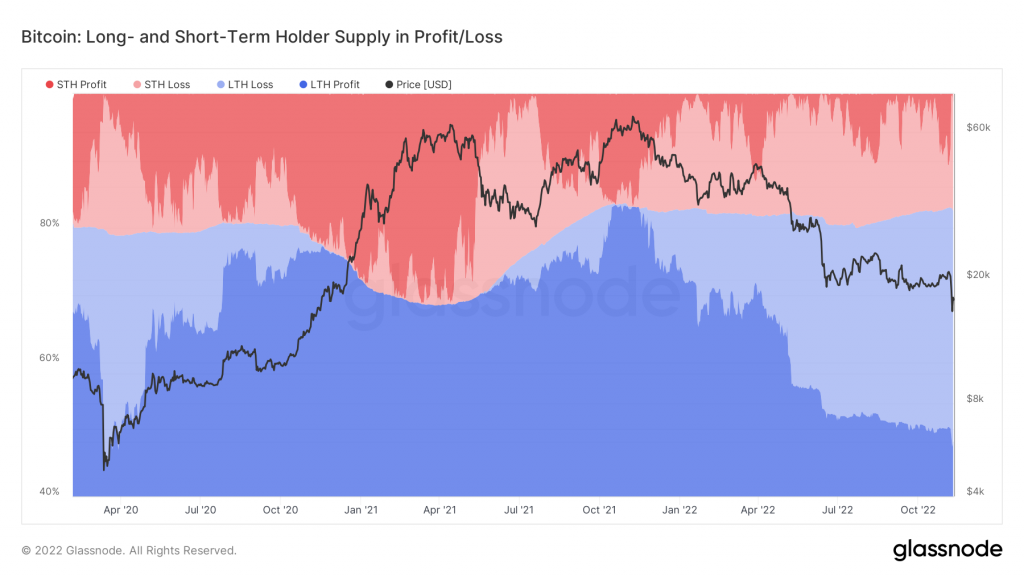

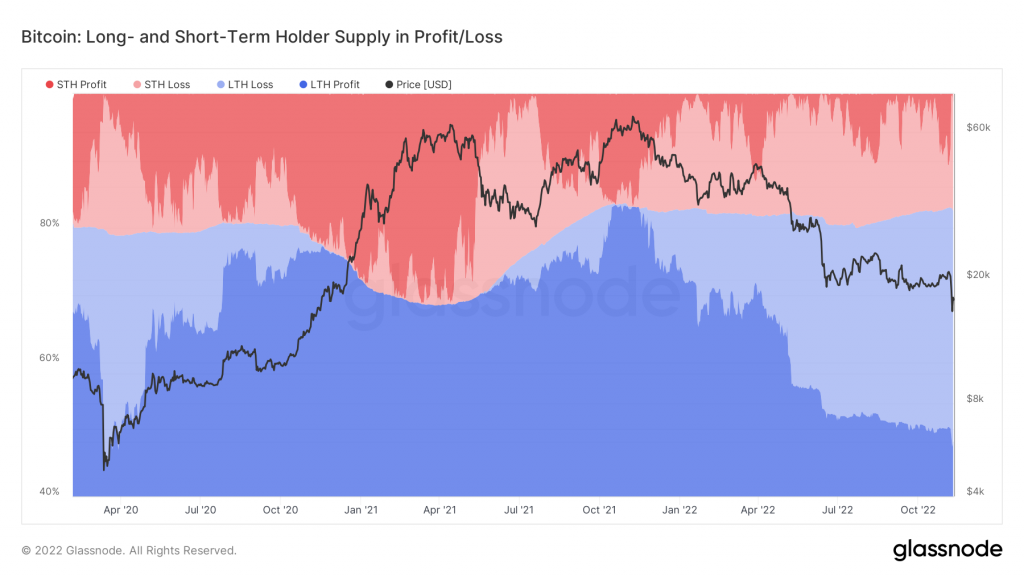

Bitcoin (BTC) holders, both long-term and short-term, are facing the brunt of the recent market crash. According to the data on Glassnode, 35.4% of BTC supply is being held at a loss by long-term holders. Meanwhile, 17% of the Bitcoin supply is being held at a loss by short-term holders. As of November 9th, short-term holders in profit held only 0.06% of the supply. The holders in profit are at 50%, the lowest it has been since March 2020, during the Covid-19 crash.

A long-term holder is a wallet that has held onto tokens for more than 155 days. On the other hand, short-term holders hold for less than 155 days.

Many were of the opinion that 2022 could not get any worse after the summer crash. Fast forward a few months, and Bitcoin fell to two-year lows of $15,600. Nonetheless, the asset has bounced back above the $17k level after US CPI numbers came in to be lesser than expected.

Bearish signals for Bitcoin

BTC’s relative strength index has fallen to an all-time low monthly index of 40.5. The development was highlighted by the famous crypto proponent, PlanB, stating that “Bitcoin has never been weaker.”

Additionally, Bitcoin formed a bear flag on the charts. Bear flags generally develop after a large rebound, during consolidation phases. A consolidation channel is represented by the flagpole as a series of higher highs and higher lows. After a brief period of stability, this structure shows that bears are increasing their selling pressure.

At press time, Bitcoin was trading at $17,357.49, up by 5.3% in the last 24 hours. The token is down by 14.1% over the week, and down by 8.9% in the monthly charts. Also, BTC is down by 74.9% from its all-time of $69,044.77, attained in November 2021, a year ago.