With the crypto market nosediving, Jurrien Timmer, Director of Global Macro at Fidelity, shared his thoughts on what he thinks is important when it comes to Bitcoin. Timmer took to Twitter to explain his opinion and inputs.

Timmer believed that the up-down debate is a hobby for many, but is mostly noise. In his opinion, what’s most important for Bitcoin, is the network.

He explained that what matters most is where the demand curve is going, and the answer to that, in his opinion, is to the top, and towards the right. The number of Bitcoin addresses with a value more than zero continues to grow, following a simple power regression curve.

In the past, Timmer has compared Bitcoin’s growth to historical S-curves, namely mobile phone subscriptions and internet adoption.

In his opinion, this follows the example of Apple’s rise to network dominance since the 1990s.

The Bitcoin and Apple comparison

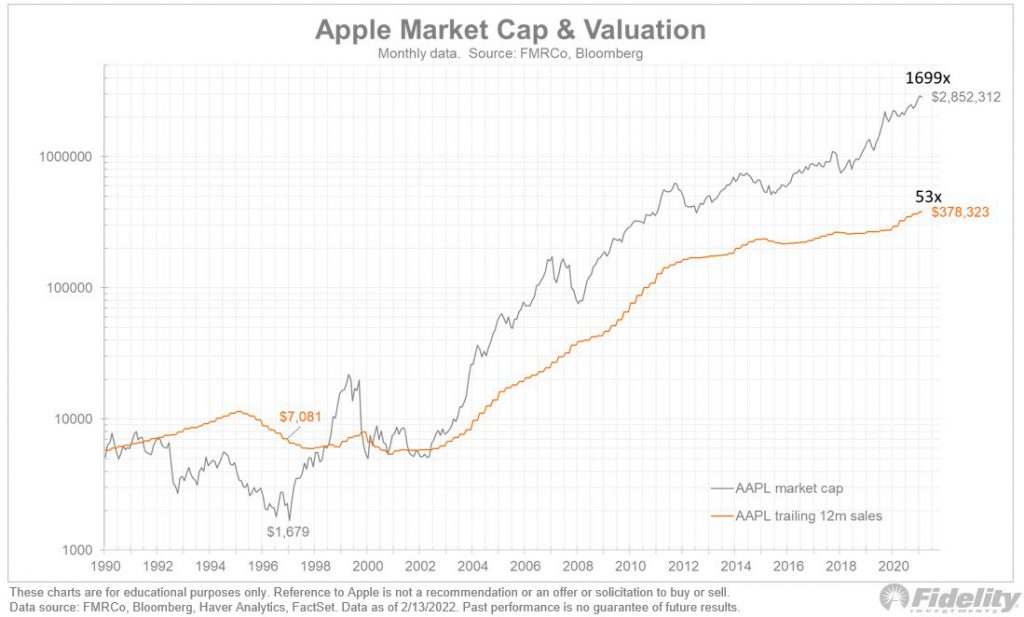

Taking some creative license, Timmer applied Metcalf’s law to Apple’s scenario. Apple’s network, since 1996, has grown 53 times. Whereas its market capitalization has increased 1699 times over.

If Apple’s growth in market value should have ideally been the square of its growth in sales (53 X 2), 2855 times growth. But at 1699X, it’s definitely in the court.

Since 1996, Apple’s price has grown 1457 times, while the price-to-sales ratio has grown 30 times over. If the increase in value is a multiple of the increase in sales (as per Metcalfe’s Law), then the price should rise as a multiple of both. It has in the case of Apple.

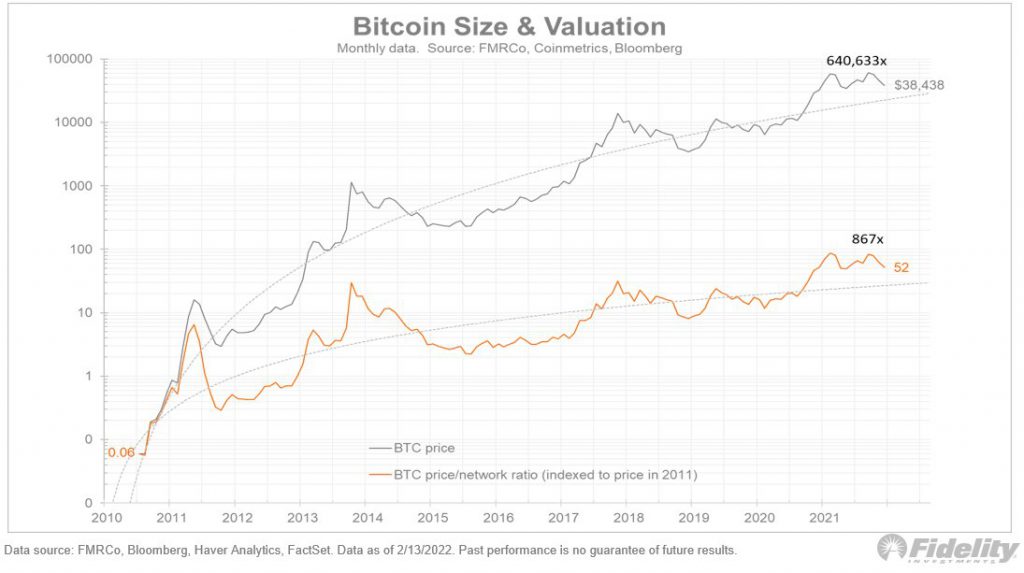

Additionally, he compared this to Bitcoin’s network growth and valuation. Since 2011, Bitcoin’s value has climbed 867 times, while its price has increased 640,633 times. The value obtained is 751,111 if Metcalfe’s Law is used to calculate the square of 867. This corresponds to the 640,633x realized price gain.

Although Bitcoin and Apple are not the same, their network expansion dictates a similar direction. Mobile phone subscriptions and internet adoption, according to Timmer, are two viable indicators based on previous S-curves. They have varying slopes, but they all point to the same long-term growth path.

Going by his opinion, Bitcoin sure has a bright future ahead. Although the market has turned its toe, it is far from being the end.

At the time of publication, BTC was trading at $40,525.58, down by 6.5%.