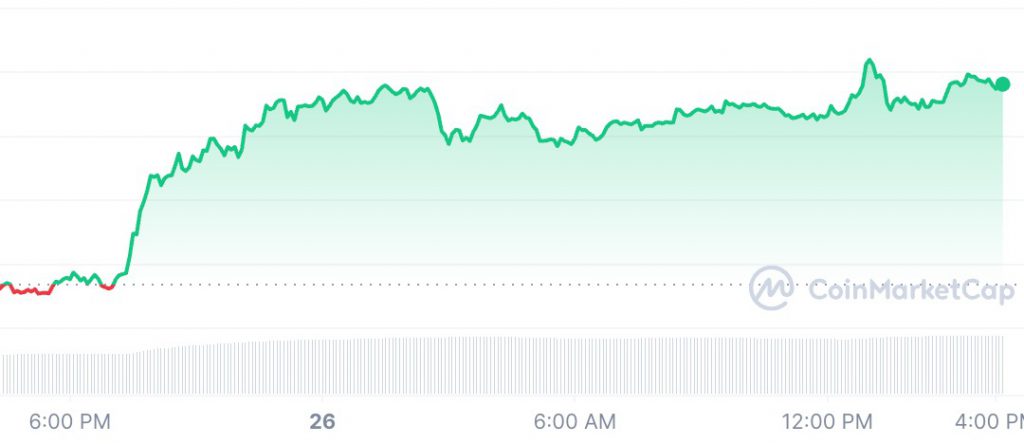

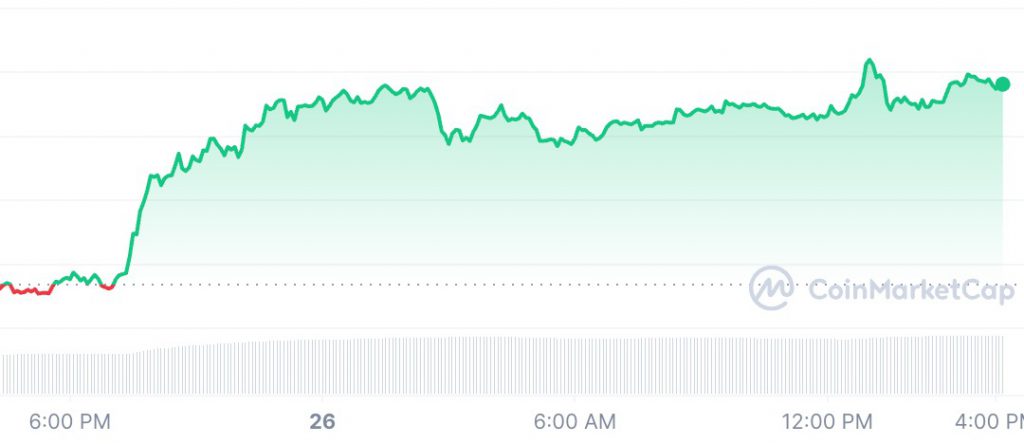

Bitcoin (BTC), has once again seized the attention of investors as it surpassed the $70,000 threshold. This marks a significant milestone in its eventful journey. This resurgence of Bitcoin not only boosted its own value but also propelled the broader cryptocurrency market forward, with altcoins benefiting from the prevailing optimism. As of the latest data, BTC is valued at $71,019.41, signaling a robust upward trend.

Standard Chartered’s Revised Forecast

In a noteworthy development, Standard Chartered, a prominent financial institution, has adjusted its price forecast for Bitcoin. They indicate a positive outlook for the digital asset. The institution now suggests that BTC could potentially surge to an impressive $150,000 by the end of 2024. This marks a considerable increase from its previous estimation.

Standard Chartered’s forward-looking projections have garnered attention. In particular, its assertion that BTC could skyrocket to an astonishing $250,000 by the conclusion of 2025 before stabilizing. This ambitious surge is anticipated to be driven by various factors. This further includes substantial inflows into Bitcoin exchange-traded funds (ETFs), heightened interest from reserve managers, and the eagerly anticipated Bitcoin halving event. Historically, the Bitcoin halving event has acted as a catalyst for positive price movements. It further enhances the allure of this cryptocurrency.

Also Read: Spot Bitcoin ETFs Already BlackRock & Fidelity’s Most Popular

Increasing Institutional Interest

Recent data aligns with the notion of a growing institutional appetite for Bitcoin. Nasdaq-listed spot bitcoin exchange-traded funds (ETFs) recorded inflows totaling $15.4 million on a recent Monday, halting a five-day streak of outflows. This surge in inflows underscores rising confidence among investors, who are increasingly turning to Bitcoin as a viable investment avenue.

Among the noteworthy ETFs, Fidelity’s FBTC emerged as a frontrunner, attracting an impressive $261.8 million in inflows, closely followed by BlackRock’s IBIT, which amassed $35.5 million. Other funds such as BITB, BTCO, EZBC, and BRRR also experienced substantial inflows ranging between $11 million and $20 million each. However, Grayscale’s ETF (GBTC) witnessed outflows, losing slightly over $350 million during the same period.

The influx of capital into Bitcoin ETFs signifies a growing institutional interest in cryptocurrencies, particularly BTC, which continues to dominate the market with its unparalleled market capitalization and brand recognition. In conclusion, Standard Chartered’s bold projection of Bitcoin reaching $250,000 by the end of 2025 underscores the growing confidence and optimism surrounding the cryptocurrency market.

Also Read: Nilam Resources Files Letters of Intent to Acquire 24,800 Bitcoin