Bitcoin has stagnated around the $20k threshold over the past few days. Resultantly, investors have been taking due advantage of Bitcoin’s discounted price.

Per data from Crypto Quant, the Coinbase Premium Index stepped into positive territory for the first time since April 2022. Well, not only did it flip to green, but it also spiked to a level that was last seen in May last year.

A high reading on the Coinbase Premium Index usually means that investors are willing to pay an extra amount to acquire Bitcoin. While the current state of this metric indicates rising demand and a strong buy bias among US investors, is it strong enough to foster a leg up for BTC?

Bitcoin doesn’t have the wings to fly

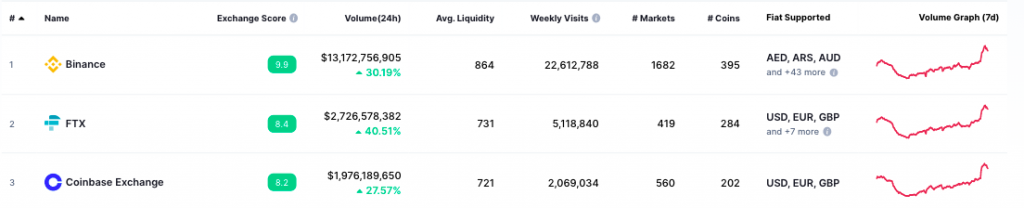

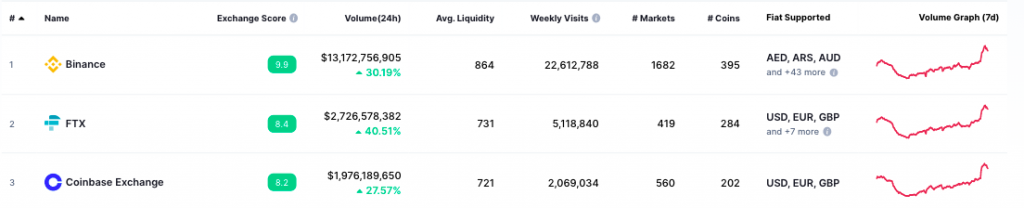

Coinbase, as an exchange, has a significant say in the crypto market. Per the market share data from CMC, it occupies the third spot. In terms of volume settled, however, it stands pretty behind its top competitors. When the numbers below are assessed, it can be inferred that Coinbase is clearly under the thumb of Binance and FTX.

Moving on, it should be noted that Bitcoin’s price has not rallied every time Coinbase’s premium has been positive. When the tip glided up in May last year, Bitcoin’s price kept falling. However, towards the last few months of 2021, and during the February-March period this year, Bitcoin reacted positively to the premium paid by US investors.

In April, again, nonetheless, the positive premium hardly supported Bitcoin’s price. The same can be observed from the first chart attached.

Other premium Indices, like the KPI, remain to be unaffected. Per data from CQ, The Korea Premium Index has dropped from 2.24 to 0.07 over the past day. The same brings to light the fading buy-interest. Thus, it can be inferred that accumulation bias remains US-centric.

The rise in the aggregate exchange netflow supported the said narrative. Over the last three days, this metric remained negative, indicating that bulls had a slight upper hand. However, on Friday, the number was positive, implying that investors had already started abandoning their Bitcoin.

Furthermore, trader sentiment remained divided at press time. The funding rate for Bitcoin remained positive on a few exchanges while it stood negative on the rest.

So, even though the Coinbase Premium Index is positive, it doesn’t necessarily guarantee a Bitcoin rally, for it doesn’t have adequate support from other market factors.