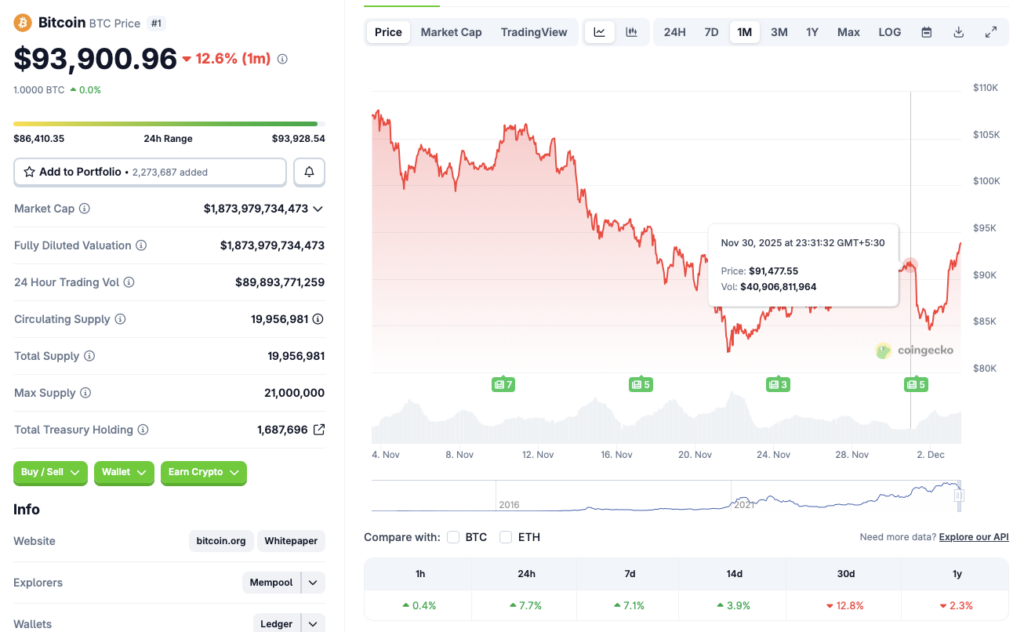

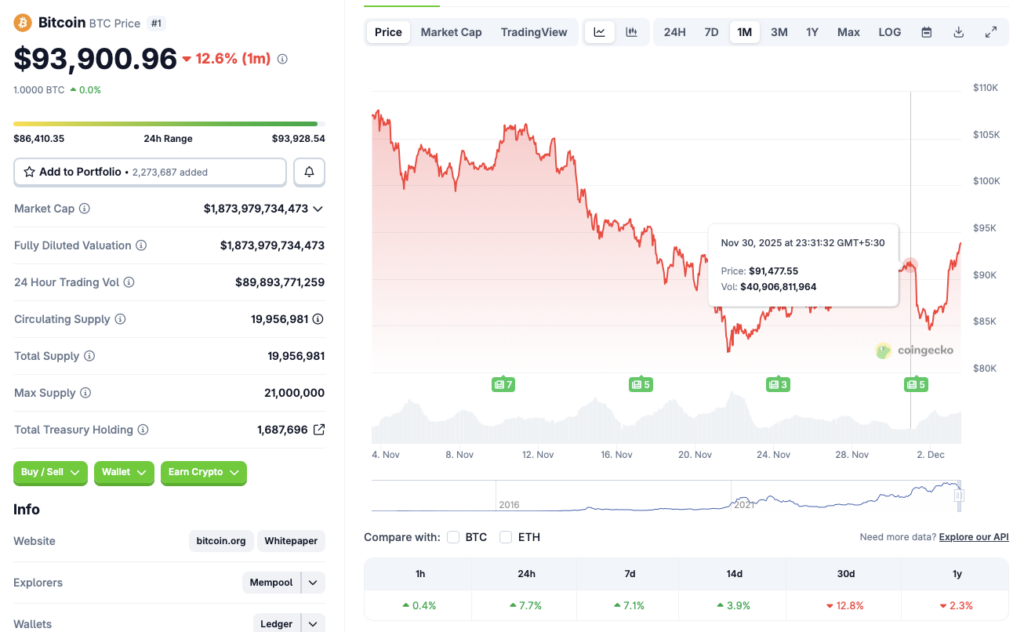

Bitcoin (BTC) has reclaimed the $93,000 mark and is inching closer to hitting $94,000. The original crypto was struggling to break past the $91,000 price level in late November, but the latest upswing seems to be pushing the asset to its older glory. According to CoinGecko’s Bitcoin data, BTC’s price has rallied 7.7% in the last 24 hours, 7.1% in the last week, and 3.9% in the 14-day charts. Despite the rally, Bitcoin’s (BTC) price is still down by 12.8% over the previous month and 2.3% since December 2024. Let’s discuss if BTC can break past the $95,000 mark this week.

Can Bitcoin’s Rally Push It Past $95,000?

The recent market rebound could be due to the futures market showing improvements. Moreover, the high chances of another interest rate cut later this month may have boosted investor sentiment. Bitcoin (BTC) and other risky assets could benefit from another rate cut.

Bitcoin’s (BTC) next challenge may arise around the $95,000 price point, a level last unsuccessfully tested in mid-November 2025. Breaking past $95,000 could push BTC beyond the $100,000 mark once again. The original crypto is currently down by 25.6% from its all-time high of $126,080, which it attained in October 2025. A rate cut could lead to BTC hitting a new all-time high.

Grayscale is also quite bullish on Bitcoin’s (BTC) performance over the coming months. The financial institution put out a report that said that BTC may follow a 5-year cycle, instead of the usual 4-year cycle. Grayscale anticipates BTC to hit a new all-time high sometime in 2026 before facing a dip.

Also Read: Bitcoin Faces 2 Major Hurdles This Cycle

ETF inflows are also expected to increase over the coming weeks, which may further fuel Bitcoin’s (BTC) price.

CoinCodex analysts anticipate Bitcoin (BTC) to dip to $91,000 and consolidate for the remainder of the year, before hitting the $100,000 mark in late January 2026.