Binance has purchased another $100 million worth of Bitcoin (BTC) for its SAFU fund amid the dip. The latest market dip has caused substantial worry among investors, but some institutions and market participants are going big on the dip. Let’s discuss if now is the best time for you to buy the original crypto, or will prices fall further.

Should You Follow Binance And Buy The Bitcoin Dip?

Bitcoin (BTC) had a historic run from early 2024, when the SEC approved several spot ETFs, till October 2025, when it hit its most recent all-time high of $126,080. Since October of last year, the original crypto has faced significant hurdles. In fact, October registered the largest single-day liquidation event in crypto history. BTC’s price has fallen by nearly 40% since its October 2025 all-time high.

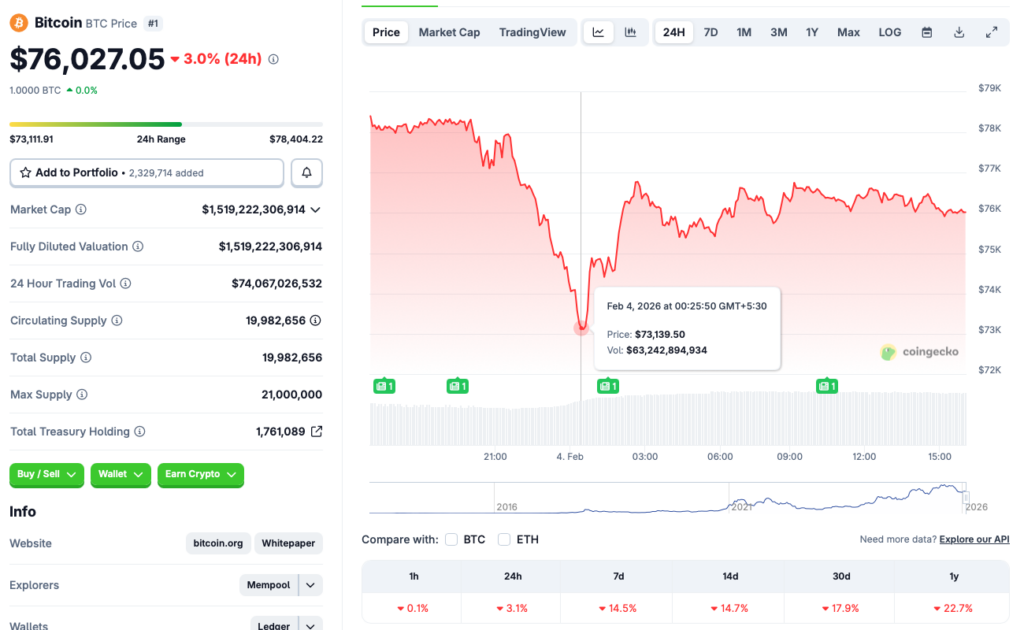

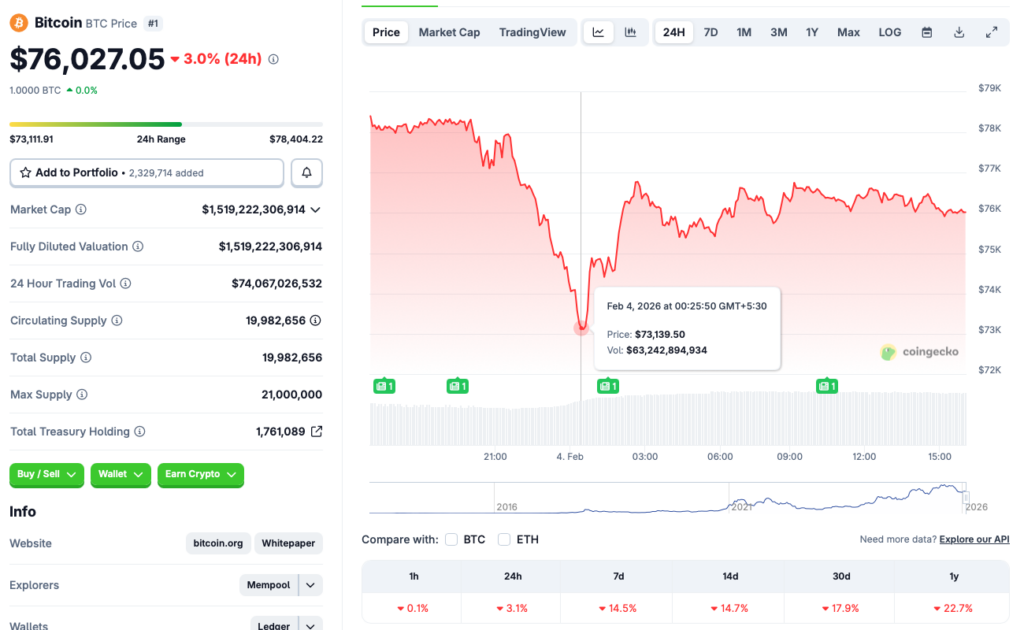

Bitcoin fell to the $73,000 price level earlier today, Feb. 4, 2026, but has since reclaimed the $76,000 mark. According to CoinGecko’s Bitcoin data, BTC’s price is down 3.1% in the last 24 hours, 14.5% in the last week, 14.7% in the 14-day charts, and nearly 18% over the previous month.

Many experts anticipate Bitcoin (BTC) to hit another all-time high this year. Bernstein and Grayscale claim that the original crypto is following a 5-year path, and not the typical 4-year trajectory. This means that the asset could hit a new peak this year, five years after its 2021 all-time high.

While there are some bullish forecasts around Bitcoin (BTC), others present quite a bearish outlook for the asset. Michael Burry, the the hedge fund manager who predicted the 2008 housing crisis, and depicted by Christian Bale in “The Big Short” movie, warns that Bitcoin (BTC) could enter a “death spiral.” He further added that BTC has failed to prove itself as a safe haven, like gold.

Also Read: Strategy’s 8-Month Decline: Sell Now Before MSTR Hits Sub-$100?

However, one should remember that the crypto market tends to move in cycles. Bitcoin’s (BTC) price fell below $16,000 in 2022, but has since hit multiple all-time highs. A similar pattern could emerge in the future. Hence, the low prices could prove to be a good entry point for investors.