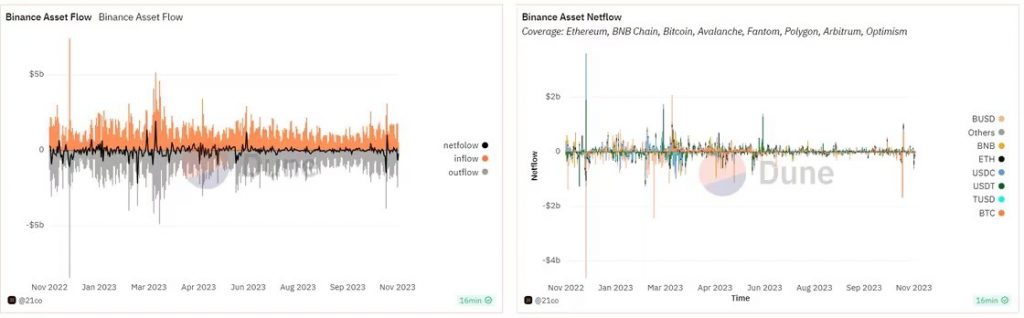

In a turbulent 24-hour period, Binance, the cryptocurrency exchange behemoth, witnessed a substantial net outflow exceeding $950 million. This coincided with founder Changpeng Zhao’s decision to step down as CEO amidst criminal charges in the United States. This pivotal event has reverberated throughout the cryptocurrency community, prompting increased scrutiny and a surge in withdrawal activities.

The net outflows, predominantly comprising Bitcoin and stablecoins, escalated following CZ’s resignation announcement. This was reported by Hochan Chung, head of marketing at CryptoQuant. While these hourly outflows are significant, they have not yet posed a substantial threat to Binance’s overall reserves, considering the exchange’s substantial holdings.

Despite the upswing in withdrawals, Binance reassures its user base that it will maintain regular operations. All of this is being done while opting for a “complete exit” from the U.S. as part of its settlement. The company underscores that the current withdrawal volumes, although elevated, do not indicate financial distress.

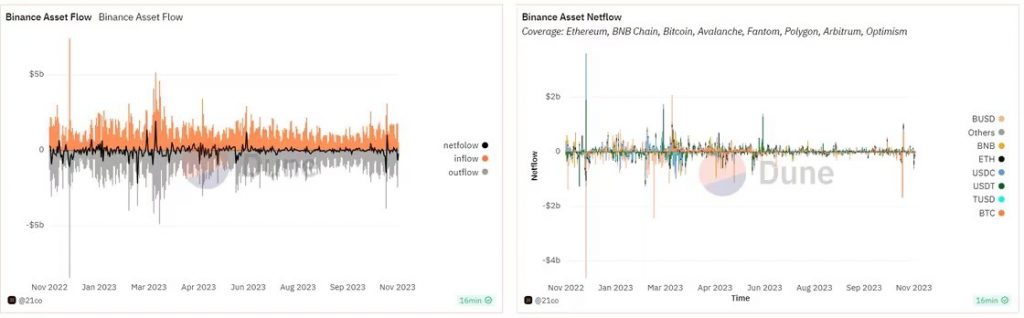

On-chain data from CryptoQuant indicates that the withdrawals, though heightened, align with typical weekly patterns. According to the Dune Analytics dashboard, over $2.37 billion in various tokens left the exchange during this period. This was further accompanied by approximately $1.78 billion in token deposits.

Notably, addresses associated with institutional entities played a significant role in these movements. An address linked to the institutional trading desk FalconX withdrew $83 million, while another associated with market maker Wintermute Trading led deposits with $190 million.

Binance’s native token, BNB, prominently featured in both deposits and withdrawals, underscoring its importance within the exchange ecosystem. The processing of these transactions helps allay concerns about Binance’s financial stability. This distinguishes the current situation from last year’s FTX crisis.

Additionally, at press time, BNB was trading at $236.82 with a 9% daily drop.

Also Read: Former Binance CEO Changpeng Zhao Faces 18 Months in Prison

Binance to Uphold Global Dominance Post-U.S. Settlement

Despite facing legal challenges and an imposing $4.3 billion fine, analysts at Bernstein assert that Binance maintains its dominance on the global stage. With $67 billion in customer funds under custody, the company is perceived as capable of settling the substantial fine while sustaining healthy operations. Analysts led by Gautam Chhugani said,

“Binance’s complete exit from the U.S would mean continued dominance of onshore and incumbent exchanges in the U.S. In our view, this is the final straw before the establishment feels comfortable to approve a regulated bitcoin ETF.”

Also Read: Binance Founder CZ’s Release: $175M Bond Set Amidst U.S. Charges

Anticipating Binance’s complete withdrawal from the U.S., analysts remain confident in the platform’s resilience with non-U.S. retail customers and its financial strength. The unfolding developments may also pave the way for regulatory approval of a Bitcoin ETF, signaling a potential shift in the regulatory landscape for cryptocurrency exchanges.