The state of the broader crypto market has been dreary over the last couple of days. While Bitcoin has remained suppressed under $40k, Ethereum has been hovering over $2.6k.

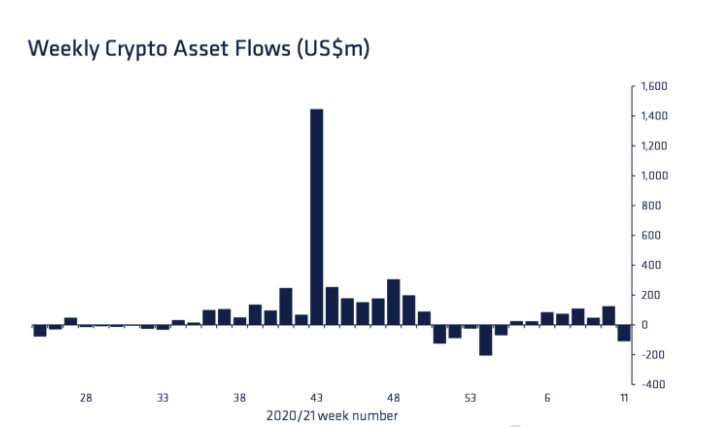

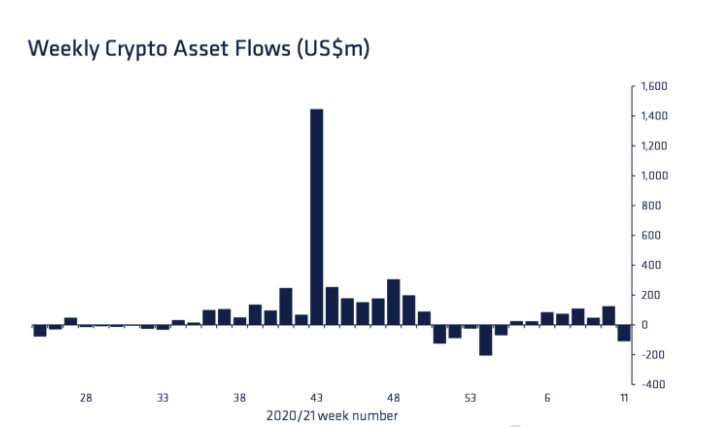

After noting inflows for 7 weeks back to back to back since mid-January, the weekly crypto-asset flows slid into the negative territory yet again last week. CoinShares’ latest weekly report brought to light that the latest amount had dunked upto $110 million. Attributing regulatory concerns as one of the “key issues” instigating the downfall, the report underlined,

“US$80m of the outflows derived from North America with the outflows beginning at the start of last week suggesting they are a response to the US Presidential Executive Order to study digital assets more deeply.“

It added,

“Given there has been little price response and that outflows of US$30m were also seen in Europe, highlights the reasons are unclear. Regulatory concerns and geopolitics remain at the forefront of investors’ concerns for digital assets.“

Asset-wise breakup

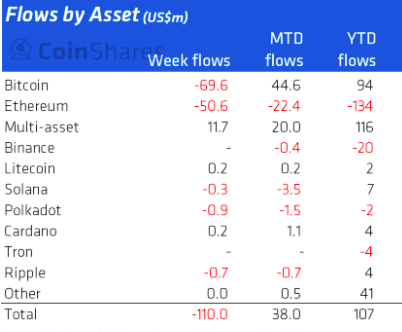

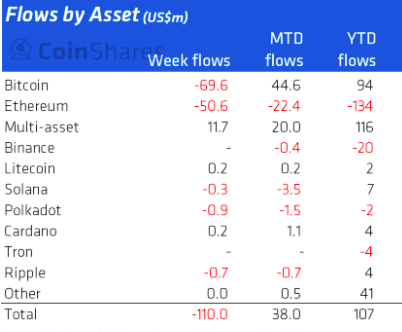

The outflows were duo-handily led by Bitcoin and Ethereum. The formerly noted outflows summing up to $70 million last week, off the back of low volumes. Ethereum, on its part, saw the largest outflows last week, totaling $51 million.

Altcoins like Solana, Polkadot, and Ripple registered minor outflows that ranged from $0.3 million to $0.9 million. Cardano and Litecoin, nonetheless, noted inflows worth $0.2 billion each.

By registering a double-digit million inflow number [$11.7 million, to be precise], multi-asset investment products stood apart on the CoinShares table.

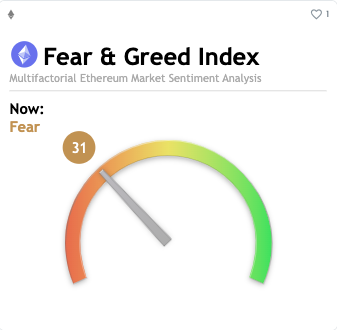

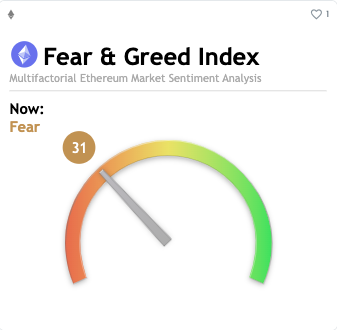

The fear factor

The needle of the fear and greed index, for both the top coins, was pointing towards unease amongst market participants. With a reading of 31, Ethereum’s reading corresponded to “fear.” The Bitcoin market was heated even more and flashed a reading of 21 [extreme fear] at the time of press.

Behavioral finance uses psychology as its key tool to decrypt investment patterns amongst market participants. Per proven theories, investors tend to behave irrationally whenever uncertainty is ruling over the market. Thus, only when things cool down on the macro-landscape geopolitically, would it make sense to expect demand rail back on track.