CoinShares has released its weekly fund flows report for Bitcoin (BTC), Ethereum (ETH), and other tokens. According to the firm, despite continued upheaval in Eastern Europe, digital asset investment products witnessed inflows of US$127 million last week, indicating that investors remain supportive of digital assets. Regionally, movements have been one-sided, with inflows of US$151 million in the Americas and outflows of US$24 million in European investment products last week.

The development was similar to that witnessed in the previous week, with North America being the center of positive sentiments.

Let’s take a deeper look.

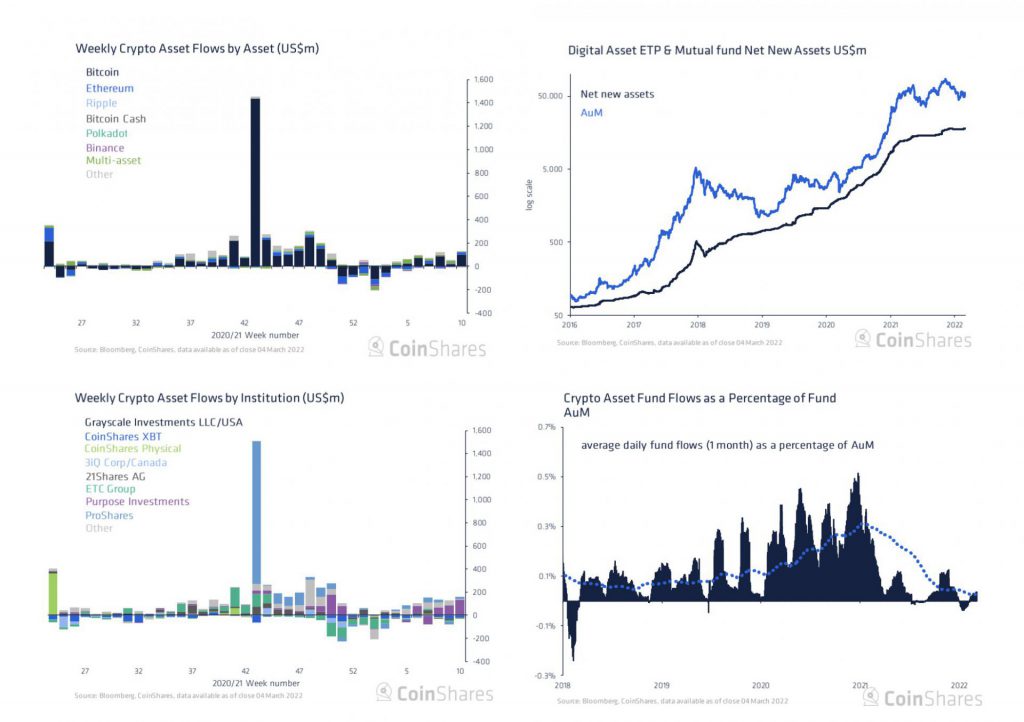

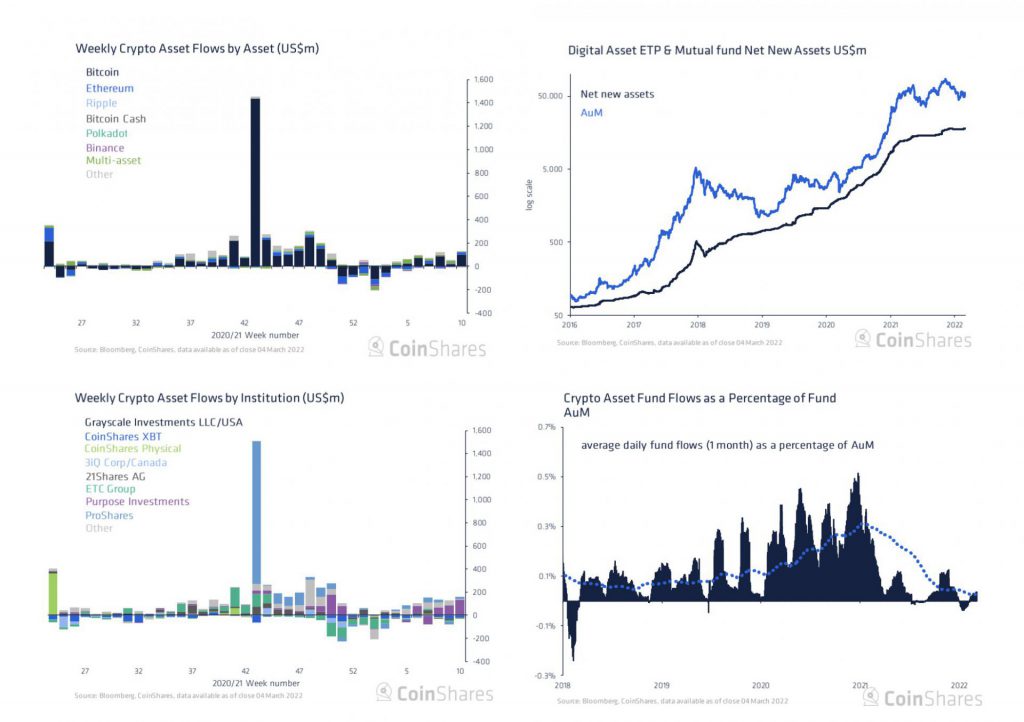

Fund flows from Bitcoin, Ethereum and other coins

Last week, Bitcoin (BTC) had a total inflow of US$95 million. The greatest single weekly influx since early December 2021, with 7 weeks of inflows in a row.

Last week, Ethereum received the greatest inflows in 13 weeks, totaling US$23 million. This comes after a period of mixed to negative feelings that began in early December.

Last week, outflows from Solana (US$1.7 million), Polkadot (US$0.9 million), and Binance (US$0.4) reflected the uneven fortunes of altcoins. Inflows of US$0.4 million, US$0.9 million, and US$0.4 million were seen in Litecoin, Cardano, and Ripple (XRP), respectively.

Last week, multi-asset investment products witnessed inflows of US$8.6 million, and they’ve been a consistent performer this year, with year-to-date inflows at US$104 million, representing 3.6% of assets under management.

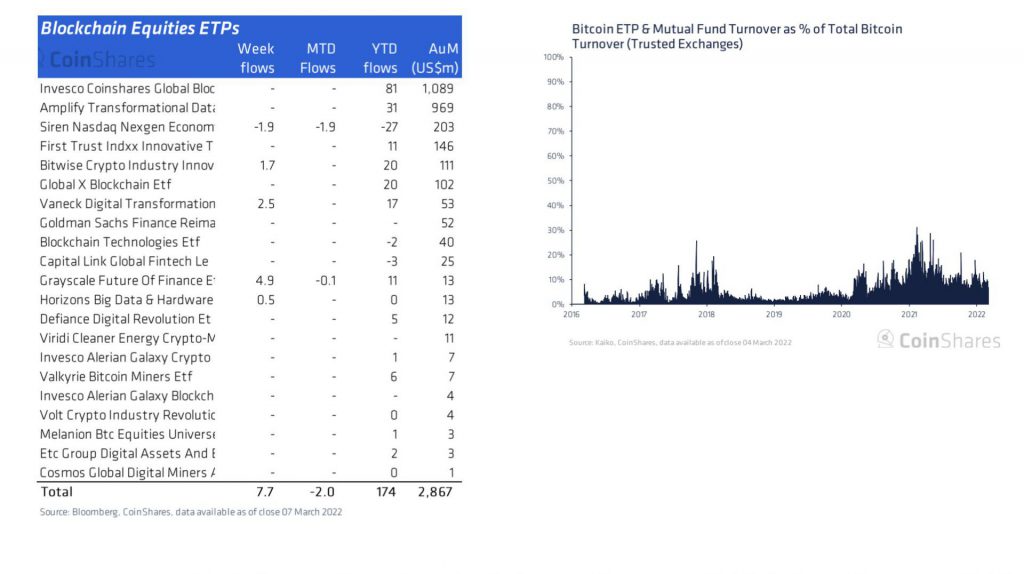

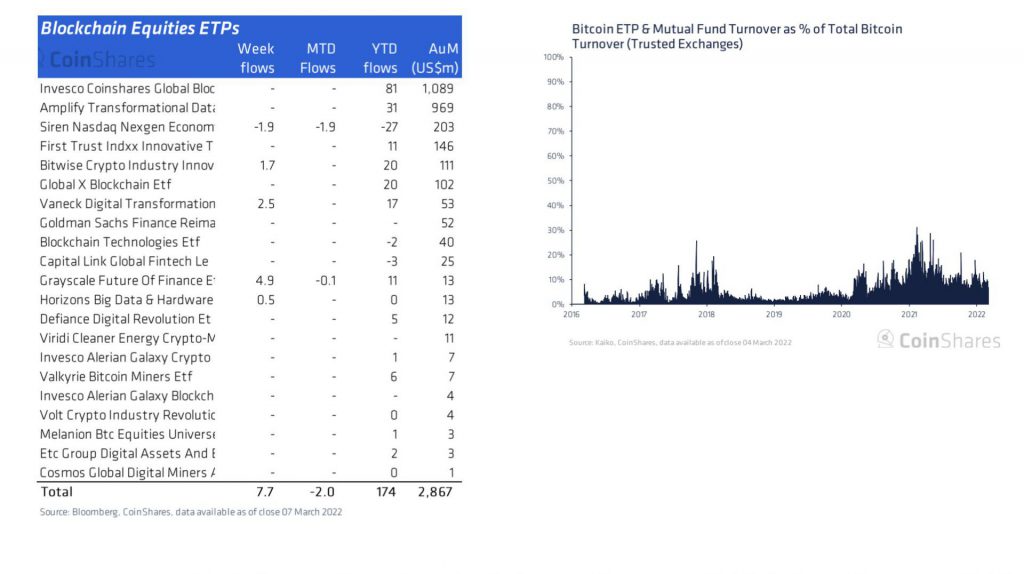

Last week, inflows to blockchain equities funds totaled US$7.7 million.

However, the data provided by Glassnode also point out that since late July, Bitcoin (BTC) inflows have been net negative across all exchanges that were studied by Glassnode.

Based on the data, it could be speculated that there is consistent institutional interest towards Bitcoin (BTC), and hence could be accumulating BTC while the prices are down.