Bitcoin (BTC) enthusiasts and investors are gripped with excitement as the cryptocurrency surged to $66,235, solidifying its dominance in the digital currency market with a staggering market cap of $1.308 trillion. However, the buzz isn’t just about its remarkable performance; all eyes are on the upcoming Bitcoin “halving” set to occur next month.

The Halving: A Cyclical Phenomenon

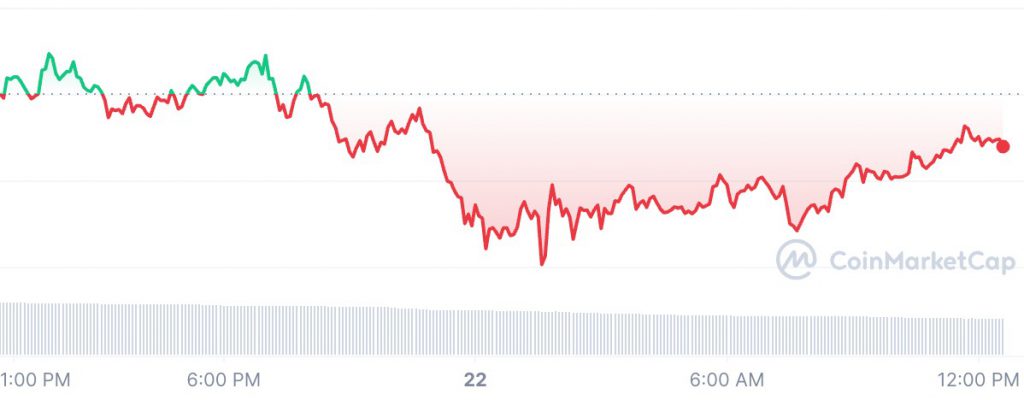

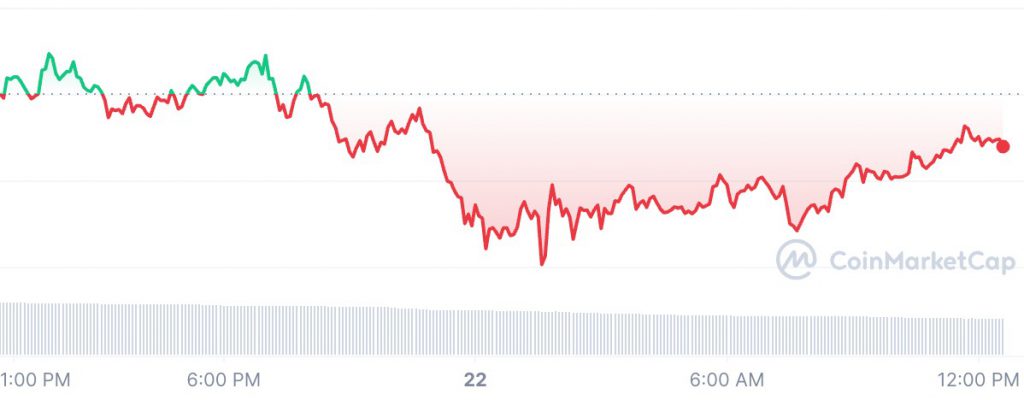

Every four years, Bitcoin experiences a significant event known as the halving. During this, the reward for mining new blocks on the network is halved. This event, hardcoded into Bitcoin’s blockchain protocol, serves to regulate the influx of new coins into circulation. Consequently, it often sparks notable market fluctuations and volatility in Bitcoin’s price.

Close observers monitoring countdown clocks may have noticed a subtle adjustment in the expected timing of the halving event. Initially slated for April 28, the date has steadily crept closer. This comes with projections pointing to April 15, as suggested by Nicehash’s countdown. This pattern echoes the lead-up to the previous halving event four years ago, piquing the interest of market analysts.

Price Projections: Buckle Up for Volatility

According to forecasts by Changelly, a prominent cryptocurrency exchange platform, Bitcoin’s price around the time of the halving event in April 2024 is anticipated to undergo significant fluctuations. Analysts at Changelly project a potential trading price ranging from around $70,657 to a soaring $81,212.46 during this period. The average anticipated value is estimated to stabilize around $75,934.73.

These projections underscore the prevailing anticipation and uncertainty in the Bitcoin market leading up to the halving event. While historical patterns provide some insight into potential price movements, the cryptocurrency market remains highly volatile, influenced by various external factors and sentiments.

Also Read: Bitcoin: Which Is the Best Day To Buy Bitcoin?

Factors at Play

Several elements could impact Bitcoin’s price dynamics in the forthcoming weeks. Market sentiment, macroeconomic trends, regulatory developments, and institutional adoption are pivotal in shaping the landscape. Additionally, the supply-demand dynamics of Bitcoin, especially within the context of the halving event, will be closely scrutinized by investors and analysts alike.

Investors are advised to approach the upcoming period with caution, acknowledging that volatility is inherent in the cryptocurrency market. While the halving event may fuel excitement and speculative activity, maintaining a long-term perspective and considering the fundamental drivers of Bitcoin’s value is essential.

Also Read: Cryptocurrency: Top 3 Coins Under $1 To Buy Before Bitcoin Halving

Ultimately, the Bitcoin halving signifies a pivotal moment for the cryptocurrency ecosystem. It highlights its decentralized nature and the unique supply dynamics that distinguish it from traditional fiat currencies. As the countdown to the halving event continues, all eyes remain fixed on BTC’s price movements, with investors eagerly anticipating the market’s response to this significant milestone in Bitcoin’s history.