The markets entered the new year with a very bearing trend. Bitcoin fell below $40,000 for the first time since September, after plunging as much as 6% to $39,774 in New York trading. The original cryptocurrency recovered off the day’s lows, putting its loss to around 14%. The drop is the biggest for a new year’s start since at least 2012. Since reaching an all-time high of about $69,000 in early November, it has dropped more than 40%.

What do the Fund Flows look like?

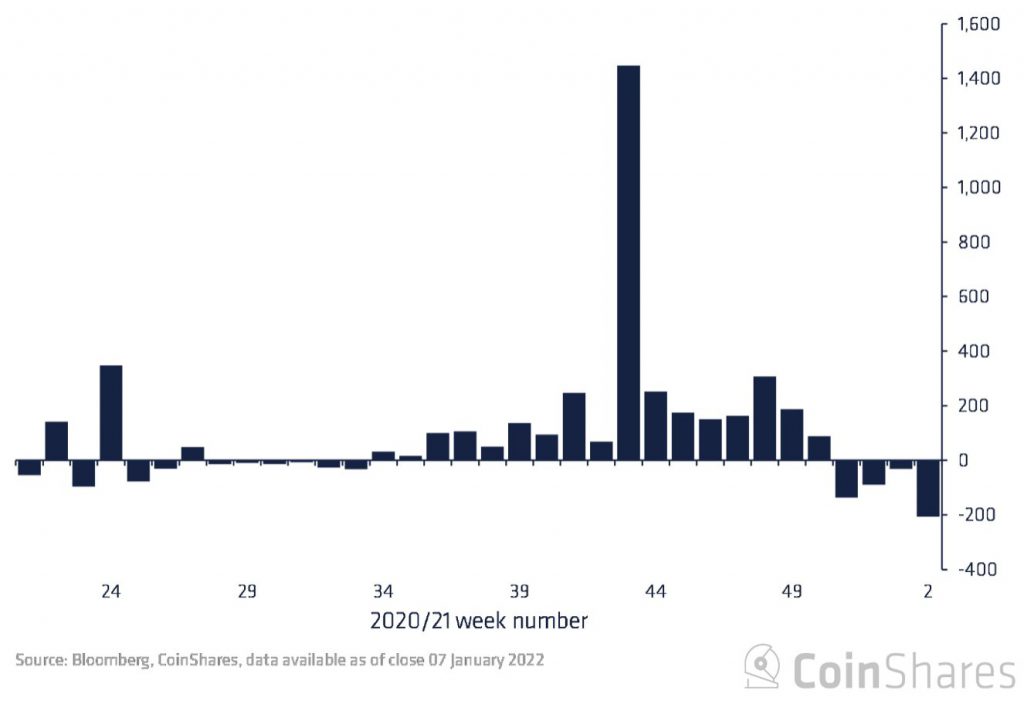

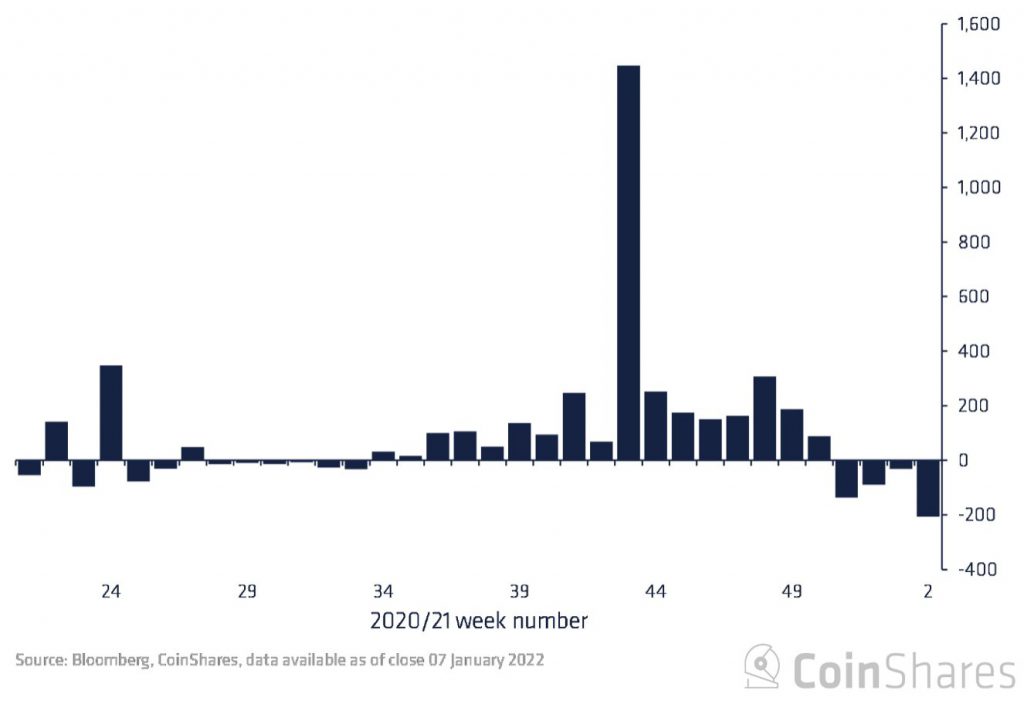

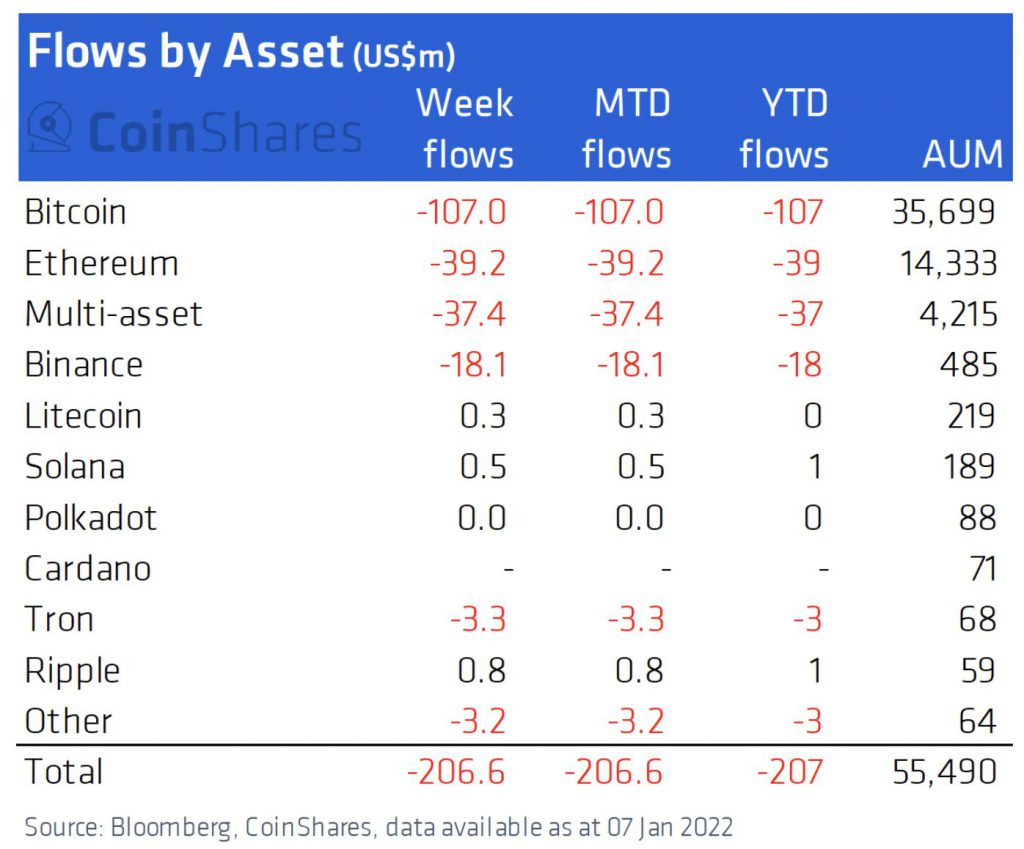

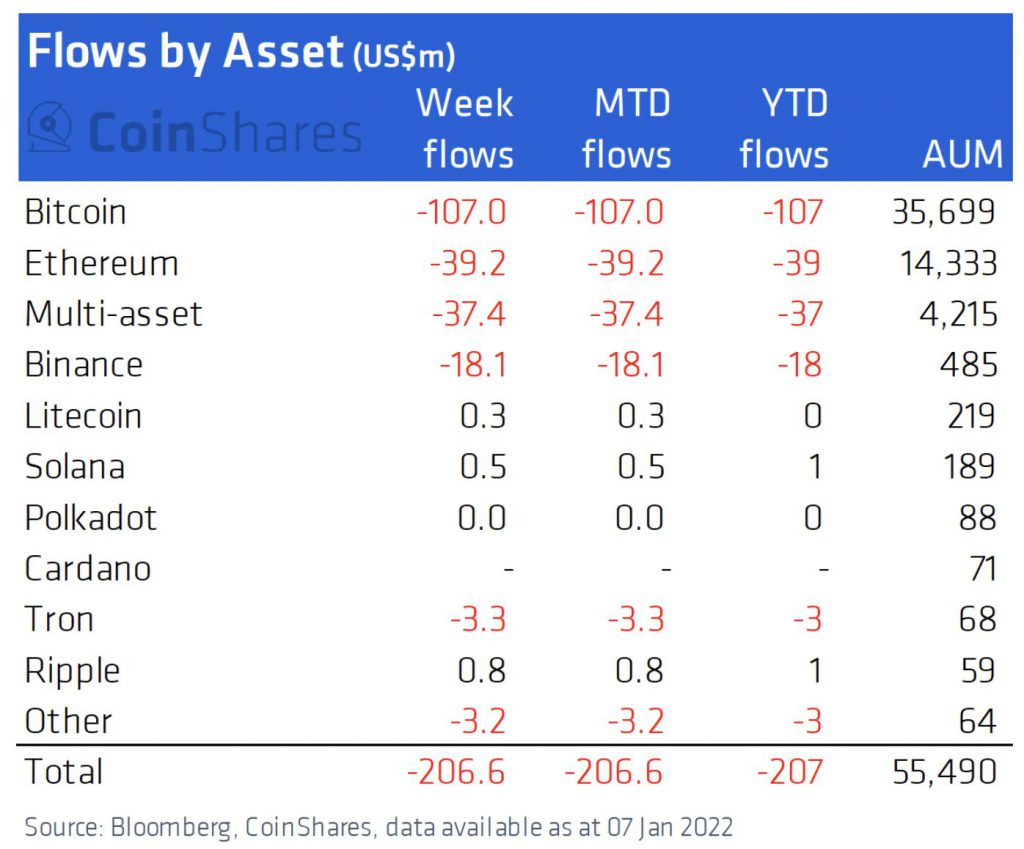

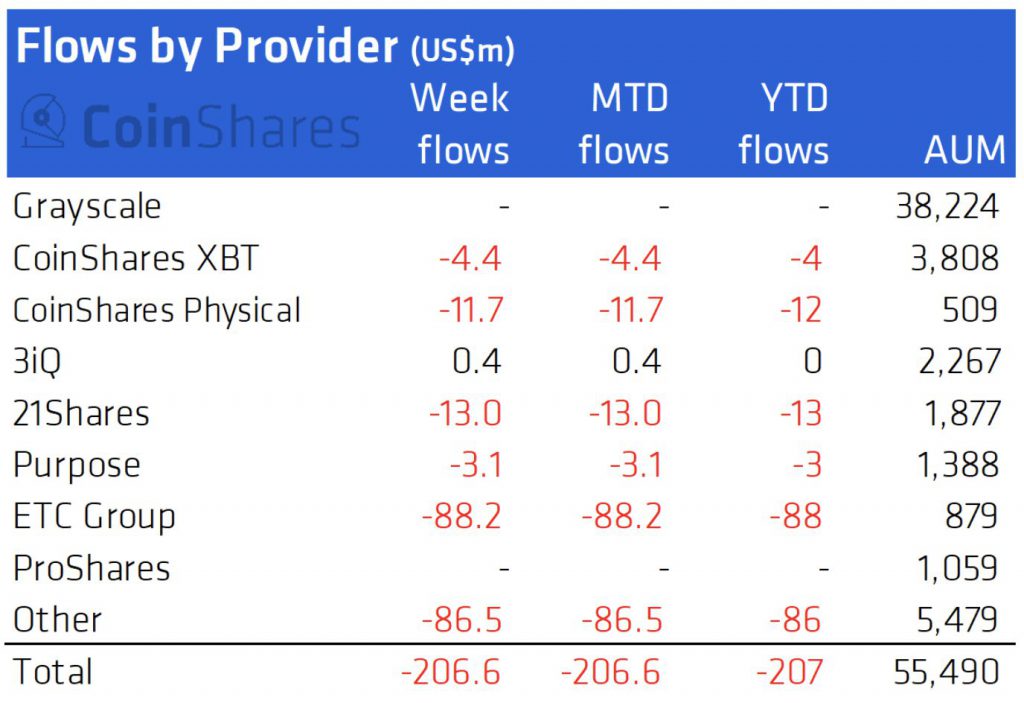

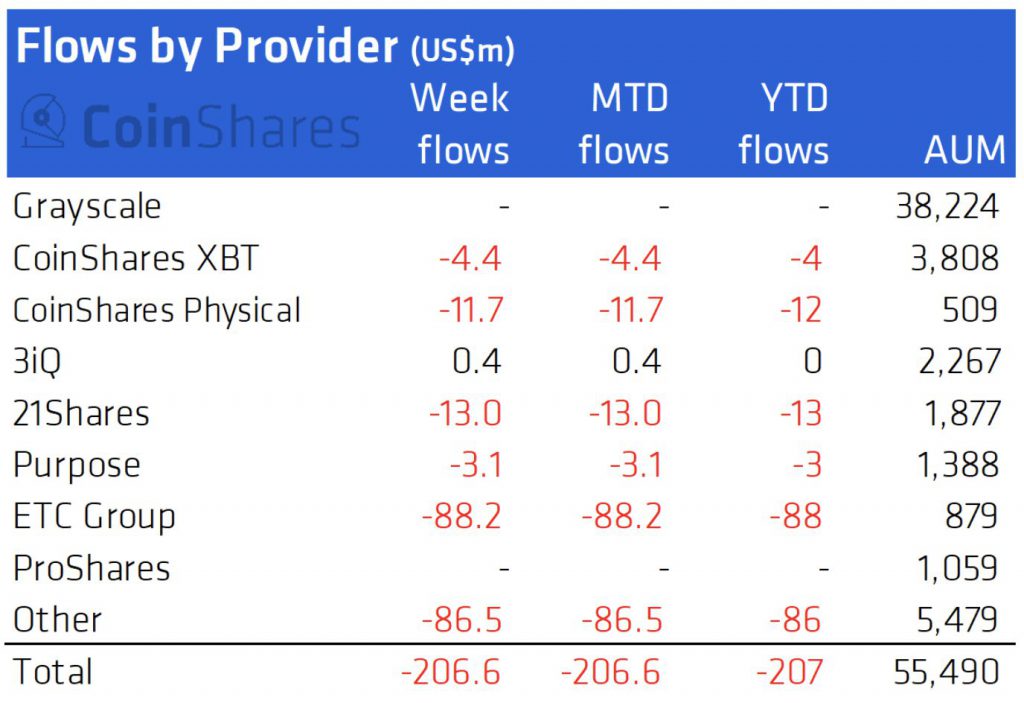

As per the data accumulated by CoinShares, outflows from digital asset investment products hit a new weekly high of US$207 million. This comes after a four-week run of withdrawals that totaled US$465 million, or 0.8 percent of total assets under management (AUM). This puts an end to US$3.6 billion in inflows that began in August 2021. With outflows of US$10 million during the previous week, blockchain equities investment products did not escape the negative attitude.

Last week, bitcoin had outflows of $107 million, which is speculated to be a direct response to the FOMC minutes. The FOMC minutes indicated the US Federal Reserve’s concerns about growing inflation. This leads to investors fearing an interest rate hike. It was seen investment products account for up to 25% of overall Bitcoin trading turnover in the last four weeks. This metric indicates a higher investor activity than typical.

Ethereum, on the other end, suffered outflows of $39 million, increasing the five-week total to US$200 million. On a relative basis, this is significantly bigger than the 1.4 percent of AuM outflows from Bitcoin. Although Solana and XRP both witnessed slight inflows, outflows from multi-asset funds totaling US$37 million suggested investors were less selective in liquidating positions.

What do the numbers tell us about the current state of affairs?

As the fiscal year comes to an end, it is of no surprise that several investors are currently off to balance their books. This could be a reason for the market’s behavior. Additionally, many of the investors are on the lookout for how exactly the market behaves once we are out of the current slump.

If we are to go by the analytics, Bitcoin’s decline looks to be driven more by short-term traders than long-term holders, according to Noelle Acheson, head of market research at Genesis Global Trading. In fact, according to her research, long-term investors are “buying the dip.”