Bitcoin is currently trending globally, as the asset continues to breach new milestones with each passing day. The token is now hovering at the $109K price level, ultimately eyeing the $110K mark as its next grand destination. Several experts and analysts have already started to issue bullish price forecasts for BTC, primarily stating how the token is capable of hitting $200K by the end of the year. What’s driving this BTC rally, and how high can Bitcoin truly soar in the process? Let’s find out.

Also Read: CNBC Projects Bitcoin to Surge to All-Time Highs Above $130,000

Bitcoin: What Are the Experts Saying?

BTC is currently trading at $ 107,000, down 2% over the last 24 hours. BTC has gained 5% in the last month, showcasing how the token is relentlessly pursuing a new price trajectory. That being said, as the geopolitical narratives continue to change, investor sentiment towards Bitcoin has also strengthened, with institutional demand for BTC also rising steadily. Moreover, several leading analysts and experts have predicted bullish price marks for Bitcoin soon, making the asset appear more lucrative to interact with in recent times.

Per Max Kaiser, Bitcoin is the only asset “that matters” in the long haul. Kaiser took to X to share his analysis, claiming that every other asset will go to zero against BTC in the near future.

“The only BTC prediction of mine that truly matters is in 2011, at $1, I said it was going to $100,000. This was said on my show, etc. As far as new predictions… The only metric you need to know is that everything is going to zero against BTC.”

The only Bitcoin prediction of mine that truly matters is in 2011, at $1, I said it was going to $100,000

— Max Keiser (@maxkeiser) June 11, 2025

This was said on my show, etc

As far as new predictions… The only metric you need to know is that everything is going to zero against Bitcoin. https://t.co/GXTdn8asvl

Swan Capital recently shared a post by Ray Dalio stating a similar analysis, adding how Bitcoin may gain global momentum as the most used hard currency.

“Bitcoin is now emerging as an accepted hard currency… because it’s widely accepted and limited in supply.” — Ray Dalio. Not long ago, Dalio warned governments might outlaw BTC. Now, he’s describing its core monetary properties. A quiet pivot—but a meaningful one.”

“Bitcoin is now emerging as accepted hard currency… because it’s widely accepted and limited in supply.” — Ray Dalio

Not long ago, Dalio warned governments might outlaw Bitcoin.

Now, he’s describing its core monetary properties.

A quiet pivot—but a meaningful one.— Swan (@Swan) June 10, 2025

Moreover, Bitcoin’s institutional demand is also on the rise. Leading firms like Metaplanet, Marathon Digital, Tesla, and many more have confirmed their stake in BTC, confirming a pivot in transitional finance mechanisms. In a recent interview, Cathie Wood, CEO of Ark Investment, stated that BTC is set to attract “trillions” worth of institutional interest and demand.

🇺🇸 CATHIE WOOD JUST SAID “TRILLIONS” WORTH OF INSTITUTIONS ARE COMING TO #BITCOIN 👀

— Vivek⚡️ (@Vivek4real_) June 11, 2025

WE HAVE “BARELY STARTED” 🚀 pic.twitter.com/fl8TZEwham

The Token’s Price Prediction: Technical Analysis

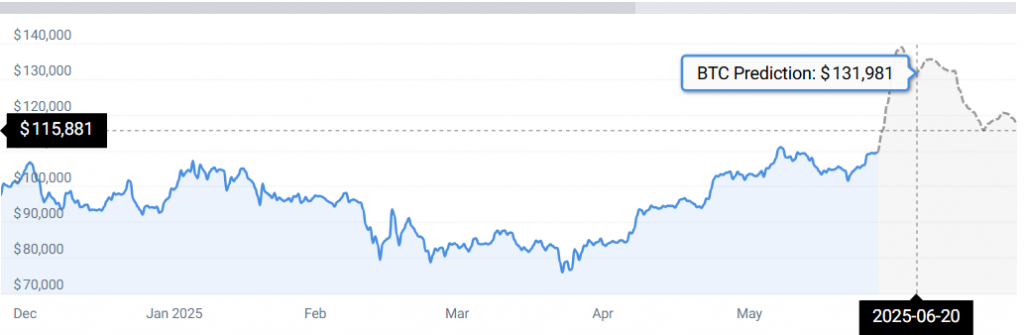

While the predictions for Bitcoin are incredibly bullish, per CoinCodex, according to CC, Bitcoin may sit around the $131K price mark by June 20, 2025.

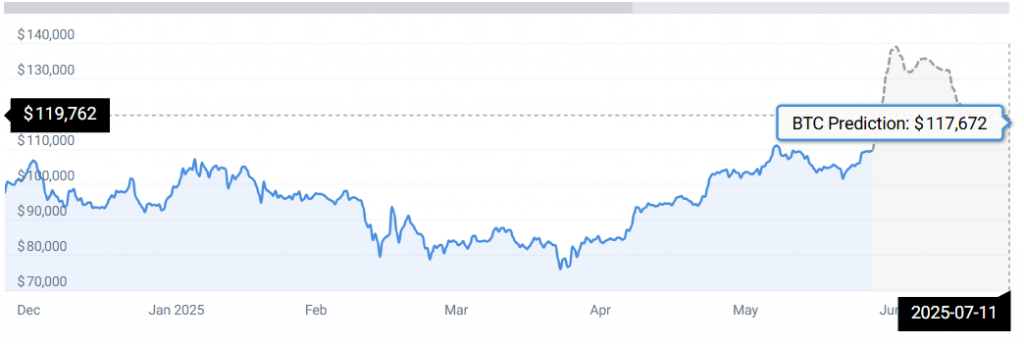

BTC may later surge to sit at $117K by mid-July 2025.

“According to our current Bitcoin price prediction, the price of Bitcoin is predicted to rise by 8.28% and reach $ 117,672 by July 11, 2025. Per our technical indicators, the current sentiment is bullish, while the Fear & Greed Index is showing 72 (greed). Bitcoin recorded 17/30 (57%) green days with 2.20% price volatility over the last 30 days.”

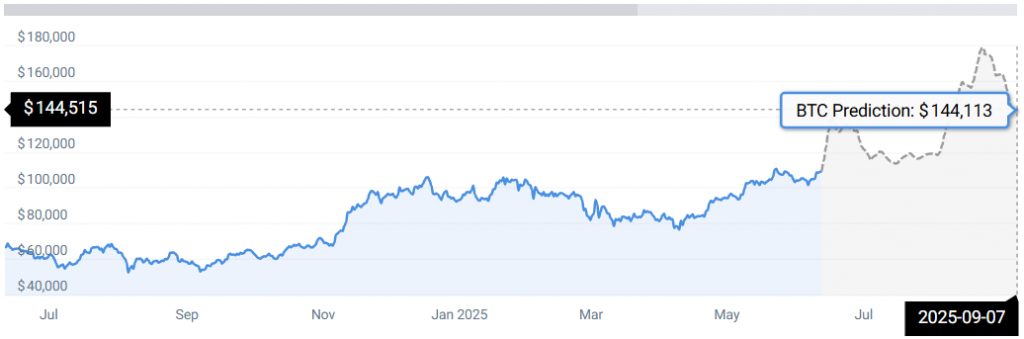

BTC may later hit the $144K price level by September 2025.

“According to our current Bitcoin price prediction, the price of Bitcoin is predicted to rise by 32.73% and reach $ 144,245 by September 8, 2025. Per our technical indicators, the current sentiment is bullish, while the Fear & Greed Index is showing 72 (greed). Bitcoin recorded 17/30 (57%) green days with 2.20% price volatility over the last 30 days.”

Also Read: Bernstein Calls Its $200,000 Bitcoin Price Prediction “Conservative”