Bitcoin (BTC) significantly dropped over the weekend following a notable recovery throughout the past week. The king coin endured a sell-off, pushing its price down below $58,000.

At press time, BTC was trading at $58,655.04, with a 4% drop over the past 24 hours. The cryptocurrency community has been expecting the king coin to move in a whole different direction following the much-awaited halving event. But why is Bitcoin dipping?

Factors Influencing Bitcoin’s Recent Drop

Looking Into The ‘33rd Week Curse’

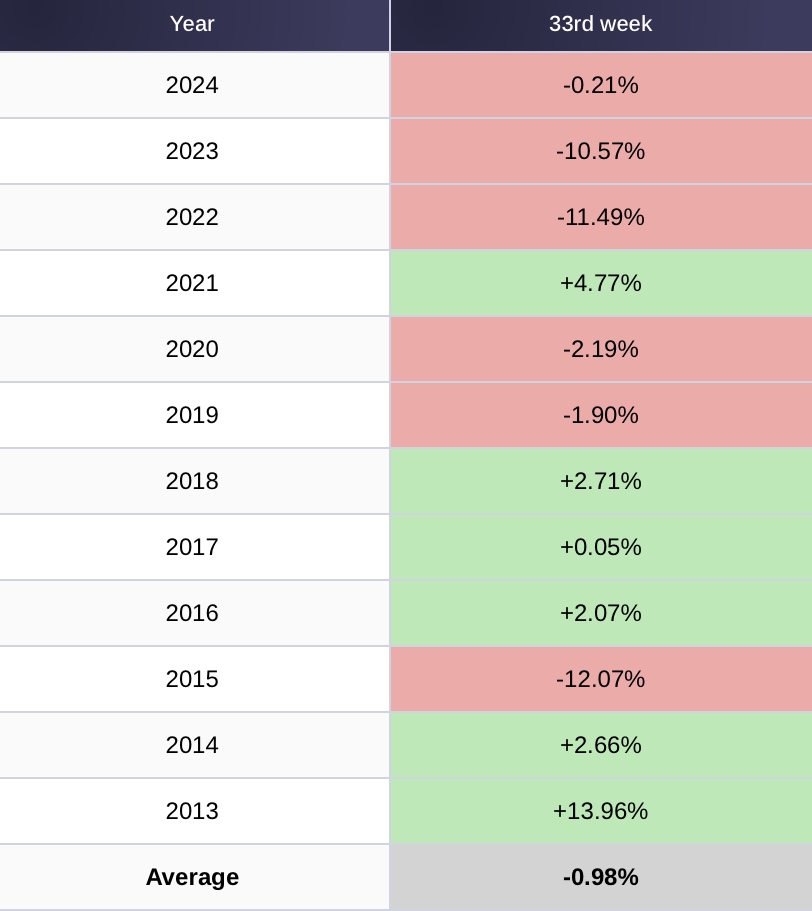

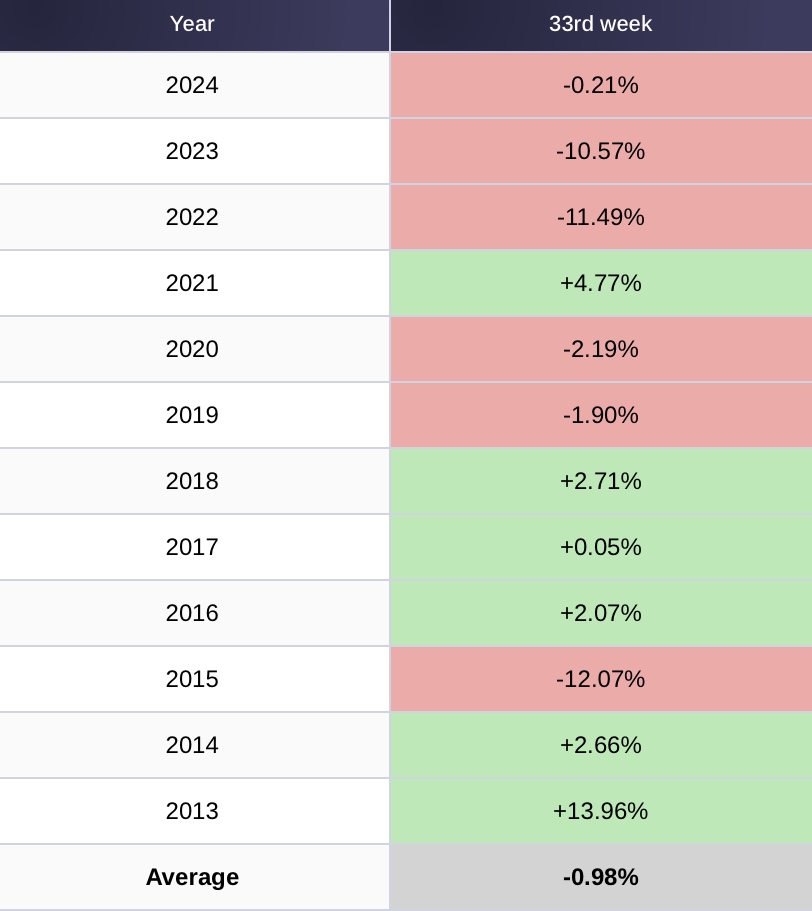

Over the past ten years, Coinglass data indicates that Bitcoin has typically dropped by 1% during the 33rd week of the year week.

Historical Performance

However, 2013 was an exception, with a strong performance. Since the 33rd week of Bitcoin, it has seen three double-digit declines. The 31st week of the year witnessed a 15% decrease, and in week 32, Bitcoin momentarily inched toward $49,000, signifying a noteworthy 38% reduction from its peak.

Also Read: Bitcoin: Experts Predict $100k BTC in 2024 Amid Rebound

Bitcoin Halving History

Bitcoin halving occurs once every four years. During this event, the rewards that miners get for adding transactions to the blockchain are reduced by half.

Impact on Bitcoin Price

This is done to keep the asset’s supply in check and eventually boost its price. The recent halving took place on April 20, 2024.

While the crypto coin hit a new all-time high of $73,750, BTC trades 20% below this peak. But a crypto analyst who goes by Eljaboom on X instilled hope into the market. He looked back at the 2016 and 2020 halving.

Historial Halving Effects

2016 BTC recorded a 40% slump before scoring a 2,300% rise. Similarly, in 2020, the king coin dipped by 30% and surged by 560%. Looking at the latest halving, the analyst pointed out at 30% and said:

Also Read: Bitcoin ETF Options to Launch in the Second Half of 2024

“Now, some consolidation between ATH and the recent lows before a breakout in Q4!”