According to Farside Investors, Bitcoin (BTC) ETF inflows rose to $524 million on Nov. 11, 2025, the highest level since Oct. 7. The uptick in BTC ETF inflows is yet to reflect in the underlying asset’s price, which is struggling to break past the $105,000 price level. Let’s discuss if the spike in BTC ETF inflows will aid BTC’s price.

Will ETF Inflows Help Bitcoin’s Price?

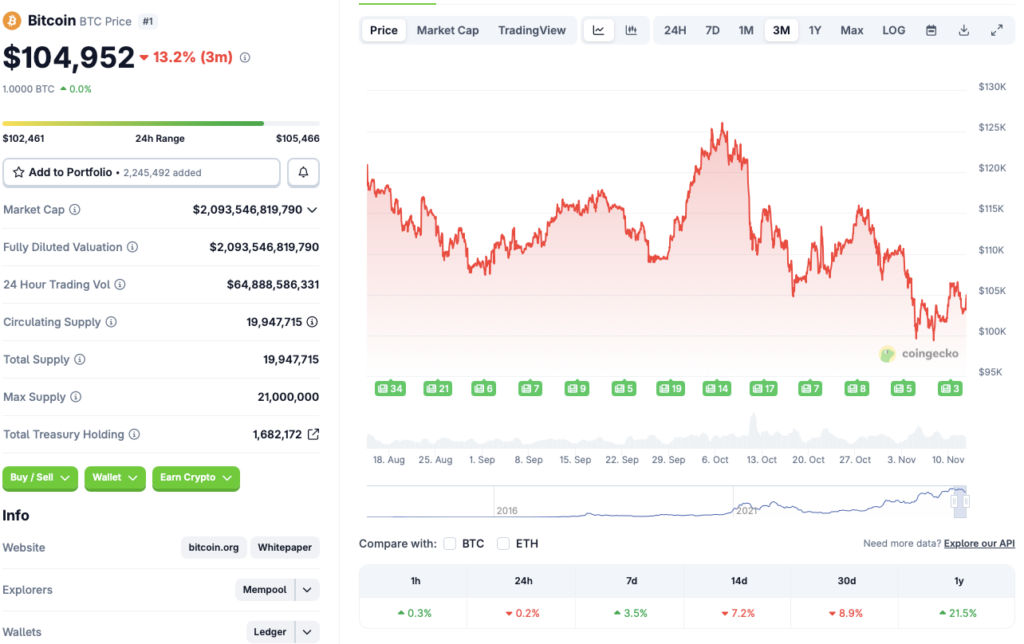

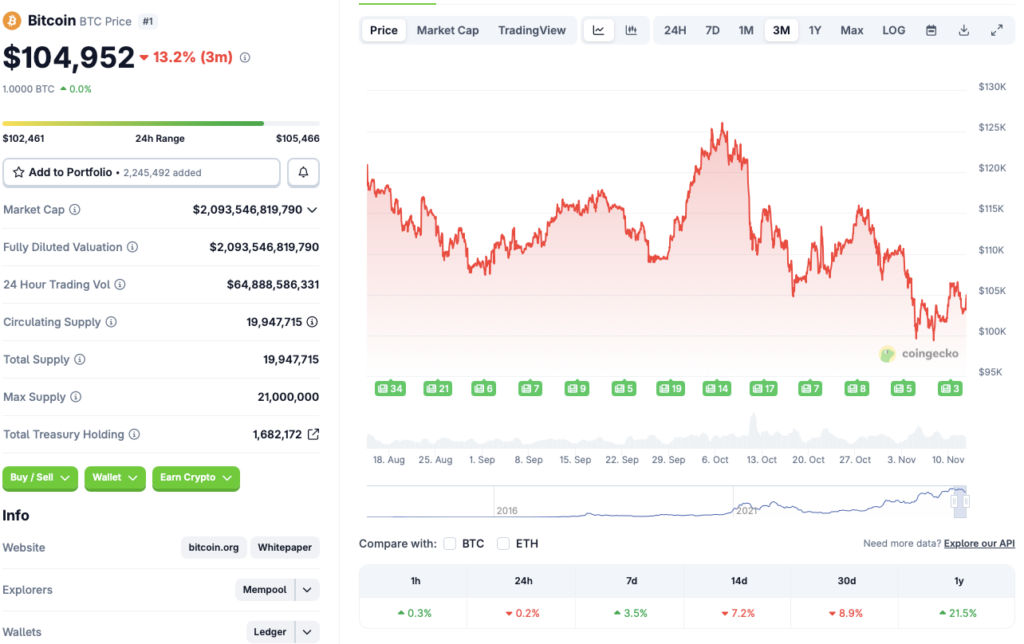

The recent ETF inflows have not led to any positive price action for BTC. According to CoinGecko data, Bitcoin (BTC) is down 0.2% in the daily charts, 7.2% in the 14-day charts, and 8.9% over the previous month. Despite the downtrend, the asset has rallied by 3.5% over the last week and 21.5% since November 2024.

ETF inflows have been a key driver for Bitcoin’s (BTC) price over the last year. BTC has hit multiple all-time highs ever since the SEC approved 11 spot ETFs in early 2024. ETF inflows took a hit over the last month, likely due to the US government shutdown and other macroeconomic factors. However, with the government reopening, we may see a spike in Bitcoin (BTC) investments.

Moreover, the recent interest rate cut from the Federal Reserve could also help propel BTC’s price beyond the $110,000 mark. There is also a possibility that the Federal Reserve will roll out another interest rate cut in December, although there is no confirmation on that front. The Fed is reportedly in a split over whether to bring out another rate cut or not.

Also Read: Whales Are Cashing Out: 738 Big Bitcoin Wallets Vanish in a Week

The ETF inflow spike is not enough to conclude whether the crypto market has fully recovered. Many would say that the market is still quite fragile and far from fully recovered. Bearish elements continue to weigh on investors. Bitcoin’s price could swing in any direction over the coming days.