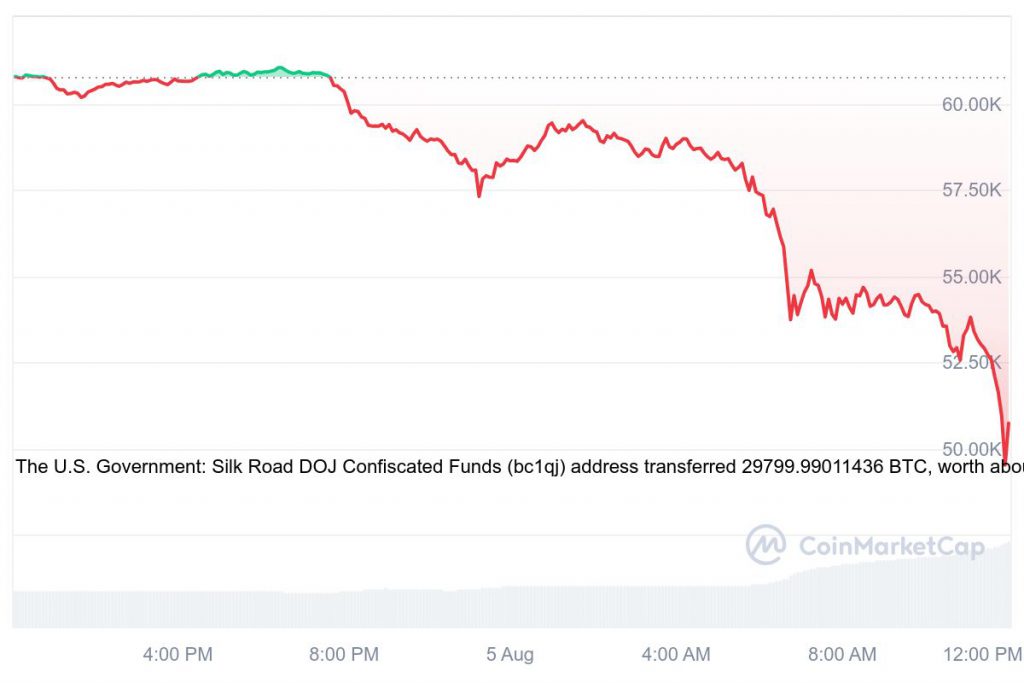

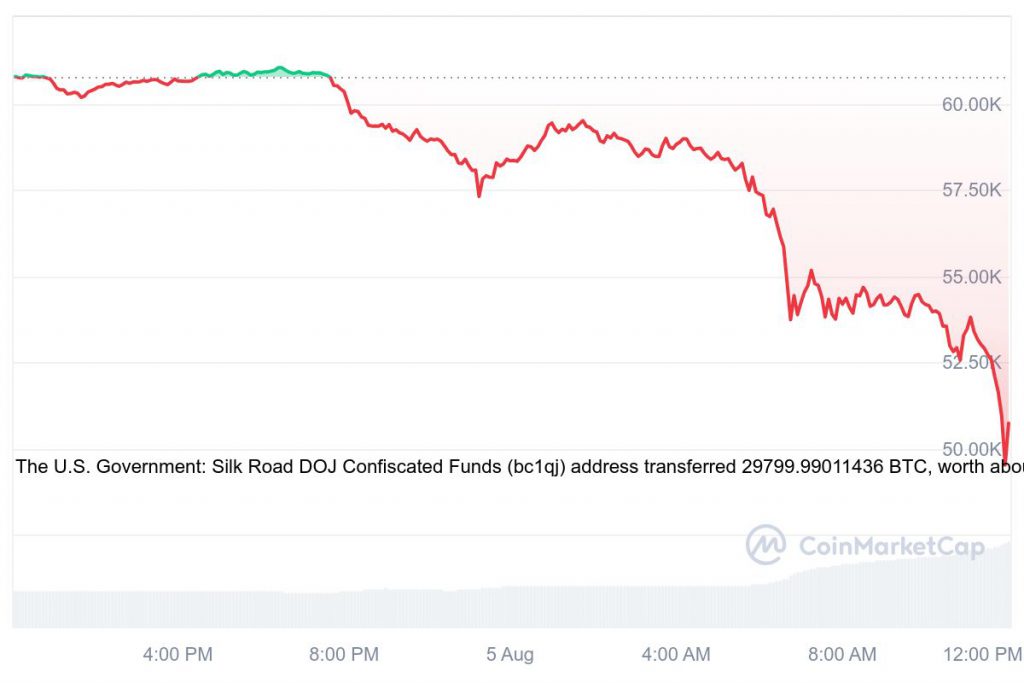

The cryptocurrency market saw a major dip over the past 24 hours. On the previous day, Bitcoin [BTC] fell by an astounding 18%, reaching a low of $49,500.

Over the last seven days, BTC has fallen by almost 30%. This was the worst week for cryptocurrencies since the 2022 collapse of FTX. In addition, BTC’s dominance dipped to 55%.

Coinglass data indicates that the overall market sell-off refuses to abate as panic increases. Almost $700 million in bets have been liquidated in the past 12 hours.

This follows last Friday’s enormous market meltdown in the United States. With a 3.4% decline last week, the tech-heavy US index Nasdaq has plummeted nearly 10% in the past three weeks.

This is the poorest three-week performance since September 2022. Bitcoin market liquidations are increasing due to significant levels broken by Asian and European markets, which abruptly turned negative. Japan’s Nikkei 225 saw a substantial 8% decline, and trade halts in South Korea also spelled trouble.

Alongside Bitcoin, Ethereum [ETH] also recorded a significant plunge. The altcoin saw a 23% dip within the past 24 hours. At press time, ETH was trading at $2,230.

Also Read: Top 2 Cryptocurrencies To Watch in August 2024

Looking at the ‘Other’ Reason Behind This Downfall

In a tweet, Arthur Hayes proposed a potential cause for the current market meltdown. The co-founder and former CEO of the biggest futures trading platform in cryptocurrency is speculating about another explanation.

He said:

My TradFi birdies are telling me somebody big got smoked, and is dumping all #crypto. No idea if this is true, I won’t name names, but let the fam know if you are hearing the same?

Also Read: Japan’s Stock Market Suffers Worst Losses Since 1987

The cryptocurrency market is experiencing significant turmoil, with major assets like Bitcoin and Ethereum facing steep declines.