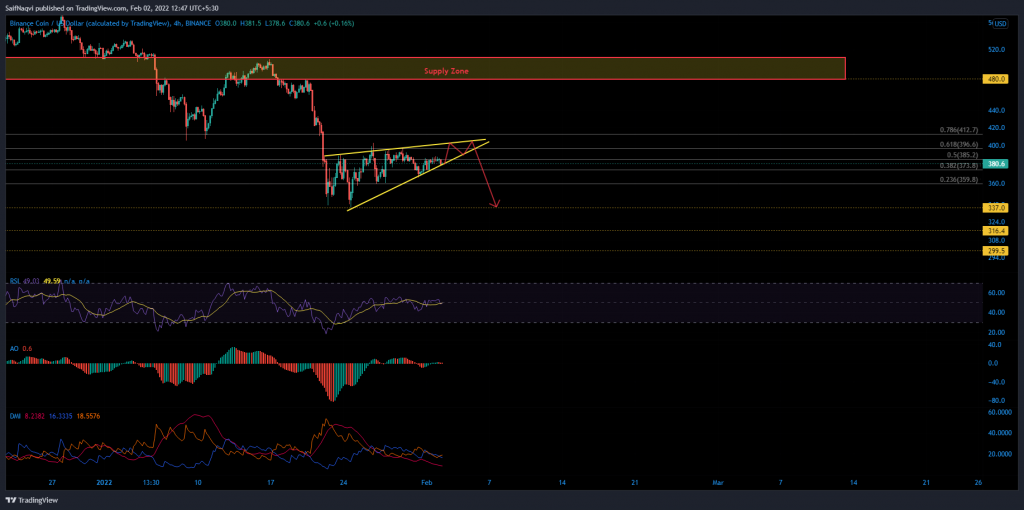

A delayed wedge breakout has left Binance Coin trailing with respect to percentage gains made by some top alts this week. Neutral readings on both the RSI and MACD underpin a consolidation stage as BNB inches towards the apex of its bearish pattern. At the time of writing, BNB traded at $380, down by 0.4% over the past 24 hours.

Binance Coin 4-Hour Time Frame

Binance Coin’s rising wedge has drawn out into a second week, with neither side finding strength for a breakout just yet. The pattern has denied BNB from catching up to some of its better-performing rivals this week so far. Unfortunately, bulls might not get a chance to tilt the tide in their favor. BNB’s vulnerability to a breakdown would only keep increasing the longer the wedge plays out.

Investors should be on the lookout for two key levels that would decide the nature of BNB’s breakout. Bears would be in the driving seat once BNB fractures its chain of higher lows below the 38.2% Fibonacci level. The resulting breakdown would see losses stretch to the 23.6% Fibonacci level or $337 in a more severe sell-off. Additional areas of support rested at $316 and $300.

On the other hand, a 4-hour candle above the 61.8% Fibonacci level would generate momentum for a northbound move. This low probability breakout would likely create a fresh high around $443 and the 4-hour 200-SMA (green).

Indicators

The 4-hour RSI and Awesome Oscillator stayed mum in terms of a breakout direction. Both the indicators held around their respective mid-lines. The Directional Movement Index echoed a similar sentiment as the -DI line was intertwined with the +DI line. A weak ADX reading of 8 showed the lack of a directional market trend.

Conclusion

Binance Coin was trading at the lower trendline of its wedge and a breakdown was likely over the coming days. Hence, it’s unlikely that BNB would be able to match gains seen by the likes of Solana and Terra (LUNA) this week. Investors can look to short BNB below the 38.2% Fibonacci level and exit their trades at $360 or $337, depending on volumes.